It’s been an outstanding year for oil and gas stocks.

Higher energy prices mean more profits for companies in the sector.

That’s an attractive proposition for investors:

Over the last year, the Dow Jones U.S. Oil & Gas Index, an index that tracks the overall sector, has jumped 51.9%, while the S&P 500 has lost 18.3%.

And one of the biggest gasoline distributors in the U.S. is reaping the rewards of the energy bull market.

It’s one of the highest-rated stocks in our Stock Power Ratings system, a tool that analyzes more than 8,000 stocks!

I’m talking about Global Partners LP (NYSE: GLP).

GLP sells and transports gasoline, diesel and other oil-based products to commercial and industrial customers such as gas stations. And it’s been a lucrative year across the board (more on that below).

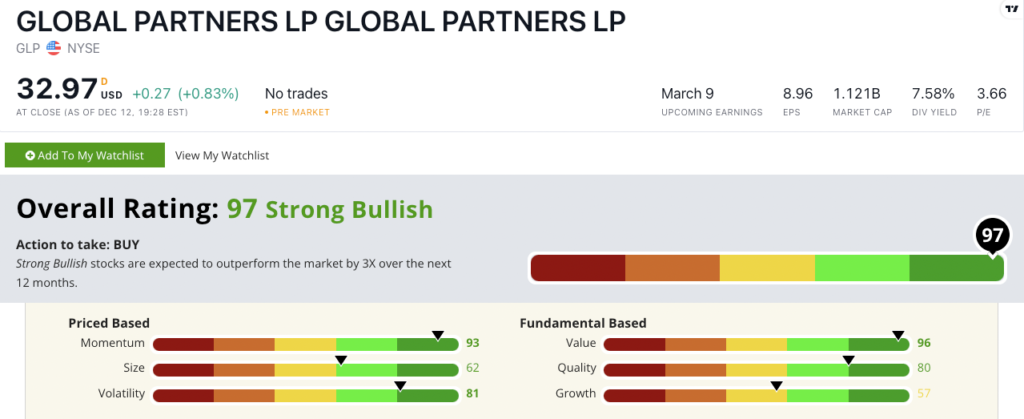

Global Partners’ stock scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Global Partners Stock: Strong Value + Excellent Momentum

Global Partners recently reported a strong quarter.

Highlights include:

- Quarterly gross profit of $328.4 million — a 61.7% year-over-year increase!

- It grew its quarterly net income to $111.4 billion — up 231.5% from the same quarter a year ago.

GLP scores a 96 on value thanks to its price-to-earnings coming in at less than half the industry average.

Its price-to-sales ratio is four times lower than its downstream energy peers — meaning it is a much better value than its competitors.

GLP is also strong on our quality factor — where it scores an 80.

Its returns on assets, equity and investment are all higher than peer averages.

This all tells us that GLP is a better value and quality stock than its peers.

What about momentum?

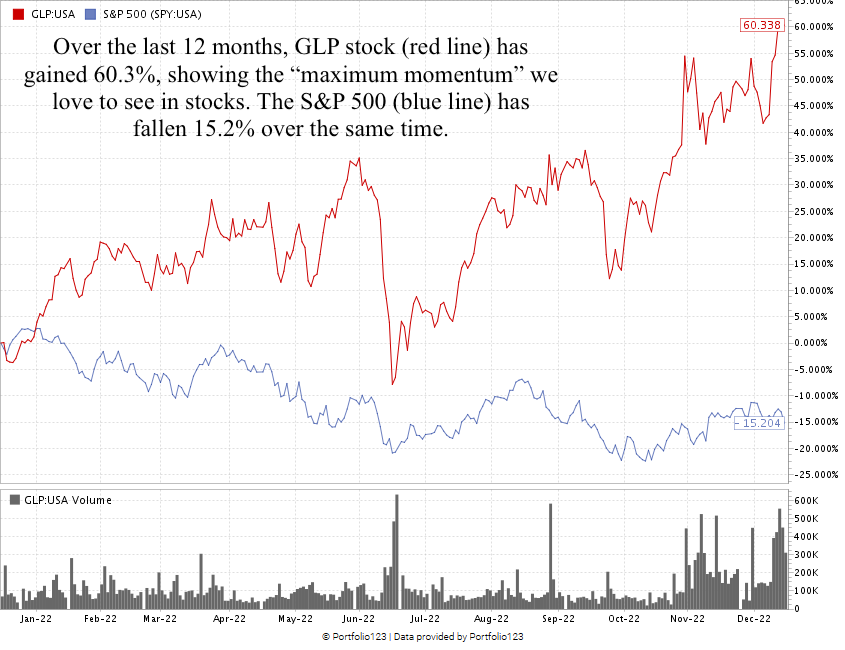

Just look at the chart below.

Created in December 2022.

GLP is trading at a 52-week high. Over the last 12 months, the stock has climbed 60.3% — earning it a 93 on our momentum factor.

GLP scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Oil and gas stocks have topped the charts over the last 12 months.

I believe this is just the beginning for the sector.

GLP’s momentum, quality and value are compelling reasons to add it to your portfolio.

Bonus: The company’s 7.58% dividend is an annual payout of $2.50 per share that you own.

What about you? Are you buying Global Partners stock? Write us at StockPower@MoneyandMarkets.com, and let us know how your position in GLP (or any of our other Power Stocks) is performing.

Stay Tuned: A Hidden Energy Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned tomorrow, where I’ll share all the details on an oil and gas company that’s exploring a massive untapped geologic formation to meet the world’s natural gas demands.

Until then.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets