It’s human nature to use the news flow for trade ideas. Plus, it’s easy to assume that if a company is in the news, “it must be doing good things.” Unless, of course, it’s in the news for something really bad … which, you trust, will be obvious to you.

But buying a stock just because it’s making headlines is not a good investment strategy.

Often, you can make a far better investment in a stock that’s not getting as much attention as a competitor that’s dominating the news.

Media companies are in the attention and advertising business. They’ll publish whatever they think will get the most attention from viewers (aka “eyeballs”), so they can justify the big money advertisers spend to sell to those eyeballs.

Media companies are not stock analysts or investment strategists. So, again, why would you think simply buying stocks that are in the news is a good idea?

It’s not.

And that’s the focus on my new Better Buy segment. Each month, I’ll find a stock that’s getting a lot of attention in the news … and then I’ll show you a different stock, in the same sector or industry group, that I think is a “better buy.”

Let’s kick off this segment with a quintessential American company …

American Stalwart General Electric Co. (NYSE: GE)

Hailing from Boston, Massachusetts, GE has been in business since 1892!

The classic American company is well-known for manufacturing household appliances, such as washing machines and dishwashers.

In recent years, though, it’s made a shift toward high-tech industrial manufacturing.

Its business groups now include Power, Renewable Energy, Aviation, Healthcare and Capital.

Both the company and the share price of its stock have struggled mightily in recent years.

In late 2016, GE’s stock topped out at just over $30 a share … and subsequently tumbled to a low of $6 through this year.

Some folks think the worst is over for GE … that its business operations will soon make a turnaround and the stock will trade higher.

Last week, the volume of call options (bullish bets) bought on General Electric’s stock exceeded the volume of call options bought on Facebook, Microsoft and Amazon. Only Apple and Tesla shares garnered higher volumes in their call options.

In short, this means a lot of folks are betting big on GE making a comeback.

It’s likely the stock traded from $6 to $7 on assurances from GE’s CEO, who told investors that the company’s second-quarter results would be the “low-water mark” for GE in 2020, and promised cash flow would return to positive territory in the second half of the year.

But I’m not convinced. When I run GE’s numbers through my 6-factor Green Zone Ratings model for stocks, it gets one of the worst scores among its 50 top competitors in the industrial machinery group: a pathetic 3 out of 100!

Personally, I wouldn’t touch GE’s stock with a 10-foot pole. And I recommend you don’t either.

The stock is in a downtrend … it’s showing market-lagging momentum … and even though you might think the stock is a good “value” after falling from $30 to $6, my model’s value-factor rating for GE is only 50 out of 100.

Buy THIS … Not GE Stock!

Rather than jumping into GE on hopes that it musters an epic “phoenix” moment, I think your money is safer with a less-newsworthy German competitor of GE’s: Siemens (Over-the-Counter: SIEGY).

Like GE, Siemens is in the industrial machinery space, operating in the fields of electrification, automation and digitization. That sounds like a mouthful, but you can think of Siemens as a high-tech manufacturer of large commercial machinery … turbines, generators, power inverters … as well as factory automation equipment and the control systems that run them. Siemens also operates in the health care equipment and renewable energy industries.

You probably haven’t heard much on Siemens in the news cycle. And that’s a good thing … because while GE has been struggling and cajoling investors to believe in its comeback, Siemens has simply been running its high-quality operation.

Siemens’ stock is in an uptrend … with market-beating momentum … and by most of my valuation metrics — particularly on cash flow — Siemens is a better value than GE.

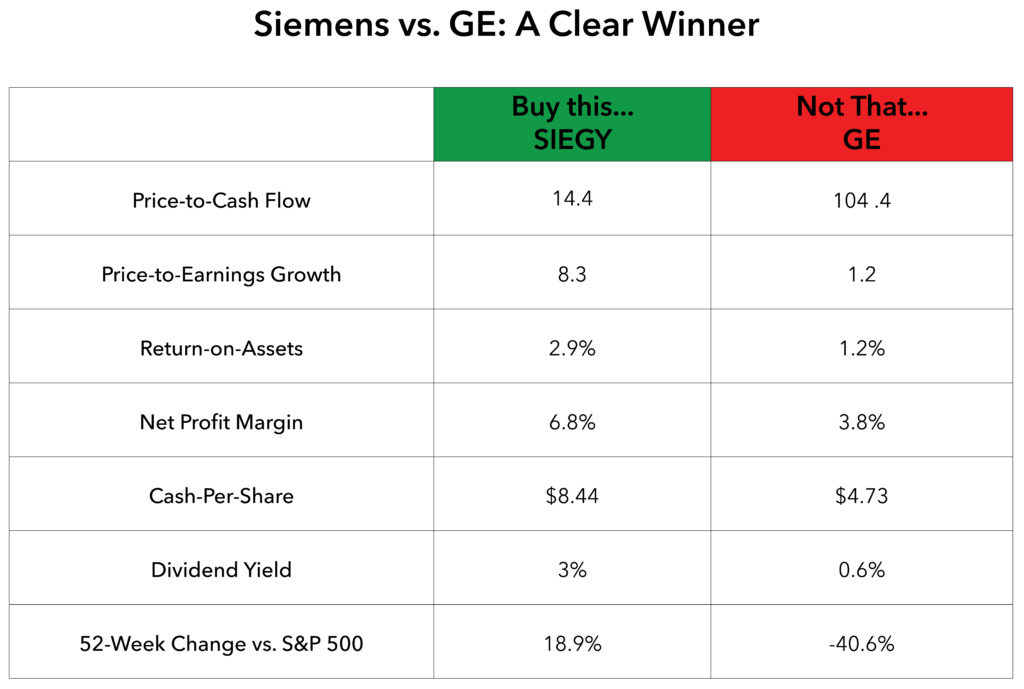

To give you some flavor on why I believe Siemens’ stock is a “Better Buy” than GE in the industrial machinery industry group, I’ve assembled two comparison tables.

The first shows a selection of metrics that stock analysts typically consider. I don’t go into these in detail in this article, as most are either commonly known or easy to find with a quick internet search.

Spoiler alert: Siemens stacks up more favorably than GE on each of these metrics:

Siemens stacks up more favorably on all seven metrics.

The second table I’ve put together for you are the factor scores each stock has earned according to my 6-factor Green Zone Rating model for stocks, as well as my model’s overall score. Have a look:

Siemens stock rates better than GE in every Green Zone factor!

All told, you can see that Siemens stock scores a 72 out of 100 on my model … whereas GE scores a 3!

It may feel patriotic to bet on a classic American company’s (potential) comeback.

But if you want to buy an industrial machinery stock that has strong numbers backing its (less newsworthy) story … I think Siemens (OTC: SIEGY) is the better buy.

Now, I know we’re sending a lot of new features your way … and my team and I would love to hear what you think of them! Is there something you want more (or less) of? Are there stocks you’d like us to look at or feature in an upcoming Better Buy article?

Just reach out to feedback@moneyandmarkets.com with your comments!

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets

P.S. With an overall rating of 72, I’m bullish on Siemens. According to my Green Zone Ratings algorithm, we expect stocks that rank between 61 and 80 to outperform the market by 2X over the next 12 months! Even better, though, are the stocks that rank between 81 and 100. Those are our “strong bullish” stocks — the ones that are poised to beat the market by three in the next year!

Once a month, I send readers of my premium service, Green Zone Fortunes, my hand-picked favorite highly-rated Green Zone stock. Click here for the details now!