Many investors are focused on the election. They are strategizing about a blue wave, a red wave and every scenario in between. But they may be overlooking the most obvious trade — market volatility.

Before the election, volatility is likely to rise. There are two reasons to expect that:

- The current state of the market.

- The history of past elections.

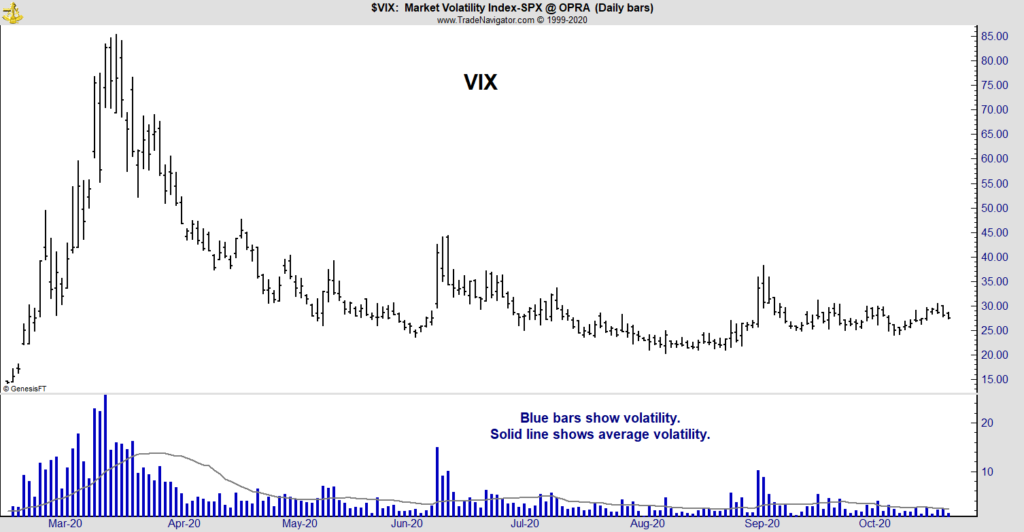

The chart below shows volatility is low right now. This is a chart of the CBOE Volatility Index (VIX). At the bottom is the true range, a stock market volatility indicator and a 22-day moving average (MA) of the true range. There are, on average, 22 trading days in a month.

Volatility Has Been Low

Source: Trade Navigator.

Market volatility moves from high to low in a series of erratic cycles. In practical terms, this means that the true range spikes above its MA after extended periods of time below the MA.

Therefore, after being below the MA for most of the last month, VIX is likely to spike.

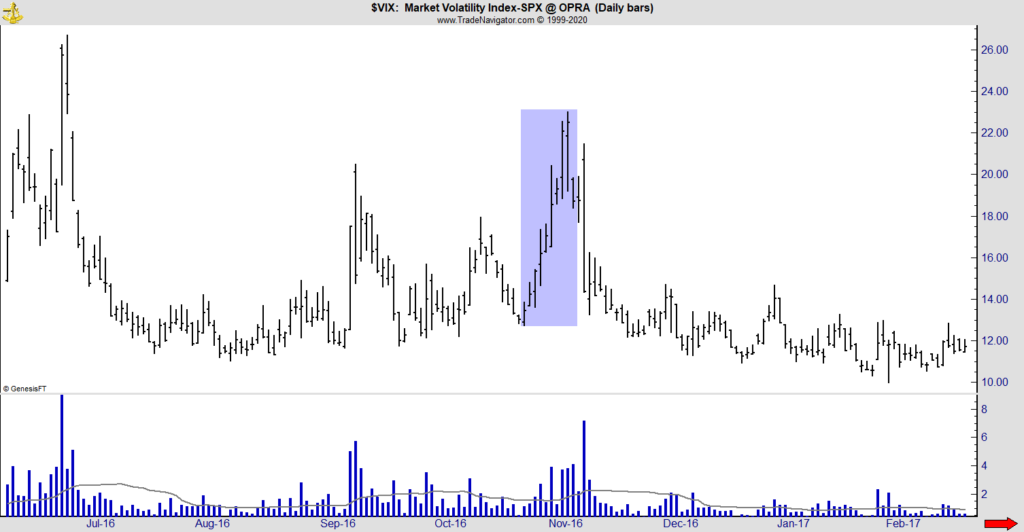

Turning to history, the next chart shows the level of VIX in 2016. In the two weeks before the election, VIX spiked.

Volatility Spiked Before the 2016 Election

Source: Trade Navigator.

VIX reflects uncertainty. Despite the polls, traders understood there was uncertainty heading into the election.

Will Market Volatility Spike Again Before the 2020 Election?

The same is true this year. Polls indicate that Joe Biden is likely to win the election. Analysts expect gains for Democrats in Congress. This is no different than the expert opinion in 2016.

In the days before the election, uncertainty is likely to rise. This will increase volatility and traders can focus on that instead of trying to determine which stocks will benefit from election results.

VIX cannot be traded directly, but there are several exchange-traded notes (ETNs) that track VIX. ETNs are similar to the more familiar exchange-traded fund (ETF) except that ETNs hold derivatives rather than shares of stock like ETFs do.

iPath S&P 500 VIX Short-Term Futures ETN (NYSE: VXX) is among the largest VIX ETNs. Traders could buy VXX or buy call options on VXX to trade increased volatility. Of course, there is risk in any trade, but volatility could be a suitable trade for aggressive investors.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.