Shortages are a defining characteristic of the current economic recovery.

Empty shelves, once a sign of panic shopping before severe weather, are now normal.

“Help wanted” signs are the norm for businesses.

The lack of employees hurts some businesses more than others. Services, for example, are afflicted with Baumol’s cost disease, where wages will increase even though productivity can’t grow. They must pay higher wages to keep the jobs filled since productivity gains allow other sectors to boost wages.

In economics, the classic example of this concept is that it takes the same number of musicians to play a Beethoven string quartet today as it did in the 1800s. Labor productivity of classical musicians hasn’t increased in 200 years, and it won’t increase in the next two centuries.

The same idea applies to many services. Hairstylists, manicurists and massage therapists can’t increase their productivity. Their services require time, and few shortcuts are available to them.

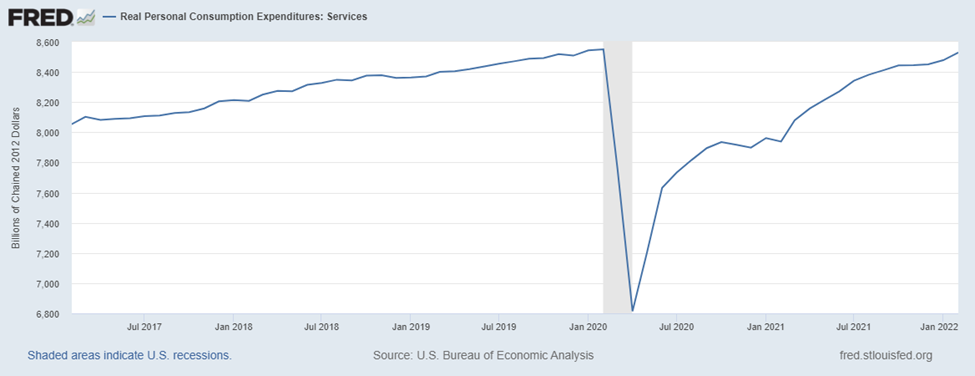

Combined with a labor shortage, this explains why it’s taken so long for spending on services to get back to pre-pandemic levels.

Spending on Services Has “Recovered”

Service Labor Shortages Threaten Economic Recovery

Adjusted for inflation, the recovery took two full years. Some service providers increased their productivity. They may have added hours or used technology to save time. However, those gains were limited. To expand, service providers will need to hire.

Unemployment is low, so hiring will remain difficult. That’s bad news for the economy.

Spending on services accounts for about two-thirds of the economy. If a lack of workers constrains the output of this sector, the economy is doomed to slow growth. That means growth will come largely from inflation, which will have negative impacts on spending.

The economy faces challenges right now. Meanwhile, policymakers seem unable to provide solutions.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.