Income isn’t super easy to come by these days. The S&P 500 yields just 1.3%, close to a record low, and the 10-year U.S. Treasury note yields about the same. But there are pockets of the market still offering a competitive payout, such as business development companies (BDCs).

I like to joke that BDCs are as close to Main Street America as Wall Street ever gets. BDCs provide debt and equity financing to “middle market” companies that:

- Have grown a little too big to get by on bank loans.

- But aren’t quite big enough to issue stocks or bonds of their own.

BDCs can be thought of as the bridge between a mom-and-pop company and a proper enterprise.

And speaking of the proverbial Main Street, one of my favorite BDCs is none other than Houston-based Main Street Capital Corporation (NYSE: MAIN).

Main Street focuses on first-lien senior secured debt investments. In plain English, it means that Main Street is the first in line to get paid. First-lien debt is the safest slice of the capital structure. The company manages about $2.4 billion in assets.

Main Street’s Dividend

Let’s talk dividends. That’s why you’re here, right?

BDCs don’t pay corporate income tax, but they are required to pay out 90% of their net income as dividends to maintain this special tax status.

There’s just one problem with that. Income can fluctuate from year to year, and paying out 90% of earnings leaves little in the way of a cushion for hard times.

That’s where Main Street’s innovative dividend policy comes in.

Its regular monthly dividend is modest, paying out less than the required 90% in most years. But it tops up that monthly dividend with semiannual special dividends that allow the stock to meet its 90% payout.

You can think of it as a regular paycheck with two performance-based bonuses per year.

At current prices, Main Street’s regular monthly dividend works out to a yield of 5.9%. That’s not bad, and in most years, the stock adds another percent or two in yield due to the special dividends.

Let’s see how Main Street stacks up on our Green Zone Ratings system.

Main Street’s Green Zone Rating

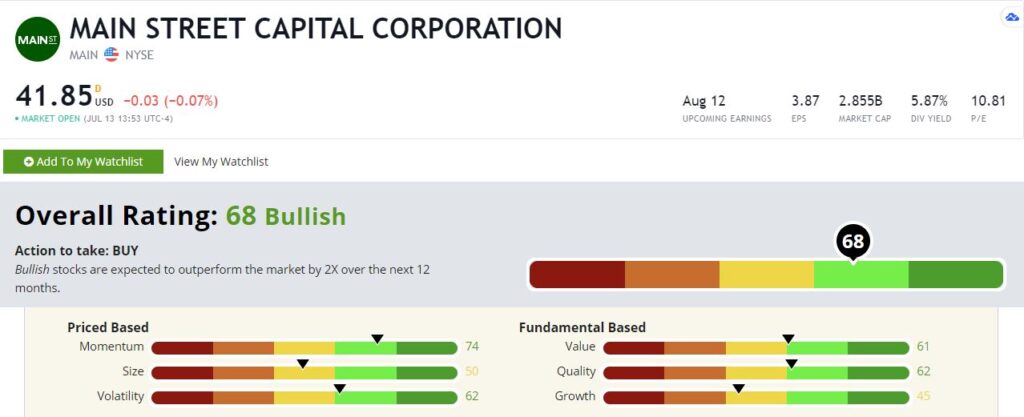

Its overall score is a respectable 68, putting it in “Bullish” territory. And Main Street also rates well enough across all six of our factors.

Main Street Capital’s Green Zone Rating on July 13, 2021.

Let’s break it down.

Momentum — MAIN rates a 74 on momentum. While the early stages of the pandemic hit Main Street and its portfolio of middle-market companies hard, the shares have nearly tripled off of their March 2020 lows. But even now, the shares are below their pre-pandemic levels, so the stock can run higher still.

Volatility — The past year notwithstanding, Main Street isn’t a volatile stock. It rates a 62 on our volatility factor, implying it is less volatile than all but 38% of the stocks in our universe. That’s good. You don’t want drama in an income stock. You want a slow and steady workhorse.

Quality — MAIN also rates well on quality at 62. I love to see this in an income stock. BDCs aren’t known as “high-quality” companies because they often carry a lot of debt, and our quality factor favors low-debt companies. Main Street’s high margins boost its rating here.

Value — Main Street is not as cheap as some of its peers in the BDC space. It regularly trades above book value, whereas many of its peers trade at a discount. That’s OK. The stock is still priced at a reasonable level with a value rating of 61.

Size — Main Street rates exactly at the middle of the pack in terms of size, with a rating of 50. It’s not a small cap, but it’s still small enough to be under the radar of many investors.

Growth — Main Street rates slightly below average on growth at 45. Still, that’s not bad. It puts the stock in the middle of the pack. Our dividend plays don’t all have to be growth dynamos.

Bottom line: So, there you have it. Main Street Capital is a solid dividend play that, based on its rating, should also give us the opportunity for some respectable capital gains.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.