Gold.

It seems, as 2022’s market chaos played out, we forgot about the precious metal.

It’s been buried beneath stories about cryptocurrency, bonds and just about every other sector of the market that took a bath last year.

But it’s a good time to reestablish ourselves with the yellow metal as miners plan to pull more from the ground:

GlobalData expects global gold production to increase 29.3% from 2014 to 2024. It expects more than 7% growth in the three years starting in 2021.

Today’s Power Stock mines for gold in a unique way: DRDGOLD Ltd. (NYSE: DRD).

When I say DRD mines for gold in a unique way … I mean it.

The South African company takes the waste sand and silt created from mining for other metals and minerals, washes it with water and finds gold.

Have you ever panned for gold in a stream on a class field trip? DRDGOLD expands on that idea on a massive scale.

And it profits from that process.

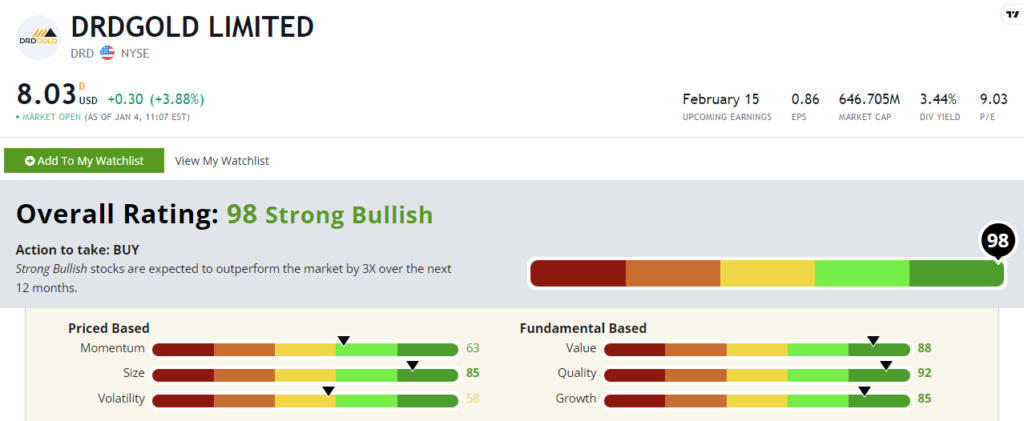

DRD scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

DRDGOLD Stock: Strong Quality + Value

DRDGOLD recently closed out a strong year.

Here are two high points:

- Reported revenue of $336 million — the second-highest annual revenue for the company in its history!

- Its quarter-over-quarter sales growth rate was 7.8%, and its earnings-per-share growth rate was 20.3%.

These sales figures show why DRDGOLD stock scores an 85 on our growth factor in our Stock Power Ratings system.

It’s also an outstanding quality stock: DRD’s return on equity is 22%, compared to the metal ore mining industry average of negative 33.1%.

DRD’s operating margin is 23.2%. By comparison, the industry average is negative 13.1%. This tells us company management knows how to keep profits rolling in.

The stock earns a 92 on our quality metric.

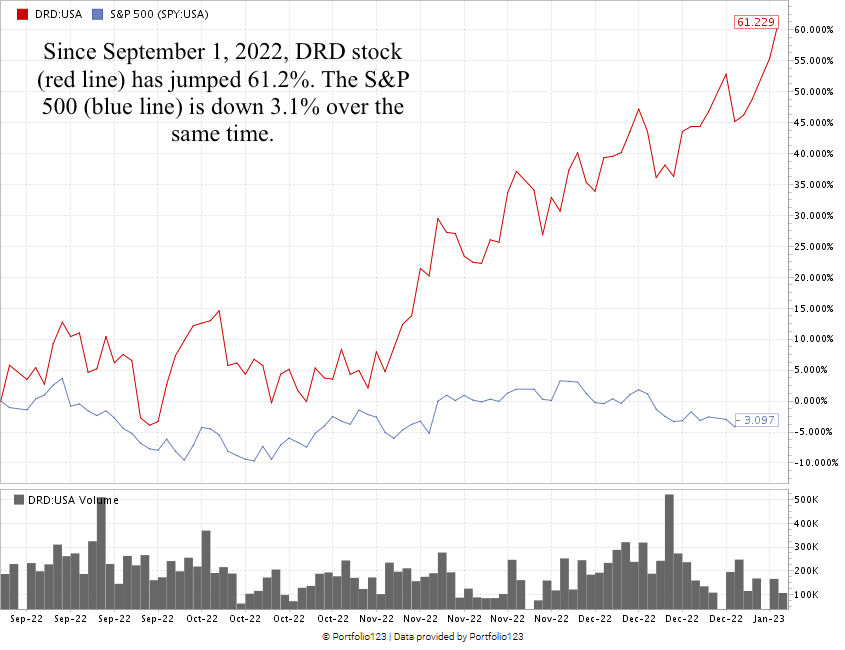

Created in January 2023.

I want to focus on how DRDGOLD stock has performed since September.

From its 52-week low in September, the stock has run up 67.4% into January. That’s the “maximum momentum” we love to see in stocks — and I believe it has a lot of room to run.

DRDGOLD stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Gold production is only going higher in the coming years.

DRD finds gold in a unique way — from waste created by other ore mining activities.

This makes it a great addition to your portfolio.

Stay Tuned: A Gig Economy Stock to Avoid

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on a staffing stock that has petered out after its COVID-era success.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets