GameStop Corp. (NYSE: GME) is a video game retailer that has been around for decades. And GameStop stock has become a popular stock for investors.

But before you jump into investing in GME in 2023, there are some important things to know.

Let’s explore what to consider before investing in this company … including how it looks in our proprietary Stock Power Ratings system.

The History of GameStop

GameStop is an American video game and consumer electronics retailer.

The company was founded in 1984 as Babbage’s, and the first store opened in Dallas, Texas.

It wasn’t until 1999 that the company was renamed to GameStop Corporation.

Today, it operates over 5,500 retail stores throughout the United States and Canada.

GameStop Financial Performance

GameStop has had mixed financial performance over its history as a publicly traded company.

The company had strong sales growth from 2007 to2011 but experienced flat sales between 2012 and 2016 due to increased competition from online retailers such as Amazon. It also faced a challenge as digital game downloads offered an alternative for gamers that were stuck buying physical copies in the past.

The company’s revenue has declined since 2017 despite enacting cost-cutting measures and increased demand for retro gaming products.

What Makes GameStop Unique?

One thing that makes GameStop unique is its focus on gaming culture rather than just selling video games or consumer electronics products.

The company organizes events such as tournaments, fan meetups and exclusive product releases which make it attractive to gamers looking for more than just a video game to purchase.

GameStop also has loyalty programs that reward customers with discounts and other perks when they shop.

Additionally, it has partnered with major gaming companies such as Microsoft, Sony and Nintendo, which means it can offer exclusive content to customers who purchase those games at GameStop’s brick and mortar stores or online.

GameStop Stock Power Ratings

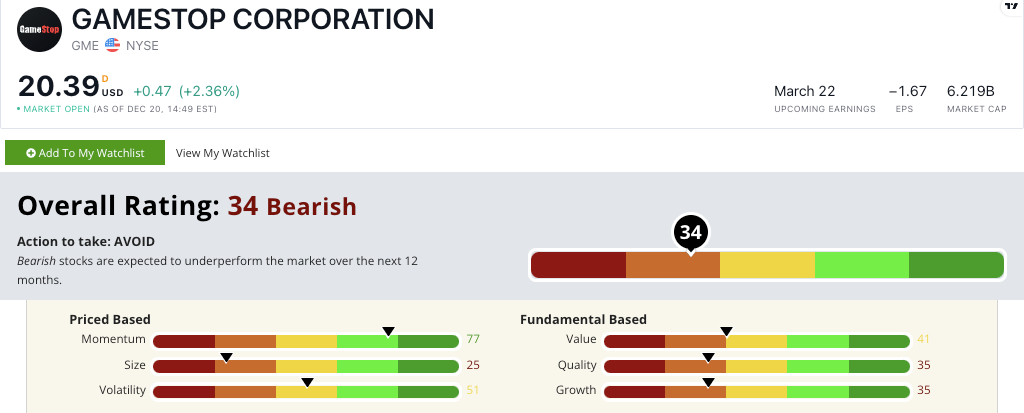

GME stock scores a 34 out of 100 on our proprietary Stock Power Ratings system.

That means we are “Bearish” on the stock and expect it to underperform the broader market over the next 12 months.

GME earns bearish marks on our quality and growth fundamental factors.

Its prior quarter sales growth rate is negative 8.5%, while its one-year annual earnings-per-share growth rate is negative 58.6%.

That earns a 35 on our growth factor.

On quality, GME has negative returns on assets, equity and investment as well as negative net and operating margins.

It scores a 35 on our quality factor.

GME also has a negative price-to-earnings ratio … earning it a 41 on our value factor.

All of these scores tell us that, right now, GME has low growth potential, low quality and is overvalued compared to its peers.

The bottom line: Investors should keep an eye on the industry trends and watch out for potential partnerships that could provide additional revenue streams for GameStop’s business going into 2023 and beyond.

But our Stock Power Ratings system shows this is a stock that’s dealing with some headwinds as we head into the new year.