We all like profits, right?

We love to see our portfolios in the green. And businesses are no different.

Some businesses reward strong performance by giving profits back to investors. Profits beget profits.

The banking sector is well-known for its profit margins. Banks are also known for turning profits into dividends paid to smart investors like you.

But, until recently, banks were limited on what they could do with profits. That kept their stock prices relatively flat.

That’s changed — thanks to the Federal Reserve.

I’ve found a regional bank that is positioned to turn larger profits after the Fed recently lifted one restriction.

Now, it’s even easier for this bank to get profits into the hands of smart investors who jump into the opportunity now.

I’ll tell you about it, but first, let’s see why healthy margins for companies mean healthy profits for investors.

Regional Banks Have Outstanding Margins

Banks have some of the highest annual profits of any sector on the market.

Regional Banks’ Profit 30.5% in 2020

In 2020, large banks turned a profit to the tune of 30.6%. Regional banks were right behind at 30.5%.

These profits can be returned to shareholders as dividends, used to pay taxes or used for future investment.

Banks tend to return a good amount of their profits to shareholders as dividends.

I’ve found a regional bank with great margins, a recent breakout in stock price and a 3.3% forward dividend yield.

FCBC Is a Top Regional Bank

One of our highest-rated regional banks is First Community Bankshares Inc. (Nasdaq: FCBC).

It’s a financial holding company based in Virginia with 50 branches in Virginia, West Virginia, North Carolina and Tennessee.

In January, FCBC was one of 41 U.S. banks that announced a stock buyback plan after the Fed eased restrictions on capital distributions for financial institutions.

The restriction on what banks can do with excess capital came after tests found banks have the capital to withstand a sharp economic downturn.

First Community reported a 6.56% increase in quarterly net income in January 2021.

Its board approved buying back 2.4 million shares of the company’s outstanding stock after the Fed’s announcement.

First Community Total Revenue Increases in 2020

The bank suffered a decline in its total revenue in 2019, by about $2 million year-over-year.

Revenue jumped to $125.7 million in 2020 and is projected to reach nearly $135 million next year — a 20% increase from 2019.

FCBC took off after the buyback restrictions were lifted.

FCBC Stock Rises 68% Off March Lows

The stock hit a low of $17 per share during the March 2020 crash and traded mostly sideways until the end of January.

After buybacks were announced, First Community’s stock jumped to a new 52-week high of around $30 per share — a 68% increase.

First Community’s Green Zone Ratings story solidifies it as a strong stock as well.

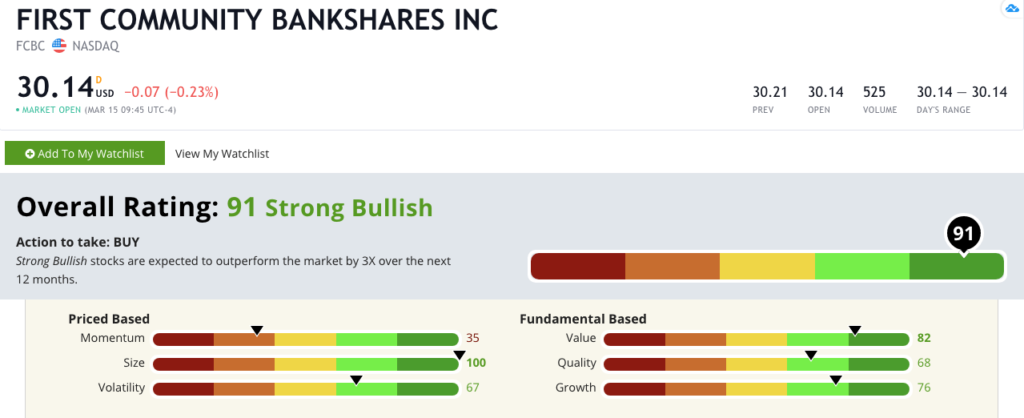

First Community’s Green Zone Rating

First Community Bankshares Inc.’s Green Zone Rating on March 15, 2021.

FCBC rates a 91 on Adam O’Dell’s six-factor Green Zone Ratings system.

That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times over the next 12 months.

The stock rates in the green on five of those six factors:

- Size — The company has a market cap of $535.4 million. It’s the perfect size in our model. And that’s why it rates a 100 on that metric.

- Value — FCBC has price-to ratios that are all in line or below the banking industry. The stock rates an 82 on value.

- Growth — First Community‘s quarterly earnings per share jumped from $0.47 in Q3 2020 to $0.65 in Q4 2020. It also has a one-year annual sales growth rate of 16%. FCBC rates an 82 on growth.

You’ll notice that FCBC rates low on momentum.

But remember that our model looks back at historical data, not at the future.

Its low momentum rating is due to the sideways trading that occurred before the January breakout.

Bottom line: With the ability to use capital for stock buybacks, great margins and a fantastic Green Zone Rating, First Community Bankshares Inc. is a prime candidate to buy.

The stock’s uptrend is on solid footing, and I expect it to keep going higher.

We’re “Strong Bullish” on FCBC, so now is the time to add this regional bank to your portfolio.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.