When I was in the market for a new car three years ago, I looked hard at an electric vehicle (EV).

I wanted to get out of the gas-guzzling sports car I was driving and into something more fuel-efficient.

Naturally, EVs were part of the equation.

The problems I found were:

- Charging locations around me were few and far between at the time.

- But the bigger problem was that the cost of EVs was just too high … even with tax credits.

I went another route and found something that wasn’t quite as efficient, but it suited my needs.

Now the EV market is surging. And automakers are slashing prices on new vehicles to entice customers amid high inflation.

As an investor, you want to know if this mega trend is one to buy into.

I’m going to share what I found out about investing in EV-related companies using our Stock Power Ratings system in a bit.

But first…

EVs Will Soon Dominate the Auto Market

In my research of the EV mega trend, I found some compelling data.

According to InsideEVs.com, 10 million new passenger plug-in electric cars were sold around the world last year.

But that only accounts for about 14% of total vehicle sales for the year.

Here’s where it gets interesting:

Morgan Stanley projects EV sales will make up 26% of all vehicle sales by 2030.

That projection jumps to more than 80% by 2050!

It means EVs will account for more than half of all automotive sales by 2040 and lap gas-guzzlers by 2050.

Two of the biggest reasons for this massive jump are:

- Increased range of EVs — in 2020, the average range of an EV was 186.4 miles. Management consulting company Oliver Wyman projects that range to reach 273.4 miles by 2030.

- Growth in fast electric vehicle chargers — the International Energy Agency found there were only 14,700 fast electric vehicle chargers worldwide in 2015. That number grew to 563,900 by 2021 — a 3,736% increase in six years! And companies are only going to increase installations as more EVs hit the roads.

The one problem EV manufacturers are starting to tackle is the price.

In January 2020, the average price of an EV was $55,000. In 2022, supply chain issues and the lack of critical EV resources pushed that price up 37% to more than $65,000.

According to Kelley Blue Book, average EV prices fell 5.4% to $58,700 in January 2023.

Popular EV manufacturer Tesla has tinkered with price cuts … dropping the price of its Model 3 sedan from $46,990 to $42,990 and its Model Y SUV from $65,990 to $54,990.

Ford and Lucid have followed suit by either dropping prices or offering consumers “credits” for vehicles too expensive to qualify for government tax rebates.

This data clearly shows the EV mega trend is not only taking hold but expanding.

Is it time to buy in?

EV Stocks Haven’t Hit “Mega Trend” Status Yet

It’s clear that EV infrastructure (charging stations) is growing, and EVs can make much longer trips than they could even five years ago.

Couple that with cheaper options in the market and we see the foundation being laid for a strong mega trend.

However, EV-related stocks haven’t followed suit quite yet.

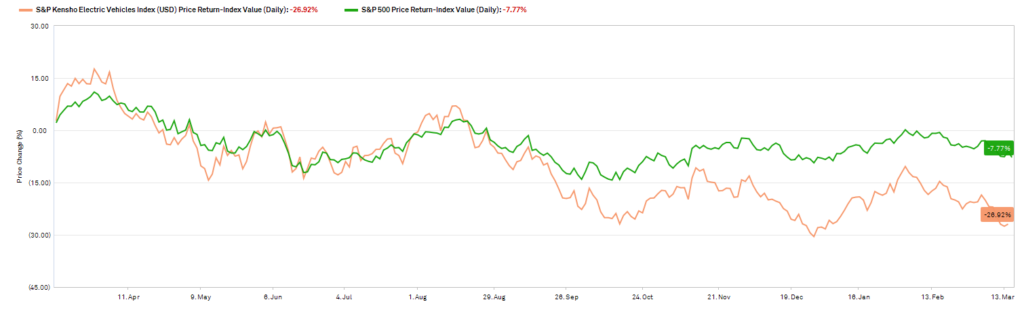

The S&P Kensho Electric Vehicles Index measures the performance of companies involved in the EV sector.

This includes auto manufacturers, battery producers and other technology companies that produce EVs, components and infrastructure.

EV Index Has Fallen 27% in 12 Months

Over the last 12 months, the index (the yellow line in the chart above) has declined 27% while the S&P 500 (the green line) is only down 7.8%.

What this tells me is that, despite the U.S. government’s best efforts to entice EV sales and production through tax credits and grants to build new charging stations, investors are still wary.

Inflation is hurting EV sales and the investment in infrastructure is still in its early stages.

Now, the big question…

Should You Invest in EV Stocks?

To answer that, I dove into our Stock Power Ratings system to see how stocks related to the EV market stacked up.

