It’s too early to say whether we’re in the early stages of a bona fide correction. But it’s starting to feel that way. The S&P 500 was down in 10 of the 14 trading days of September, and buyers haven’t rushed in to buy the dips.

Corrections are normal. They happen. And they are healthy in the long run. If there was no risk to investing, then there would be no return.

But that doesn’t mean they’re fun to live through.

I don’t know with certainty what happens next. But I do know that stock prices are high and look a little stretched after 18 months of almost uninterrupted bullish behavior. We were due for at least a pause. The disruption coming out of China’s property sector with the Evergrande liquidity crisis was just the trigger.

So, what do we do now?

In a rough patch, it makes sense to have a few defensive dividend-paying workhorses in the portfolio — stocks like Flowers Foods Inc. (NYSE: FLO).

In a correction, boring is beautiful. And Flowers is about as boring as you get. The company makes assorted packaged food, and specifically bread products. Some of its brands include Nature’s Own, Wonder Bread, Sunbeam, and Tastykake. And as a proud Texan known to consume ungodly amounts of fajitas, I’m happy to say Flowers also sells tortillas under the Mi Casa brand.

Flowers Foods’ Dividend and Stock Rating

Let’s talk dividends. At current prices, Flowers yields 3.65%. That’s a solid yield at a time when the 10-year Treasury yields a pitiful 1.3% and even the 30-year Treasury yields just 1.8%.

And Flowers has a history of raising its dividend over time. The company raised its dividend this past June and even managed to raise it during the pits of the pandemic last year.

Like many packaged foods companies, inflation has been an issue of late. But most branded consumer products companies don’t mind passing rising costs on to the consumer. If inflation continues to trend higher, Flowers should be just fine.

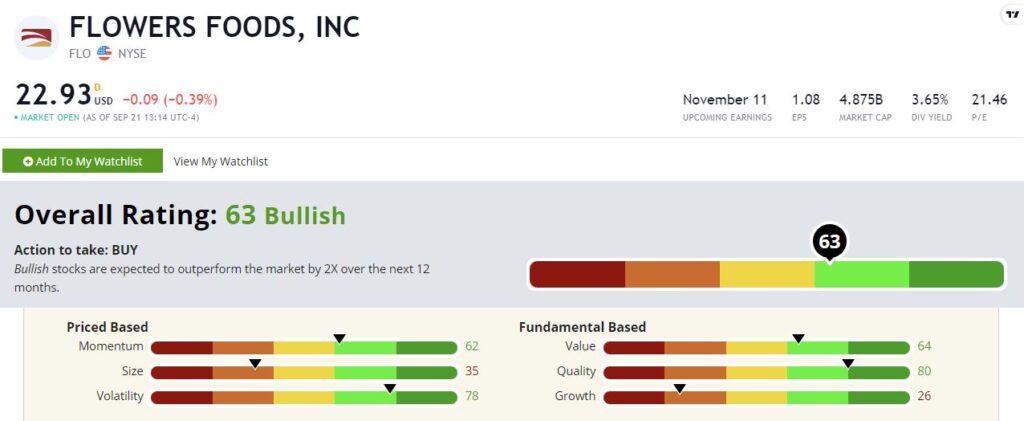

Flowers rates a “Bullish” 63 on our Green Zone Ratings system. And it rates highest exactly where we want when dealing with a market correction.

Flowers Foods Inc.’s Green Zone Rating on September 21, 2021.

Quality — Flowers rates highest on quality at 80. During rough patches in the market, investors flock to quality names with moderate debt profiles and high profitability. Flowers fits that bill.

Volatility — Investors also prize less volatility when the market gets rocky. Flowers delivers here as well. The stock rates a 78 on volatility, meaning that it is less volatile than 78% of the stocks in our universe. We’re betting on the tortoise, not the hare.

Value — Most defensive, high-quality stocks are more expensive. Yet FLO rates well on our value factor at 64. The recent spike in inflation has somewhat dampened investor enthusiasm for the stock, which gives us a better entry point.

Momentum — FLO also rates respectably well on our momentum factor at 62. If the market is taking a turn for the worse, I’d expect to see this rating improve as investors flock to quality.

Size — Flowers is a large company with a market cap of just under $5 billion. So, it’s not surprising that it rates low on our size factor at 35. That isn’t a bad thing. If things get rough, most larger companies are safe havens.

Growth — Flowers isn’t a high-growth company. It sells bread, for crying out loud. So, its growth rating of 26 isn’t a huge surprise.

Bottom line: Again, I can’t say with any certainty that this is a true correction. But whether it is or isn’t, Flowers Foods is a solid dividend payer that won’t give you much drama.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.