Picture this: You’re scrolling down your Facebook timeline and come across a product advertisement. The ad is colorful and attractive — you haven’t seen anything like this before.

You stop scrolling for a second and take note of the product. You even consider making a purchase.

This mindless series of events happens to most of us on a daily basis. We log onto our computers and are bombarded with promises of better health, nicer looks and more money if only we buy this one product.

We’ve entered the age of digital marketing. This type of advertising is new, adaptable, aggressive and, most importantly, effective.

The digital marketing sector is just getting started, and it’s primed for tremendous growth in the future.

Let’s break down the industry…

About the Digital Marketing Industry

Digital marketing is here to stay. It’s a cheap alternative to television ads, and companies aren’t going to stop capitalizing on this option.

The 2020 Facebook boycott proved the industry’s resilience. Last year, a coalition of civil rights groups led an advertising boycott of the social media platform.

Due to Facebook’s inaction when it came to hate groups and misinformation on the platform, many large companies pulled their advertisements from the feed.

A lot of people thought this boycott would mean death for Facebook. They were wrong.

That’s because the top 100 advertisers only make up 6% of Facebook’s total revenue. Smaller companies rely on Facebook for advertising and customer contact, so they didn’t join the boycott.

In the second quarter of 2020, Facebook brought in $18.8 billion, 30% higher than analysts expected. The boycott had virtually no effect on Facebook.

Again, digital marketing is not going away. It’s the future of advertising.

But companies, especially small businesses, often need help with digital marketing strategies. Increasingly, small businesses need to figure out how to get the most bang for their buck through digital marketing.

This creates a demand for consultants and digital marketing firms — people who can create effective digital marketing strategies and reach customers.

And this is where my stock pick, Fluent Inc. (Nasdaq: FLNT), comes in.

Fluent is a New York City-based digital marketing firm with around 500 customers and 30 million target users. Fluent has its own ecosystem of consumers who have opted in to receive advertisements and marketing from the firm.

In short, Fluent connects marketers with consumers directly.

Fluent Inc. Stock: My Approach to a Speculative Pick

Fluent is a speculative stock because it’s teetering on profitability.

But, according to my Green Zone Ratings system, it also has high momentum and growth while remaining small in size.

Despite the uncertain profitability, this stock is worth consideration because it’s part of a stable market — digital marketing.

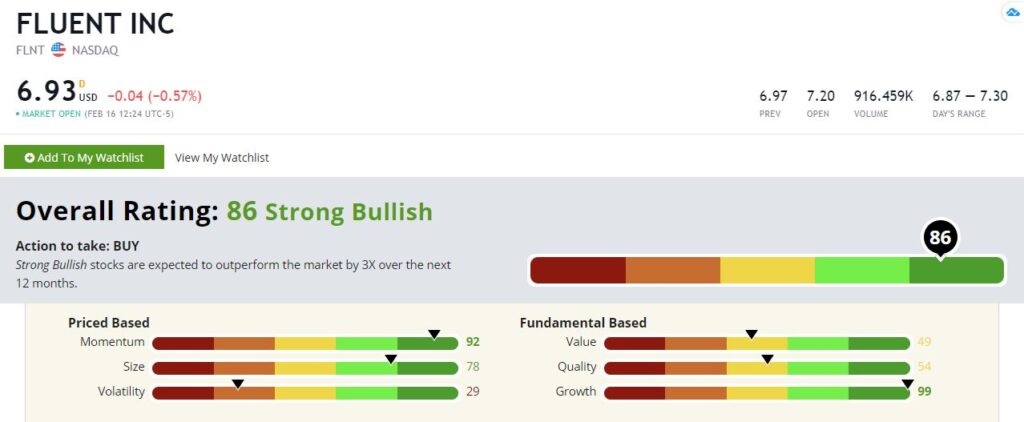

Fluent Inc.’s Green Zone Rating on February 16, 2021.

Fluent Inc’s Green Zone Rating

Momentum — FLNT rates a 92 on momentum. This is an impressive score for a smaller company like Fluent. Over the last year, earnings per share are up 384%.

Growth — With a growth score of 99, FLNT is a high-growth company. Over the past five years, its sales have grown more than 150%. With the onset of the COVID-19 pandemic, everything that was not already digitized entered the digital world … including marketing. I expect this trend to continue into the future.

Size — FLNT rates an impressive 78 on size. Although this isn’t a great value stock on a price-to-earnings scale, price-to-sales and price-to-book metrics are actually better than Facebook’s numbers. FLNT also gets a better bang for its buck per employee than larger companies. This stable and promising foundation is a key indicator of immense future growth.

FLNT may be “unproven” in terms of profitability, but I’m certain that if it can figure that out and gain traction, it will take off.

To good profits,

Adam O’Dell

Chief Investment Strategist

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.