Gold vs. stocks: Which is the smarter buy?

This will surprise many investors. Since 2000, gold has delivered much larger gains than the S&P 500 Index.

Investors are focused on the short term. Since the end of March, they have noticed the S&P 500 soar by more than 50%. Over that same time, gold has gained a little more than 30%.

This strong rally in stocks has created a sense of complacency for some investors. They saw stocks fall but rise again, so there is no need to consider alternatives right now.

It’s useful to step back and take an objective look at alternative investments.

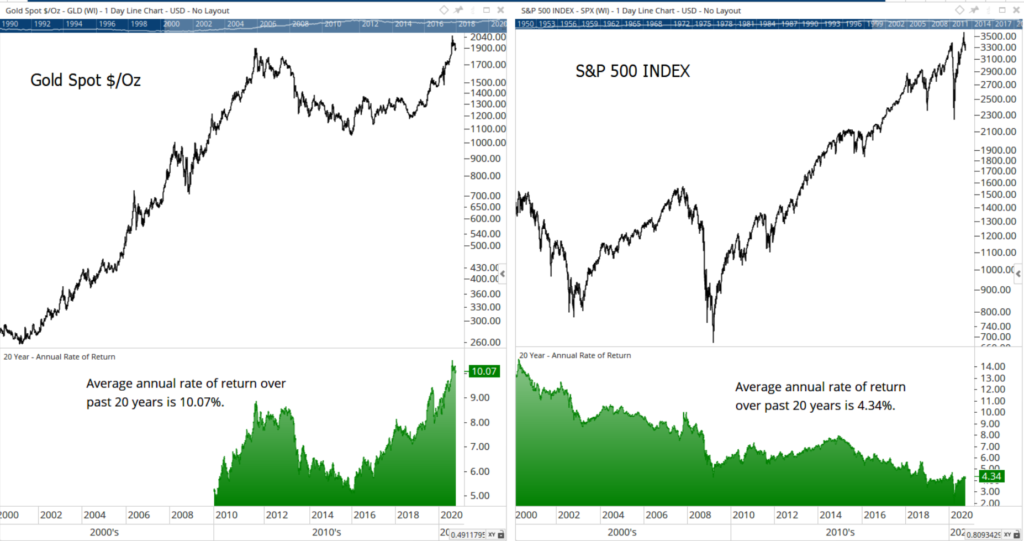

The chart below takes a long-term view. You can see the annualized rate of return over the previous 20 years at the bottom.

Gold vs. Stocks: Gold Nearly Triples S&P 500 Since 2000

Source: Optuma.

A dollar invested in gold in 2000 would now be worth about $6.82. That same dollar in the S&P 500 would be worth about $2.34. Gold delivered gains that were 2.9 times larger than the index.

While gold has been the better performer since 2000, the S&P 500 posted annualized gains of more than 14% at the beginning of this period.

This brings up the obvious problem for investors: determining the best choice for the next 20 years. The chart indicates investors should consider gold.

Gold vs. Stocks: A Good Buy Right Now

Gold enjoyed a strong run into 2011. Then prices fell and formed a consolidation pattern. Consolidation is a period when prices move sideways. It took about nine years for gold to get back to where it was in 2011.

The S&P 500 also experienced a long consolidation in the last 20 years. It took 13 years for the S&P 500 to recover from the bear market that began in 2000. After finally breaking out to new highs, the S&P 500 moved sharply higher.

Strong trends often follow multiyear consolidation patterns. And gold is in a similar position to where the S&P 500 was in 2013. Now, gold could deliver large gains over the next few years.

Investors don’t often look at long-term charts. But if they did, they would notice prices often move sideways for years, and then they move sharply higher.

And if you are looking for an easy way to invest in gold without buying the metal outright, my colleague and Money & Markets CMT Adam O’Dell has just the thing. He calls them “A9 gold stocks,” and they have the potential to beat the price of bullion nine times over. Read more about it here.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.