Competition is heating up in the electric vehicle, or EV, space.

Tesla Inc. (Nasdaq: TSLA) has enjoyed its position as EV king for a while now. But automakers big and small are ready to cut into TSLA’s market share in a big way.

Just look at some of these headlines:

- “High Demand for Ford EVs: Lightning, Mach-E, and E-Transit”

- “Automakers Stock up on Batteries in the Growing EV Race”

- “GM can ‘Absolutely’ Catch Tesla in EV Sales by 2025, says CEO Mary Barra”

The Money & Markets team is always looking for the best ways to invest in the biggest stock mega trends. And EVs will be one of the most lucrative opportunities of the next decade.

The global EV market hit a value of $171 billion in 2020. Statista expects it to grow to $725 billion by 2026 — a 320% increase in only five years!

I want to focus on that last headline and pit Tesla against General Motors Co. (NYSE: GM) to see which is a better buy for the electric vehicle stock mega trend now.

CEO Barra Is Confident GM Can Catch Tesla

GM CEO Mary Barra is confident the American automaker can overtake Tesla by 2025. She said in a recent interview with CNBC:

I am very comfortable because when people get into these vehicles, they are just wowed. So we will be rolling them out and we’re going to just keep working until we have number one market share in EVs.

Tesla’s EV market share was 79% in 2020. IHS Markit expects that to drop to 56% in 2021 and all the way to 20% in 2025.

That leaves the door wide open for other players. (Enter GM.)

TSLA and GM: Green Zone Stock Ratings

Let’s see how TSLA and GM look right now using Adam O’Dell’s proprietary Green Zone Ratings system.

Adam built this model to rate stocks on the six factors proven to drive market-beating returns. (Read more about the six factors at the end of this story.)

Our team runs this model daily on a universe of more than 8,000 stocks and rank based on “Overall Rating.” These ratings range from 0 to 100, where 0 is “worst,” and 100 is “best.”

And best of all? It’s on our website! Feel free to use it to look up any stocks on your radar. Read our handy guide here to get started now.

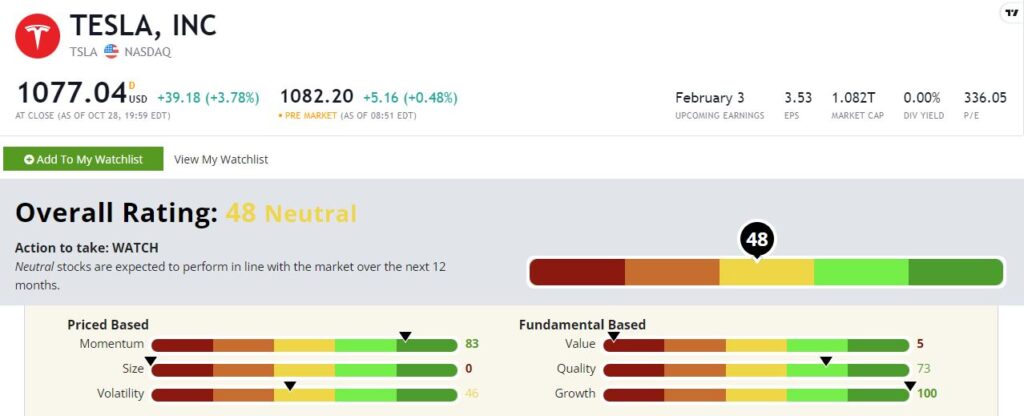

Tesla Inc.’s Green Zone Rating on October 29, 2021.

Tesla rates a 48, which is “Neutral” on our scale. That means we can expect the electric vehicle stock to perform in line with the overall market over the next 12 months.

At first glance, that isn’t impressive. But the individual factor ratings tell a different story.

TSLA rates a perfect 100 on growth! Looking at its latest earnings report, the EV stock giant’s $13.7 billion in reported revenue for the second quarter of 2021 was a 56% increase from the same quarter in 2020.

Its net income also increased 388% year over year!

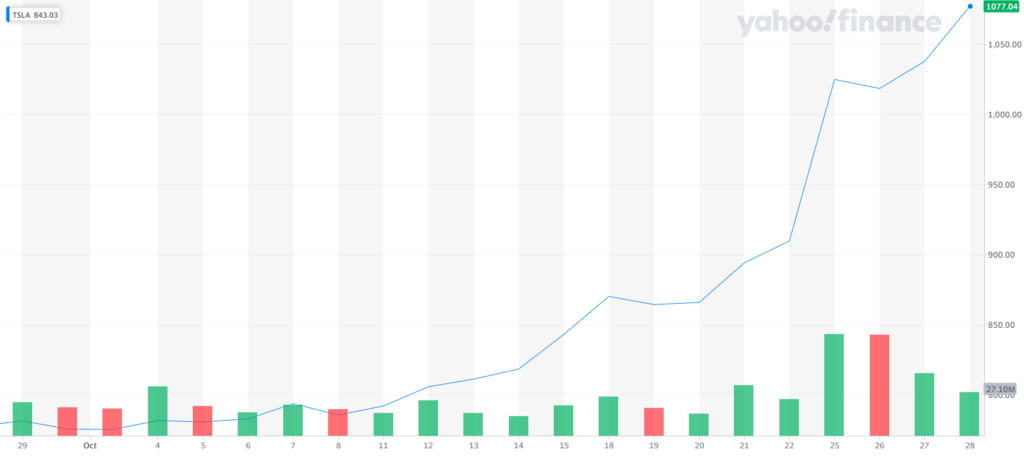

TSLA touts an 83 momentum rating. Adam is always on the lookout for stocks exhibiting “maximum momentum,” and TSLA fits the bill. Just look at its stock chart:

Tesla’s Stock Soared Over the Last Month

Source: Yahoo Finance.

