Today, I’m thrilled to tell you about a solid dividend stock that’s jumped 22% since September — and should at least double the market’s returns over the next year.

I usually defer to Green Zone Fortunes co-editor Charles Sizemore when it comes to dividends.

He’s our dividend genius, seeking out and recommending strong income stocks.

But right now, higher inflation is making the market more volatile.

So, smart investors like you should be looking at dividend-paying stocks as a way to get paid, even when the market is volatile.

Plus, dividend-paying stocks make excellent hedges against higher inflation.

Using Adam O’Dell’s proprietary six-factor Green Zone Ratings system, I found a dividend-paying stock that has continued to rise as the market dropped. It reached a new 52-week high during last week’s market pullback.

It rates “Bullish” in Green Zone Ratings, which means it is poised to beat the broader market by at least two times over the next 12 months.

I’ll show you why you should buy this consumer staples stock now.

Dividend Stocks vs. Non-Dividend Stocks: A Clear Winner

Charles likes to remind us: “With dividend stocks, boring is beautiful.”

If you want market-bashing gains, you look for risky, sexy stocks.

But if it’s consistency and income you’re after, consider buying stocks that you can set and forget.

A study by Ned Davis Research found that, since 1971, all dividend-paying stocks had a total annualized return of 8.6%.

This blew the doors off non-dividend stocks’ annualized return of minus-1.2%.

On average, stocks that pay a dividend perform better in the market than those that don’t.

This strong dividend payer is no exception, boasting steady gains and strong payouts.

J.M. Smucker Co. — Inflation Buster

In the land of jams and jellies, Ohio-based J.M. Smucker Co. (NYSE: SJM) is about as well-known as they come.

But Smucker is much more than apple butter and grape jelly.

It produces well-known products under labels, including:

- Folgers, Café Bustelo and Dunkin’ coffee.

- Jif peanut butter.

- Crisco oil.

- Kibbles ‘n Bits, Meow Mix, Pup-Peroni and other pet food brands.

For the 2021 fiscal year, SJM expects to report total annual revenue of just over $8 billion — a 2.5% increase from 2020.

The company expects higher inflation to affect sales. However, it estimates its total annual revenue for 2021 will hit $7.9 billion — its second-highest year of revenue since 2018.

And after this year, Smucker expects to increase its annual revenue by more than 1% each year through 2024.

Smucker stock had a strong start to 2021, reaching a 52-week high in June. After that, it pared those gains and fell to $118 in late September.

But it started to show strength going into 2022, jumping nearly 22% to its price today of around $144.

SJM gained around 24% in the last 12 months compared to its food and beverage production peers, which rose 16%.

J.M. Smucker Stock Rating

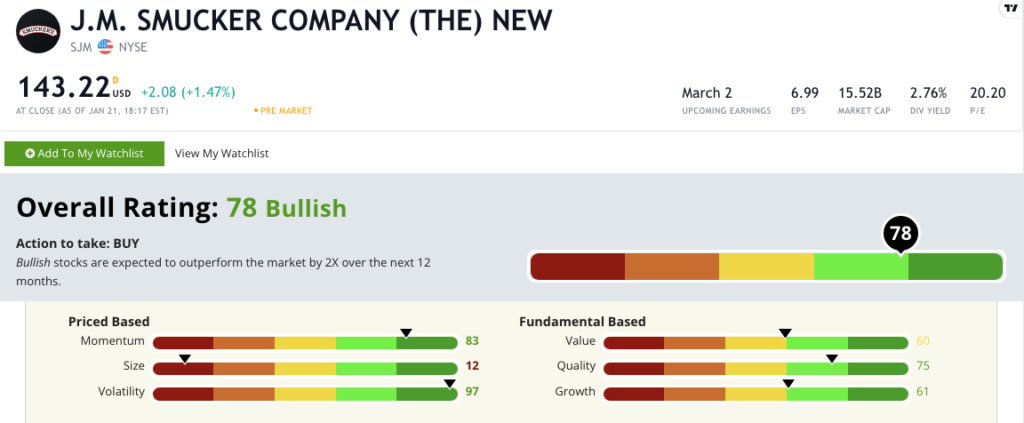

Using Adam’s six-factor Green Zone Ratings system, J.M Smucker Co. stock scores a 78 overall. That means we’re “Bullish” on the stock and expect it to beat the broader market by at least two times in the next 12 months.

J.M Smucker Co.’s Green Zone Rating on January 24, 2022.

Smucker stock rates in the green in four of our six rating factors — and it’s on the cusp of “bullish” in a fifth:

- Volatility — SJM faced headwinds in the summer of 2021, but since September, its stock has seen higher highs and higher lows. The company scores a 97 on volatility — meaning its volatility is lower than 97% of the stocks we rate.

- Momentum — Since September, SJM has risen almost 22%. This is the definition of “maximum momentum.” It rates a “strong bullish” 83 on momentum … exactly what we look for in a stock.

- Quality — With positive returns on assets, equity and investments compared to negative returns for the food and beverage production industry, SJM scores a “bullish” 75 on quality.

- Growth — SJM’s one-year annual earnings-per-share growth rate is 14%. Its one-year annual sales growth rate is 2.6%. It scores a solid 61 on growth.

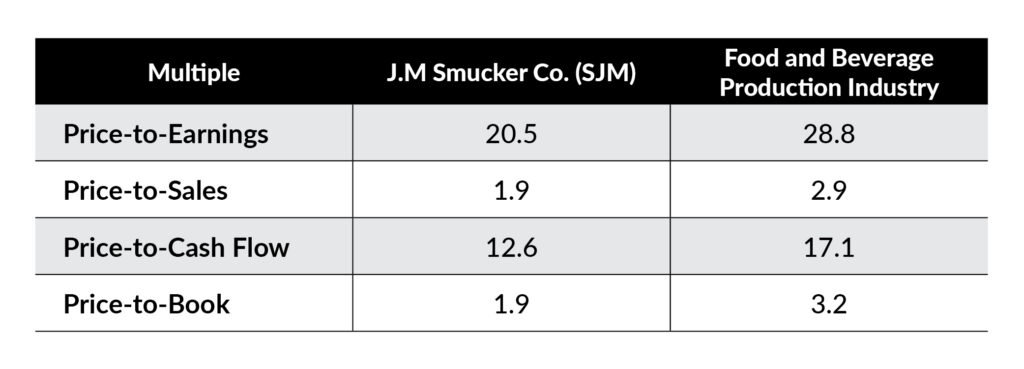

SJM rates a 60 on value. This by no means shows that Smucker stock is overpriced, though.

As you can see in the table below, its value multiples are lower (i.e., better) than its food and beverage production peers:

Smucker scores a 12 on size. With a market cap (shares outstanding times current share price) of $15.5 billion, this is a large-cap stock. But large market caps come with the low volatility I mentioned — and if inflation continues, we’ll be happy to hold stocks with size and staying power.

Another benefit of SJM is its 2.76% forward dividend yield. Smucker will pay its shareholders $3.96 per share this year — just for owning the stock.

The stock has a compounded dividend growth rate of more than 7% per year — enough to double the payout since 2010.

Bottom line: Inflation is the highest it’s been since June 1982.

While the Federal Reserve has indicated it will take steps to battle that inflation, the stock market continues to wobble.

Smart investors like you are looking for ways to hedge against inflation and earn “endless income” from your holdings.

That’s why J.M Smucker Co. stock is a strong candidate for your inflation-busting portfolio.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.