One of the economy’s biggest drivers is getting shellacked thanks to the coronavirus pandemic.

According to FactSet, the financial sector reported the fourth largest year-over-year earnings decline of all 11 S&P 500 sectors — a 54.4% drop.

Digging deeper into the numbers, we get a clearer picture of which industries are struggling the most:

- Consumer finance reported a 118% drop in earnings.

- Banks saw a 77% decline.

But one area of finance seems to be untouched by the COVID-19 pandemic: financial tech, aka fintech.

Fintech companies find new technologies to improve and automate financial services. [Think mobile payment apps Square Inc. (NYSE: SQ) and Paypal Inc. (Nasdaq: PYPL).]

Fun fact: The Automated Teller Machine (ATM) gave birth to fintech. The first ATM was installed in London in 1967, and the first drive-up ATM was in Louisiana in 1980.

In a minute, I’ll show you how investors like you and I can profit from fintech stocks. But first, you need to know why fintech is so strong.

Acquisitions Lead Fintech Stocks to Gains

While banks are struggling with their core business, fintech companies are in demand.

This is evident by the number of recent fintech acquisitions.

According to ETF Trends, these were some of the biggest purchases in the second quarter:

- Square Inc. (NYSE: SQ) acquired European peer-to-peer payments startup Verse.

- Mastercard Inc. (NYSE: MA) bought personal financial data analysis provider Finicity.

- Credit Sesame acquired Canadian bank Stack.

Note that all of these companies were bought in June — when the coronavirus was starting its second rise.

Additionally, insurance startup Lemonade Inc. (NYSE: LMND) launched its initial public offering and gained nearly 140% on its listing date.

The Fintech Advantage

Our world is getting digitized faster than we realize.

Think of all the tasks we can easily complete online:

- Book travel.

- Order dinner.

- Even reconcile our bank accounts.

It’s second nature.

Managing our money online is a segment that’s only going to grow in the next four years.

Digital Transactions Keep Going Up

As you can see, the value of all digital transactions will jump 67% by 2024.

What’s more telling is the value of digital payments (payments you make online using an app or a website) will increase by 144% to $1.7 billion in the same time.

The bottom line is that companies embracing new ways of digitizing our finances will increase in value. Investors who get in now will realize big profits.

Use This 1 ETF to Capitalize on Fintech Stocks’ Gains

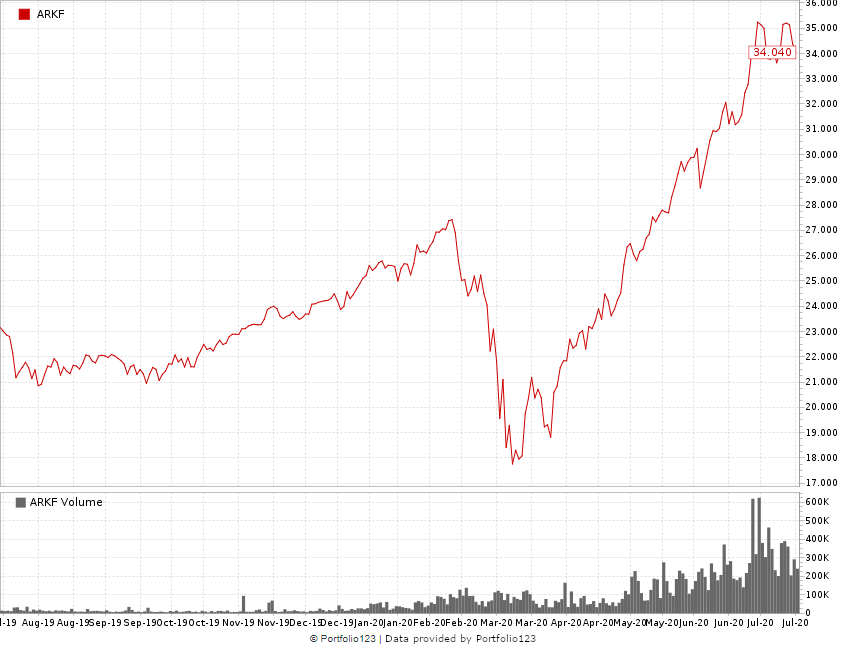

Researching exchange-traded funds (ETFs) specializing in fintech stocks, we found the ARK Fintech Innovation ETF (NYSE: ARKF).

The fund invests in growth and value stocks of fintech companies such as Square Inc. (NYSE: SQ), Apple Inc. (Nasdaq: AAPL), Alibaba Group Holding (NYSE: BABA) and Lendingtree Inc. (Nasdaq: TREE).

It has a return rate of 45.6% over the last 12 months compared to just 6.2% for the S&P 500.

This ETF gives great exposure to fintech companies along with outstanding long-term gains.

Don’t miss the boat on fintech stocks. Invest in ARKF today.