In October 2022, I used Adam’s Green Zone Power Ratings system to find a promising stock in the emerging field of “edge computing.”

For reference, edge computing allows companies to process data at the “edge” of the network, which is much faster than if they had to access data from remote locations like data centers.

The edge computing market was projected to jump 187.7% between 2021 and 2030, and this specific company was at the head of the class by manufacturing hardware for edge computing, the Internet of Things and data storage.

But then, just one month later, OpenAI launched ChatGPT — unleashing a whole new artificial intelligence (AI) mega trend that transformed the tech world.

As a result, that same edge computing powerhouse has now become a critical player in the AI boom. So today, I’m going to revisit the company and tell you where it is now and what you should do if you missed out the first time around.

An AI Sleeper Company

The company in question is Super Micro Computers (Nasdaq: SMCI).

This stock first hit my radar thanks to an overall “Strong Bullish” rating of 96 out of 100 on Adam’s Green Zone Power Ratings system.

Taking a deeper look, I found that SMCI released a quarterly report with a 53% year-over-year increase in quarterly revenue and a 46% jump in total annual revenue.

Moreover, the stock demonstrated the “maximum momentum” we love to see in stocks, with a 59% jump over the prior 12 months. SMCI outperformed the computer hardware and storage sector, which was down 25.2% at that time

After a slow start, SMCI ramped up thanks to the buzz generated by AI.

It turns out that Super Micro’s graphic processing units were a key component of AI and machine learning.

In its January 2023 quarterly report, SMCI reported a 53% year-over-year increase in net sales and a 319% jump in net income.

By the first week of August, SMCI stock had risen 534% since the date of my coverage of the company.

Despite reporting even stronger quarterly numbers in August 2023, the shine on AI stocks started to falter and SMCI pared back some of those gains — but was still up 347% a year after I covered the stock.

The stock had another big run in the first quarter of 2021 and showed a 2,032% gain from October 2022 to March 2024.

However, another pushback on AI stocks caused SMCI to drop 60% since reaching its 52-week high in March.

The company was hit in September when a short-seller alleged the company’s financial reports contained “false or inaccurate statements.”

That prompted Super Micro to delay its annual filing, but the company said it didn’t expect any material changes in its quarterly or fiscal year results.

SMCI remained up 723.2% from our October 2022 essay.

Where Does SMCI Stand Today?

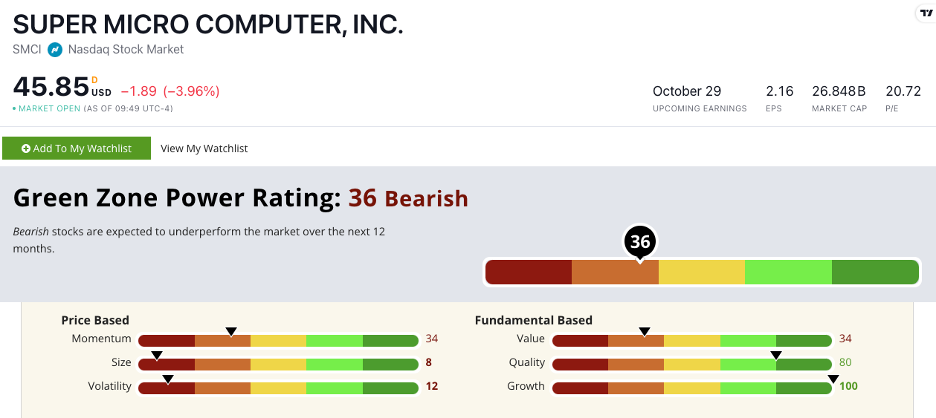

The repeated ups and downs of SMCI’s stock price have had a negative impact on its ratings on our Green Zone Power Ratings system:

In two years — with its recent sluggish momentum and higher volatility — SMCI plunged from “Strong Bullish” to a “Bearish” 36 out of 100.

Although its higher price has put pressure on its value metrics, the company’s returns on assets, equity and investments, along with its sales and earnings growth, remain strong.

Super Micro also recently released new information that could prove to be a catalyst for growth, pushing its stock price higher…

On Monday, the company announced it was shipping more than 100,000 of its graphic processing units per quarter with its liquid cooling systems to some of the largest AI factories in the world.

These liquid cooling systems have proven essential to maintain temperatures needed for hardware to process massive amounts of data and reduce the power demand of these systems — allowing data centers to deploy more AI servers.

While this is great news for SMCI, Adam’s Green Zone Power Ratings system tells us that now isn’t the right time to buy the stock.

My suggestion would be to hold the stock if you already own it or wait and see if it regains its “maximum momentum” before jumping in.

That’s all I have for today.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets