With inflation at a 40-year high, everyone’s feeling the crunch. Now it’s time for boring, old financial services stocks to shine.

Businesses aren’t immune to rough patches. They struggle to pay the bills sometimes — just like us.

Like banks for individuals, financial service companies loan money to small- and medium-sized companies to help them through tough times.

Using Adam’s proprietary six-factor Green Zone Ratings system, I found a stock that’s jumped 33% in the last 12 months!

It rates “Strong Bullish,” which means it is poised to crush the broader market by at least three times over the next 12 months.

This company provides flexible financing to smaller companies when times are tough.

Here’s why you should buy this financial services stock now.

Financial Services Stocks Beat the S&P 500

Financial stocks delivered a total return of 35% (price appreciation plus dividends) in 2021, according to Kiplinger. Only energy (55%) and real estate (46%) generated higher returns.

For comparison, the S&P 500 netted a total return of 28.7% last year.

The iShares U.S. Financial Services ETF (NYSE: IYG) currently holds 111 financial services stocks.

Shifting gears to the last 12 months, IYG has a total return of 25.5% compared to the S&P 500‘s 14.4% return.

Here is one high-performing financial services stock that is poised for strong performance in 2022 and beyond.

Profit-Boosting Growth: Oaktree Specialty Lending Corp.

Oaktree Specialty Lending Corp. (Nasdaq: OCSL) is a business development company (BDC). It provides small and mid-sized companies with what it calls “innovative financing solutions.”

This ranges from:

- First and second lien loans (Example: The first lien is your mortgage. A second lien loan uses your home as collateral, even with a mortgage in place).

- Mezzanine loans (Example: Oaktree can convert its loan into equity interest in the company).

Leading into 2020, OCSL‘s total annual revenues were almost flat before the COVID-19 pandemic cut into that revenue by more than 3%.

But Oaktree came roaring back last year … increasing its total annual revenue by 46.3% over 2020. Now, OSCL’s revenue is projected to soar 75% higher by 2023!

OCSL Hits Higher Highs and Higher Lows

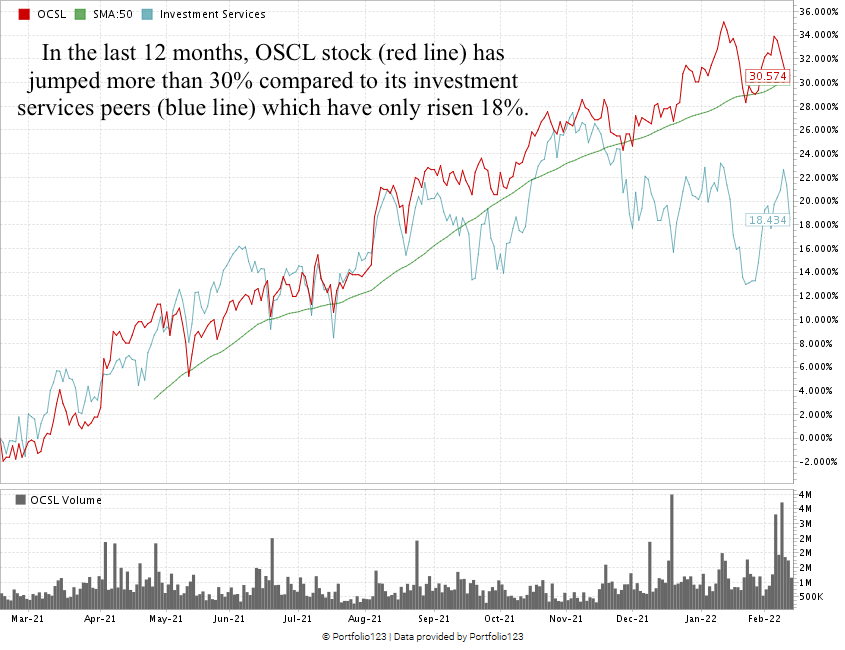

The trend for OCSL stock can be summed up in two words: high momentum.

Over the last 12 months, the stock has marched higher, even during the broader market sell-off that started in December.

It is currently trading around 30% higher than 12 months ago and is just 3% off its 52-week high set in late January.

Oaktree Specialty Stock Rating

Using Adam’s six-factor Green Zone Ratings system, Oaktree Specialty Lending stock scores a 96 overall. That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times in the next 12 months.

OCSL rates in the green on four of our six rating factors:

- Growth — Oaktree’s one-year annual earnings-per-share growth rate is a massive 425.8%. Its year-over-year quarterly sales growth rate is 82.5%. It scores a strong bullish 95 on growth.

- Momentum — OCSL has jumped around 30% in the last 12 months. It’s now testing a new 52-week high. It rates a 92 on momentum.

- Volatility — OCSL didn’t have a lot of trouble reaching that 52-week high, either. It scores a 91 on volatility, meaning it's less volatile than 91% of the stocks we rate.

- Value — OCSL is a great value, especially when compared to other financial services stocks. Its price-to-earnings ratio is 5.8 compared to the average of investment services (22.25). Oaktree’s price-to-book is 1 while the average of its peers is 1.9. It scores a 76 on value.

Oaktree earns a 50 on size due to its $1.35 billion market cap.

OCSL rates a 53 on quality. But its returns are still much stronger than its peers:

OCSL also comes with a forward dividend yield of 8.5%, or $0.64 per share.

Bottom line: Inflation is soaring right now. Small- and medium-sized businesses need help combating the increased cost of goods and services.

This is where business development companies like Oaktree Specialty Lending Corp. excel.

With high growth, solid momentum, low volatility and excellent value, OCSL is a financial services stock worth considering for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.