Economists and traders were happy to see the latest news from the Institute of Supply Management (ISM). On the first business day of every month, ISM publishes a report that offers a glimpse of economic activity in the prior month.

The latest Manufacturing ISM Report On Business showed that economic activity in the manufacturing sector grew in August, with the overall economy notching a fifteenth consecutive month of growth.

The report includes information on a number of factors that affect manufacturers. Supply managers noted that new orders are increasing, wait times for deliveries are shortening and price pressures are easing. Overall, the report was bullish for the economy.

But manufacturers did note a significant concern: employment. They can’t hire enough people to meet demand.

One respondent noted: “[We] continue to be unable to hire hourly personnel or machine operators due to few applicants. New business continues to grow and come in. [We are] unable to handle influx of orders without staff, both hourly and salaried.”

Supply mangers across a variety of industries are facing this challenge. Overall, 35% expressed difficulty in filling positions. The report added that “a significant number of panelists note increasing employee-turnover rates, continuing a trend evident in the comments in July.”

What Low Employment Means for the Economic Recovery

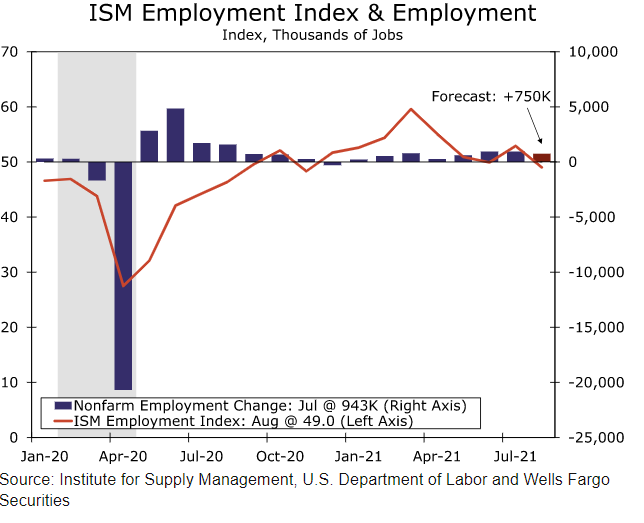

The ISM Employment Index is highly correlated with the creation of new jobs. Based on the ISM report, economists at Wells Fargo lowered their estimate for the August employment report. They now expect the Bureau of Labor Statistics to show that just 750,000 jobs were created in August.

Source: Wells Fargo.

Wells Fargo’s employment outlook is still above the expectations of most economists. Consensus forecasts call for a gain of 720,000 jobs, down from the 943,000 new jobs created in July.

This is all bad news for the economy. An inability to hire and increased turnover will hurt productivity and could slow the economy if it continues.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.