I used the Global X Autonomous & Electric Vehicle ETF (Nasdaq: DRIV) as a starting point.

This exchange-traded fund (ETF) holds companies involved in the development of autonomous vehicles, EVs and other renewable technology.

It has 75 holdings, including:

- Tesla Inc. (Nasdaq: TSLA).

- Nikola Corp. (Nasdaq: NKLA).

- Lithium Americas Corp. (NYSE: LAC).

- Stellantis NV (NYSE: STLA).

- Ford Motor Co. (NYSE: F).

- General Motors Co. (NYSE: GM).

I ran all of the holdings through the ratings system and what I found was eye-opening.

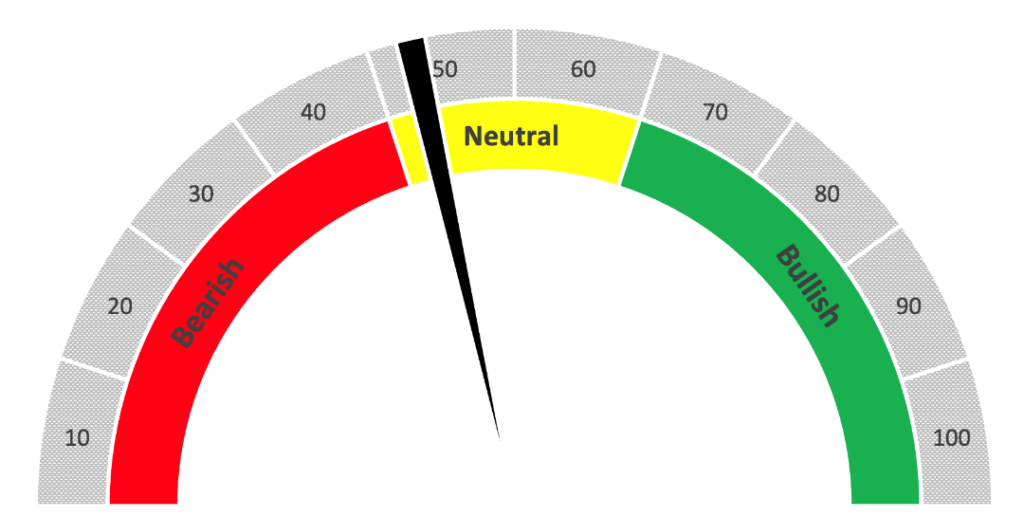

Of the 75 stocks in the ETF, 23 rated “Bullish” or higher while 30 were rated “Bearish” or lower. Eleven of the stocks were rated “Neutral.”

The remaining 11 did not meet the threshold to score. This usually happens when a company’s market cap is very small.

DRIV Stocks Average 42 on Our Stock Power Ratings System

The average overall score of stocks in the ETF was 42 out of 100. This indicates our system is “Neutral” on the ETF and it’s expected to perform in line with the broader market over the next 12 months.

Bottom line: Using ETFs to get broad exposure into an innovative industry like EVs isn’t bad … but your returns could be much better.

It’s why I use the Stock Power Ratings system to find individual stocks within an ETF for better buys.

Remember, 23 stocks in the DRIV ETF are rated “Bullish” or better, so there are certainly gains to be had in the EV sector. But the 30 “Bearish” or “High-Risk” stocks are a drag on the fund.

If you’re looking for individual stocks within DRIV that do rate well, check out STMicroelectronics NV (NYSE: STM) or Advanced Energy Industries Inc. (Nasdaq: AEIS). I’m not going to dig into these companies now, but our system says they are “Bullish” and should outperform the broader market by 2X over the next year.

Of course, our chief investment strategist, Adam O’Dell, is big on the renewable energy mega trend as well. He sees potential for EVs, but his highest convictions lie with updating our energy infrastructure and battery storage.

Adam’s “Infinite Energy” presentation highlights the largest untapped energy source in the world.

This source is worth trillions of dollars and makes massive oil fields look tiny in comparison.

We’re still in the early stages, but this breakthrough is set to turn the global energy market on its head.

Make sure to watch his presentation for more information about this revolutionary new renewable tech (and the one company behind it all).

Stay Tuned: Stock Power Daily Wins!

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Tomorrow I’m going to show you how some of the recent stocks I’ve featured have fared in this volatile market.

It’s proof that Stock Power Ratings works!

Stay tuned…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. Tell us what you think about electric vehicles. Are you investing in this mega trend? What is driving your decision? Email us at StockPower@MoneyandMarkets.com and let us know!