In addition to being a big history buff, I also love music from the ‘60s and ‘70s.

Now that I’m a grandfather — even though I’m only 45 — one song from 1973 is at the top of my playlist: “Ooh La La” by Faces, an English rock band.

This classic song’s lyrics are a conversation between a grandfather and his grandson about being in a relationship.

And these lyrics stood out to me:

I wish that I knew what I know now when I was younger.

In the stock market, hindsight always seems better. Investors look back and wonder: “How much would I have if I had invested in (insert stock here)?”

Today, I look back at our weekly hotlist from July 14, 2020. It’s one of the best performing lists we’ve had since I started tracking them more than a year ago.

I want to show you some of these numbers as proof of how powerful Green Zone Ratings and Adam’s weekly hotlist is, and why you should use it in your own investing.

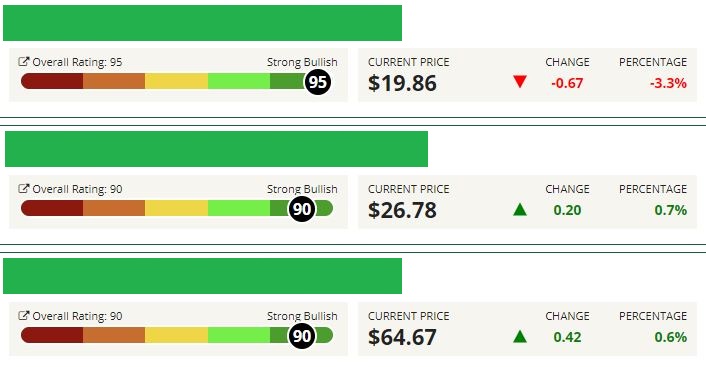

Using our Green Zone Ratings system, chief investment strategist Adam O’Dell and I compile a list of 10 stocks every week that have the potential to crush the market over 2-3 months … and even longer.

This hotlist didn’t disappoint.

Weekly Hotlist Winner: 400% Gain in Celsius Holdings Inc.

The biggest gainer from our July 14, 2020 hotlist is Celsius Holdings Inc. (Nasdaq: CELH).

This Florida-based company develops and sells calorie-burning fitness beverages around the world.

These beverages are sold in supermarkets, convenience stores, drug stores, nutrition stores and on e-commerce websites like Amazon.

When Celsius Holdings made our weekly hotlist, it scored a 77 overall in Green Zone Ratings.

It meant we were “Bullish” on the stock and expected it to outperform the market by two times over the next 12-18 months.

Celsius Holdings Crushes the Market in 12 Months

When put on the hotlist a year ago, Celsius Holdings was trading at $13.38 per share.

Today, thanks to a massive jump in the fourth quarter of 2020, the stock is over $70 per share — a 420% increase in a year!

More Triple-Digit Gains: Daqo New Energy

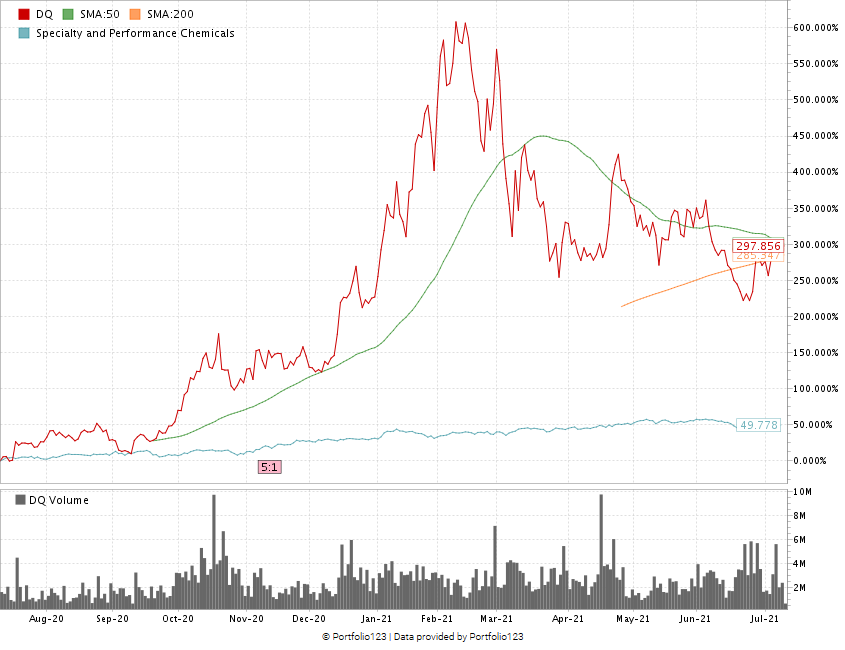

Before the November 2020 election and any talk of a government policy shift toward renewable energy, our system identified Daqo New Energy Corp. (NYSE: DQ) as a strong buy.

The Chinese company manufactures and sells polysilicon to Chinese solar panel producers.

Daqo New Energy scored a 100 overall on our Green Zone Ratings system when it was put on our weekly hotlist a year ago.

Daqo Jumps Almost 300% in 12 Months

At the time our July 14, 2020 hotlist came out, Daqo New Energy was trading at under $18 per share.

Now, like Celsius Holdings, the stock is priced at around $70 per share — thanks to China’s push for more renewable energy production.

That’s close to a 300% gain in 12 months.

From July 2020 to February 2021, Daqo New Energy skyrocketed more than 560%!

Here’s how other stocks on our July 14, 2020 hotlist have performed to date:

- Strattec Security Corp. (Nasdaq: STRT) — Up 115%.

- Canadian Solar Inc. (Nasdaq: CSIQ) — Up 79%.

- Cintas Corp. (Nasdaq: CTAS) — Up 44%.

- Masonite International Corp. (NYSE: DOOR) — Up 40%.

Bottom line: If you’re looking for stocks with the potential to add massive profits to your portfolio, the hotlist is a great place to start. The proof is in the numbers above.

Click here to check it out now!

Until next time …

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.