Back in July, innovative artificial intelligence (AI) tech and mega caps were driving an impossible-to-ignore 2024 market rally. The S&P 500 was up almost 20% with no signs of slowing down.

And it prompted us to ask you a question in Money & Markets Daily: How much will the S&P 500 gain (or lose) by the end of 2024?

We wanted to know how bullish you all were feeling. Looking back after closing out 2024, 87% of you who voted in the poll believed the S&P 500 would finish the year with a gain, and 65% of you thought the index could finish between 10% and 30% higher. With the index closing 2024 out with a 23% annual gain, I’d say you all were right on the money!

That bullish result prompted me to find a stock using Green Zone Power Ratings that had a strong finish in 2024 and ended up tripling the S&P 500’s gain.

Read on to see how it rates now…

Want to Go for a Run? Garmin Stock Ratings

I’ve been running (slowly) in fits and starts for years now. And I never leave the house without my Garmin watch. This was an aspirational purchase about a decade ago, and it is finally starting to pay off. I even upgraded my watch to a newer model this year. (Past Chad had a 10-year plan … clearly.)

Now, I’m a little obsessed … I’m poring over running data, tracking my goals and setting my sights on longer races and faster times.

Garmin Ltd. (NYSE: GRMN) has always been on my radar as a potential investment, which prompted me to look up the stock in Adam O’Dell’s proprietary system.

And I was in for a pleasant surprise:

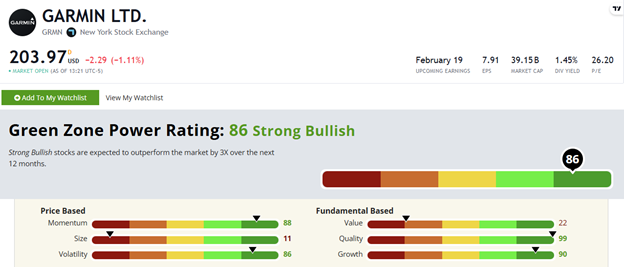

Garmin stock rates a “Strong Bullish” 86 out of 100 in Green Zone Power Ratings. Stocks in this lauded category are set to outperform the broader S&P 500 by a rate of 3-to-1.

At first glance, what stands out most is Garmin’s strong ratings on Momentum (88) and Volatility (86).

Like my heart rate as I struggle to hit a 12-minute pace in the South Florida heat, GRMN stock keeps steadily climbing higher. It has gained 60% over the last year (tripling the S&P 500’s 20% gain).

According to Garmin’s latest earnings report, the company has also increased its operating income by 61% to $437 million year-over-year. That’s contributing to its near-perfect 99 rating on our Quality factor.

The bullish first half of 2024 and some audience participation prompted me to look up GRMN in our system, and Green Zone Power Ratings gave it the green light back in July.

And it looks like Garmin stock is still in a great spot to kick off 2025!

Until next time,

Chad Stone

Managing Editor, Money & Markets