We might have seen at least a short-term bottom in the market last month.

It’s far too early to say, but since mid-June, the S&P 500 has been trading in a tighter range.

That doesn’t sound like much, but after three continuous months of bear market declines, not falling further is a win.

We’ll see.

I’m not ready to call the official bottom. Until the market proves otherwise, I think it’s only prudent to stick with what’s working: low-volatility dividend workhorses.

As a case in point, consider Flowers Foods Inc. (NYSE: FLO).

Flowers Foods Stock Revisited

I recommended Flowers last year, noting:

In a correction, boring is beautiful. And Flowers is about as boring as you get. The company makes assorted packaged food, and specifically bread products. Some of its brands include Nature’s Own, Wonder Bread, Sunbeam and Tastykake.

And I’ll echo those comments again today.

We left “correction” territory behind a long time ago — we’re officially in a bear market. But again, when it’s rough within financial markets, boring is beautiful.

While the S&P 500 is down almost 20% in 2022 as I write, Flowers stock is close to flat on the year. It hasn’t been immune to the broader sell-off, but investors are keeping FLO afloat.

At current prices, FLO stock also yields an attractive 3.3%.

That might not sound high in a world with 9.1% inflation, but it’s beating the yield on the 10-year Treasury note today.

Unlike that Treasury, which will lose value every passing year to inflation, Flowers has a history of raising its dividend. It’s more than doubled its dividend over the past decade and it hasn’t indicated any plans to slow down those efforts.

FLO Stock Power Rating

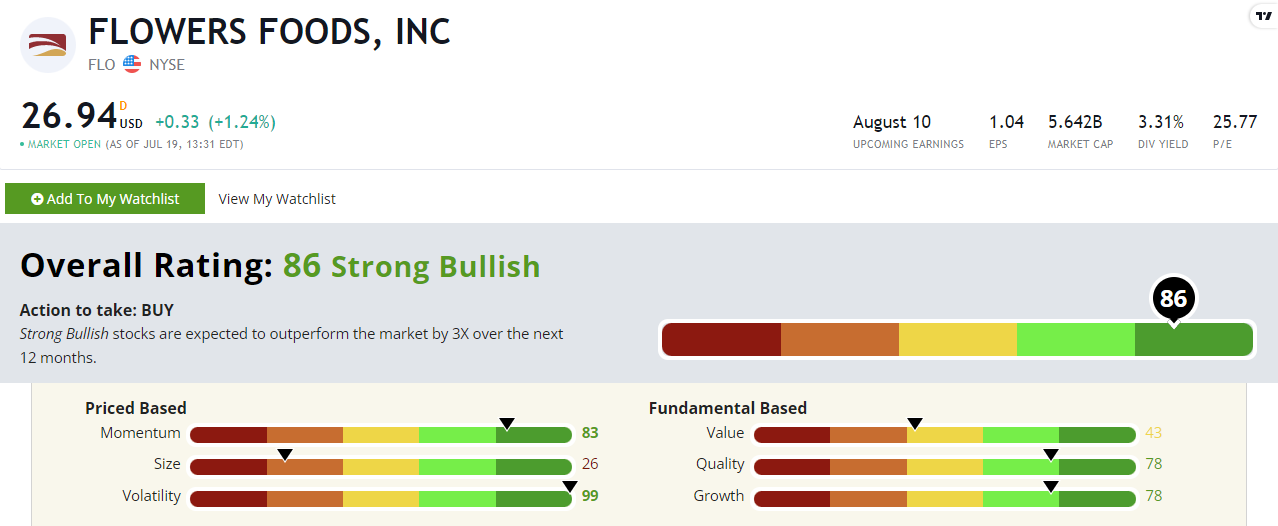

With a “Strong Bullish” 86 on Adam O’Dell’s proprietary Stock Power Ratings system, Flowers rates even higher today than it did when I recommended it a year ago.

But rather than just focus on the raw composite score, I want to drill down to see what drives FLO’s rating.

There’s one stat that jumps off the page: Flowers rates a stellar 99 out of 100 on our volatility factor. The higher the number here, the lower the volatility. It’s in the 1% of more than 8,000 stocks we look at, making this one of the least volatile stocks in the market.

FLO is a safe haven that investors flock to when it’s scary out there. And that’s exactly what we’ve seen in 2022. While most of the market has cratered, Flowers has managed to keep its head above water.

This ties in closely to its momentum score of 83.

In normal times, I wouldn’t consider FLO to be a “momentum stock.” It’s a boring packaged foods company.

But in a bear market, you win by not losing. That’s exactly what we’ve seen in Flowers. By not losing this year, Flowers is now a high-momentum stock in 2022.

Flowers also scores a solid 78 on both our quality and growth metrics. That’s important because only healthy, growing companies can sustain strong dividends and dividend growth. FLO might not grow hundreds of percent per year like a new tech startup, but its growth factor rating is solid.

Flowers loses some points on value and size. That’s OK. High-quality, low-volatility stocks often trade at a premium. And while we tend to prefer smaller companies for their potential to outperform, larger companies are often the safer bet in a difficult market.

Bottom line: You’re not going to get rich quick from Flowers Foods. But you’ll sleep well at night while you collect a high and growing stream of dividends.

In a year like 2022, that sounds fantastic to me.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.