Recessions seem easy for consumers to understand.

Ronald Reagan explained the concept when he ran for president in 1980: “Recession is when your neighbor loses his job. Depression is when you lose yours.”

Unemployment is low at 3.6%. But for many consumers, it feels like a recession.

Many of us know someone who lost a job. Others are now insecure about their own positions. It feels like unemployment should be higher.

Then there’s inflation.

Consumers haven’t experienced inflation this high since Reagan was president. He left office in 1988. Anyone under 40 probably doesn’t remember Reagan’s administration or high inflation.

Recession Data for All

For now, economists don’t agree with consumers.

They use models and economic data to determine when we’re in a recession. Their analysis doesn’t show a recession. But many indicators are pointing to the start of one soon.

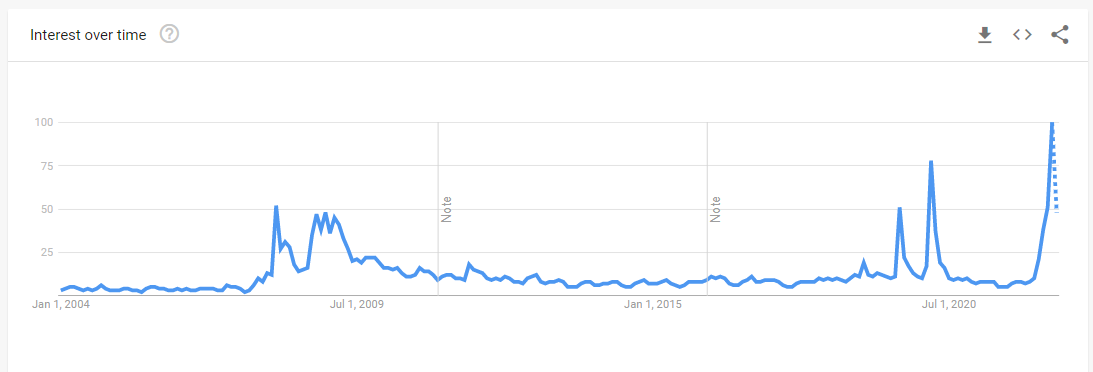

Among those indicators is a recent tool, Google Trends. Searches for the word “recession” have spiked above levels seen during previous recessions.

Google Is a Recession Indicator

Source: Google Trends.

Google’s Recession Indicator Spikes Explained

The first spike in the data occurred in November 2007. The National Bureau of Economic Research (NBER) determined the recession started in December 2007.

The second group of spikes began in June 2019. NBER economists concluded that the economy peaked in the fourth quarter of that year before the pandemic shut everything down in 2020.

In both cases, consumers understood the economy turned before it was in recession.

Google Trends shows us what people are interested in, which can help us spot emerging trends in the stock market.

The tool offers insight into sentiment. When searches for negative terms, like recession, are high, the country’s mood is bearish.

Bottom line: With recession searches spiking for a third time, we can be fairly certain the economy is either in or near a recession.

Economists will agree with that soon, but we can’t wait for the economists as investors.

We need to be defensive now.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.