You don’t need me to tell you how nasty the markets are right now.

The tech-heavy Nasdaq index is in an official correction after it dropped by well over 10%.

The damage has been the most severe among growth superstars, including Netflix Inc. (NFLX) and Amazon.com Inc. (AMZN).

The Federal Reserve’s easy money regime is over.

More accurately, we’re shifting from a period of extraordinarily loose monetary policy to something approaching normal.

We won’t get there overnight. Even aggressive estimates put the federal funds rate at 1% or less by the end of the year.

But the direction is clear: Rates are going higher. It’s just a matter of how high and how fast.

Old-School Dividends: Coca-Cola Co. Stock

In a market like this, companies that expect to earn their best profits far in the future look less attractive than the ones earning gobs of cash right now.

I’ll spare you the math. Just know that the higher interest rates go, the less valuable future earnings are in today’s dollars.

So we’re going old-school.

This is one of the oldest companies in America. It happens to be a long-term favorite of one of America’s oldest investors, the great Warren Buffett himself.

I’m talking about the Coca-Cola Company (NYSE: KO).

In addition to its namesake soda, its brands include Sprite, Dasani, and Minute Maid.

The company has been around since 1886.

And unless humans somehow evolve to no longer require hydration, we can assume that Coca-Cola will still be around in the year 2886.

Coca-Cola Co. Stock Rating

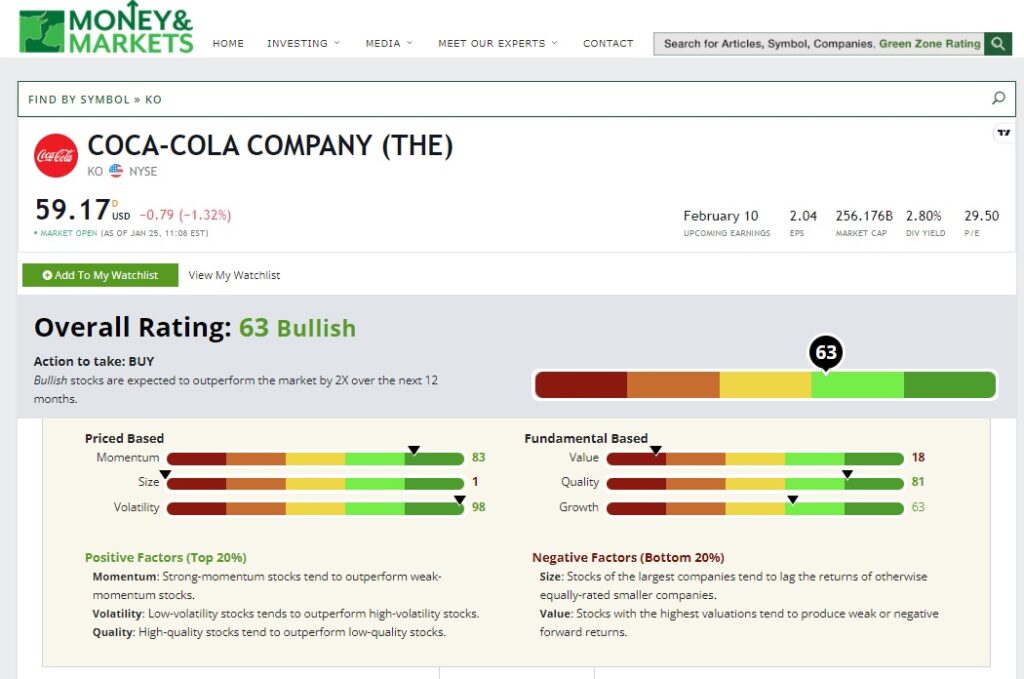

Coca-Cola Co. Green Zone Ratings on January 25, 2022.

Overall, Coca-Cola stock rates a “bullish” 63 out of 100 on chief investment strategist Adam O’Dell’s Green Zone Ratings system. That means we expect it to beat the market by at least two times over the next 12 months.

Its dividend yield isn’t the highest you’ll find. But at 2.8%, it’s competitive with high-quality bond yields.

And unlike bond coupon payments, Coca-Cola’s dividend will almost certainly rise over time. That’s been the case for the past six decades.

Let’s dig deeper into the stock’s ratings.

Volatility: If you want something stable during a time of market stress, this is the right place to look. KO rates a 98 on our volatility score, meaning it is less volatile than all but 2% of the stocks in our universe.

Momentum: When growth names struggle, investors prefer low-volatility stocks. This helps boost Coca-Cola’s momentum factor, which rates a “strong bullish” 83. We can’t expect this established company’s momentum score to remain high like this forever. But it should persist for the next year or two.

Quality: Coke is about as close to a bulletproof stock as we can get, earning an excellent 81 on our quality factor. As one of the most iconic brands in the world, its strong branding allows the company to charge premium prices. That, in turn, boosts the profit margins that comprise our quality score.

Growth: Though Coca-Cola is an old company with an established portfolio of products, it’s no slouch on growth. The company rates a solid 63 here, which is a testament to its ability to evolve with changing consumer tastes.

Value: Coca-Cola stock isn’t cheap. It rates an 18 on our value factor. But that’s normal here. Because of its high quality and stability, it’s rare for KO stock to go on sale. We’re paying a premium for a blue chip.

Size: Coca-Cola was one of the largest stocks in the world before multitrillion-dollar tech market caps became a reality! It’s still massive, with a market cap (shares outstanding times current share price) of $255 billion. Coke stock rates a 1 on our size factor. That’s OK — at times like these, large stocks with staying power provide shelter from the storm.

Takeaway: I don’t think we’ll get rich quick with Coca-Cola.

But it’s a solid long-term dividend payer that I’d be comfortable holding for years, if not decades.

This stock belongs in your dividend-focused retirement portfolio.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.