One thing is clear after Friday’s sell-off…

This is a headline-driven market that loathes uncertainty!

President Trump triggered the latest wave of selling after threatening to impose higher tariffs on China, as the two countries continue to drag out their trade dispute.

The threat was enough to wipe out $2 trillion in market value after a week of bullish trading. The S&P 500 and Nasdaq Composite were trading near all-time highs before Friday’s bombshell.

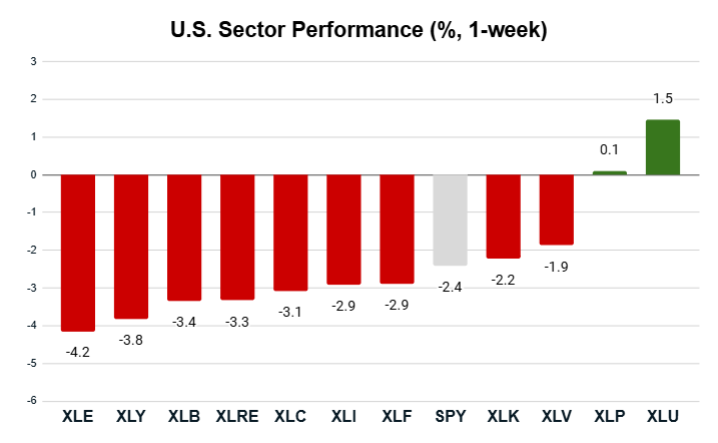

Here’s how the 11 S&P 500 sectors looked after the dust settled:

Key Insights:

- The S&P 500 (SPY) reversed course, closing 2.4% lower.

- Four sectors beat the S&P 500, while seven lagged the index.

- The utilities sector gained 1.5% and was one of only two sectors to close higher.

- The energy sector’s (XLE) decline continued, closing the week 4.2% lower.

A recovery rally is shaping up this morning after Trump mentioned he may not follow through with his latest threat. This isn’t the first time we’ve seen tariff threats trigger whipsaw trading, and I bet it won’t be the last…

It’s why leaning into a system like Green Zone Power Ratings is key. By looking beyond the headlines to see what the data says about individual stocks, we can gain a valuable edge.

Let’s try that now by examining the utilities and energy sector — the best- and worst-performing sectors from last week.

Utilities Sector: Lonely at the Top

The utilities sector was one of only two sectors to weather Friday’s market storm.

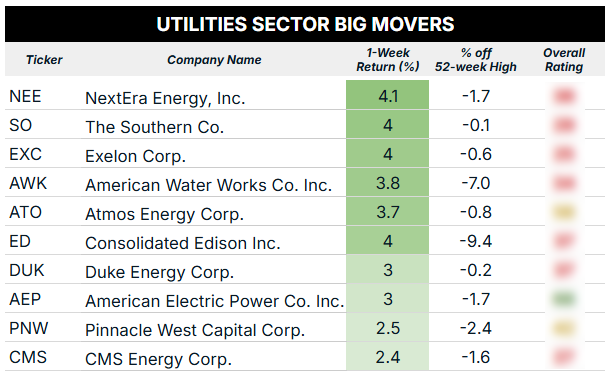

Below, you’ll find the 10 best-performing utility sector stocks that closed within 10% of their 52-week highs and how they stack up in my Green Zone Power Rating system:

Of these stocks, seven are trading within 2% of their 52-week highs.

But I’ll also note that only one stock above is rated “Bullish” in my Green Zone Power Rating system. What’s worse is that seven are rated “Bearish,” meaning they are slated to underperform.

I’d rather find stocks that are trading higher and have a good rating. That gives me a better shot of investing in stocks that are built to last in this market.

We’ll run the numbers on the utilities sector tomorrow to get a better idea of its long-term prospects in this rocky market.

Now, let’s look at a sector that can’t catch a break…

Energy Sector Sinks Even Lower

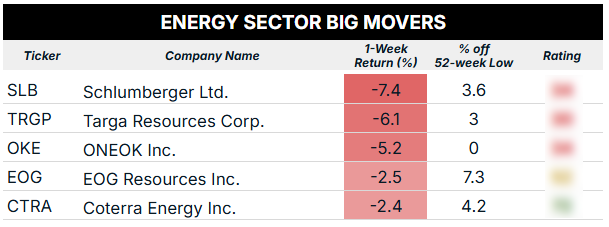

It was another rough week for the energy sector (XLE), which posted another 4.2% decline after sinking 3.4% lower the week prior.

Here are the five energy stocks that sank to close within 10% of their 52-week lows:

My Green Zone Power Rating system was already warning about most of these stocks, as the four with the worst performance last week rate either “Bearish” or “Neutral.”

Of note, ONEOK Inc. (OKE) established a new 52-week low after sinking more than 5%. Paired with its “Bearish” rating, this is one I would avoid for the foreseeable future. I’d rather find a stock that’s in a confirmed uptrend instead of trying to “buy the dip.”

As always, you can look up any of these stocks to see how they rate in my system with a Green Zone Fortunes membership. To see how you can join up today, click here.

To good profits,

Editor, What My System Says Today