Economists have spoken ad nauseam about the type of economic recovery the U.S. is facing in the aftermath of the novel coronavirus pandemic, but what about areas to profit?

“Our stocks are heating up thanks to emerging megatrends like the Internet of Things, artificial intelligence and precision medicine.”

We’ve heard talk of U- and W-shaped economic recoveries, but Banyan Hill Publishing’s Amber Lancaster, the Director of Investment Research for Bold Profits, doesn’t think we’ll see a gradual bounce back (U-shaped) or even double-bottoms (W-shaped) when it comes to a certain segment of stocks.

Banyan Hill’s Amber Lancaster

“We here at Bold Profits are forecasting a V-shaped recovery, particularly where ‘America 2.0‘ stocks are concerned,” Lancaster said.

“America 2.0” focuses on how to profit from the great technological paradigm shift happening right now, and Lancaster sees these particular equities catching back on quickly.

“Our stocks are heating up thanks to emerging megatrends like the Internet of Things, artificial intelligence and precision medicine,” Lancaster said.

Renowned economist Mohamed El-Erian on Bloomberg TV warned recently of a “massive cognitive failure” in how stock markets are processing the damage done during the coronavirus shutdown, but that doesn’t mean there aren’t pockets of profitability to be found during the economic recovery.

“Because these numbers were so unthinkable, we are having problems internalizing them. Second, we still have an inclination to go back to old conventional wisdom that (is) failing us in this environment,” El-Erian said. “You add these two things together, you get massive cognitive failure. And I think that’s what’s going on right now. We don’t realize that this hit to the global economy is not just historic, but it is causing structural damage.”

Opportunities in the Economic Recovery

Lancaster said the current trading environment is ripe for the picking — if you know where to look.

“It’s definitely a stock-picking environment, but investors need to make sure they’re choosing stocks from the seven specific ‘America 2.0′ megatrends we follow at Bold Profits,” she said. “These ‘America 2.0’ megatrend stocks will be the first out of the starting gate, propelling higher as the U.S. economy recovers.”

One of Lancaster’s picks as part of “America 2.0” is ARK Innovation ETF (NYSE: ARKK).

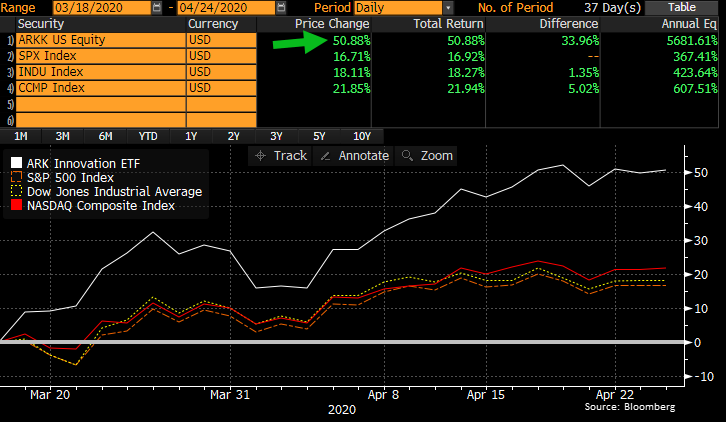

“This exchange-traded fund holds 33 of the most innovative companies of today. ARKK invests in companies relevant to the theme of disruptive innovation,” Lancaster wrote via email. “Year-to-date it’s up 5% while the major U.S. indices are underwater. And since its recent 52-week low on March 18, it’s up a staggering 50.88%, beating the Nasdaq 2-to-1 and the Dow nearly 3-to-1.”

The comparative returns performance chart below illustrates the type of gains Lancaster is talking about.

El-Erian said “we are not going to emerge to what we knew” through the economic recovery following the pandemic.

“This is going to be a ‘new, new normal’ if you like. The demand side will be different, the supply side will be different and the balance sheet will be different,” he said.

But while most economists see a grim future ahead, particularly the longer businesses remain shuttered, there are still places to profit — if you know where to look.