Tesla stock gained more than 38% over the last month. It’s trading at all-time highs.

Of course, the stock isn’t cheap, according to our value metric. It only rates a 5 on the value factor, and it carries a 349 price-to-earnings ratio. Investors seem comfortable paying a premium for growth. It’s hard to argue when the stock jumps almost 40% in one month.

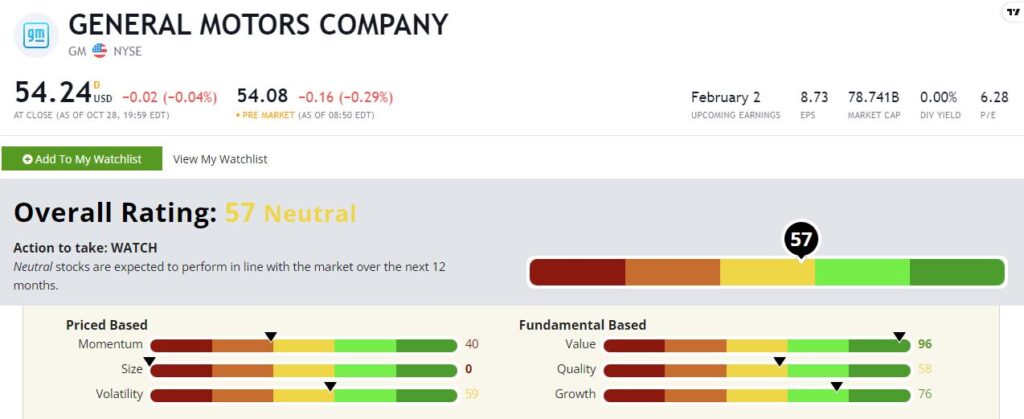

GM is in a similar spot, going by its overall Green Zone Rating of 57.

General Motor Co.’s Green Zone Rating on October 29, 2021.

GM stock has enjoyed a run-up in 2021 as well. It’s gained around 33% year to date.

While Tesla is a pure EV stock play, GM is a standard automaker that is shifting its business model into the EV space. And its 96 value rating reflects that. Its P/E ratio is only 7 compared to TSLA’s P/E ratio of 349.

But it sports a 76 growth rating as well. GM’s revenue grew 103% year over year, according to its most recent earnings report.

The Better EV Stock to Buy

It’s hard to ignore the EV stock mega trend. TSLA and GM don’t rate “Bullish” or “Strong Bullish” in our Green Zone Ratings system.

However, Tesla’s maximum momentum makes it worth a look, at least for a short-term play.

And GM is determined to cut into that market share over the next decade.

But if you want Adam O’Dell’s most promising play on the EV stock boom, you’ve got to check out Green Zone Fortunes. Adam recently recommended a company that is coming for TSLA’s lunch money. And it rates a “Strong Bullish” 90 in Green Zone Ratings!

Green Zone Rating on October 29, 2021.

Adam expects this stock to soar 135% higher over the next three years as it develops a new battery technology that will be an EV game-changer.

To find out how you can gain access to this stock recommendation, along with information on genomics, Adam’s No. 1 stock mega trend of the next decade, click here to watch his “Imperium” presentation now.

Green Zone Ratings Factors

Momentum — Strongly uptrending stocks earn higher momentum ratings. We prefer to buy stocks that are already trending higher and at a faster rate than the overall market. This approach can increase our odds of success and decrease risk.

Value — Less expensive (aka “cheap”) stocks earn higher value ratings. We prefer to buy great companies at good prices because the price we pay impacts future returns. Overpaying for a stock can be a costly mistake.

Quality — High-quality companies earn higher quality ratings. We prefer to buy high-quality companies, of course! To determine quality, the model considers a company’s returns, profit margins, cash flows, debt ratios and operational efficiency, among other things.

Growth — High-growth companies earn higher growth ratings. All things equal, we prefer to buy companies that are growing both revenues and earnings at faster rates than the market and economy.

Size — Smaller companies earn higher size ratings. We prefer to buy smaller companies for the extra “juice” that typically comes with them.

Volatility — Less volatile stocks earn higher volatility ratings. We prefer low-volatility stocks because they’re proven to generate superior risk-adjusted returns over the long run — with less heartburn.

Best investing,

Chad Stone

Assistant Managing Editor, Money & Markets