Yelp is providing important economic data.

For years, the site collected reviews of local businesses. Consumers used the information to avoid unpleasant surprises.

Businesses realized positive reviews helped attract customers. So they provided data on operating hours and information about their business to Yelp.

When the economy closed in March, many updated their hours on Yelp or closed permanently.

Yelp has been publishing that data. It shows that more than 132,000 small businesses have closed. These are mostly customer-facing businesses like restaurants and gyms.

But other small businesses aren’t on Yelp. These include manufacturers or companies providing services to other businesses.

These companies, whether they are on Yelp or not, are an important part of the economy. Investors might be surprised by how important these businesses are.

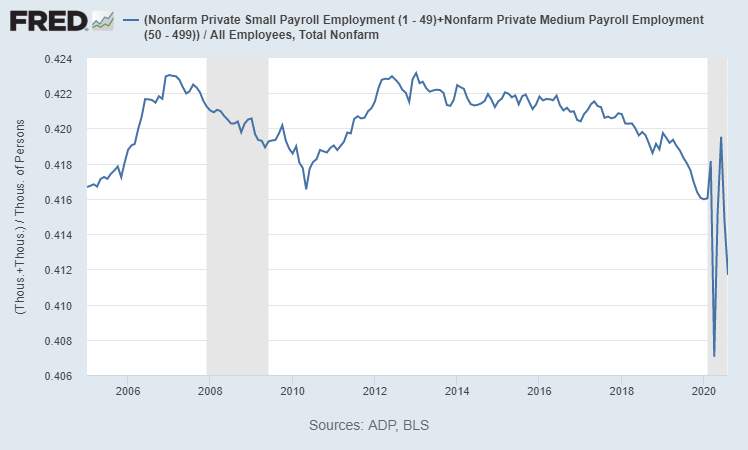

Firms with less than 500 employees accounted for more than 41% of all employment before the pandemic. The chart below shows the percentage of employees in small businesses.

Unstable Small Business Employment

Source: Federal Reserve.

The percentage has been unstable since the lockdown in March.

The Small Business Crisis Accelerated

Small businesses accounted for more than 42% of all jobs for most of the last decade. But that number has been falling for some time. Note the sharp decline in 2019, before the current recession started.

The economy was going through an important transition before the pandemic hit. Economic shutdowns accelerated that trend.

A rapid small business recovery isn’t likely. The underlying downward trend will have to play out.

This means empty storefronts on Main Street and vacancies in strip malls across America. That makes it hard for landlords to maintain their properties, let alone expand.

Investors should track this chart closely.

Small businesses were already facing a crisis last year. And that crisis is accelerating.

Without significant help from Washington, many small businesses and their communities face long economic recoveries. And that will have a trickle-up effect on the rest of the economy.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.