Wall Street was more like the wild west in August as volatility changed the call from “buy” to “sell” and back again at the drop of a hat, but after a relatively calm September, Goldman Sachs warns the markets are setting up for another crazy month in October.

According to Goldman, stock volatility has been on average 25% higher in the month of October since 1928, and no sector has been safe. Every major benchmark and sector that Goldman tracks has been hit at some point over the last 30 years, but technology and health care have seen the most action.

“We believe high October volatility is more than just a coincidence,” Goldman Sachs Managing Director John Marshall said Friday in a note to clients. “We believe it is a critical period for many investors and companies that manage performance to calendar year-end.”

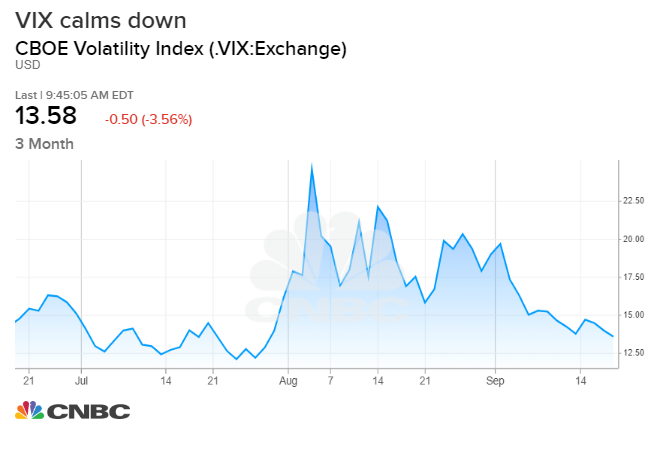

August was a rough month for Wall Street as investors tried to maneuver in a market that was hammered by developments in the trade war between the U.S. and China. Many tried to run to the bond market, which in turn sent Treasury yields to record lows and triggered several inverted yield curves, a prime recession indicator.

But September has been calm in comparison. Both the U.S. and China have pulled back their pressure on each other as they prepare to resume negotiations in October, and the bond market has returned to normal levels of activity.

Here’s a look at the Chicago Board Options Exchange Volatility Index, also known as the VIX or “fear gauge:”

With earnings season set to begin again in October, though, investor sentiment could lead to big swings.

“Such pressures boost volumes and volatility as investors observe earnings reports, analyst days and management gives guidance for the following year,” Marshall said.

And the swings are big compared to the rest of the year.

“Not only are earnings day moves rising relative to average daily moves, but October tends to be the quarter with the largest absolute earnings day moves for U.S. stocks,” Marshall said.