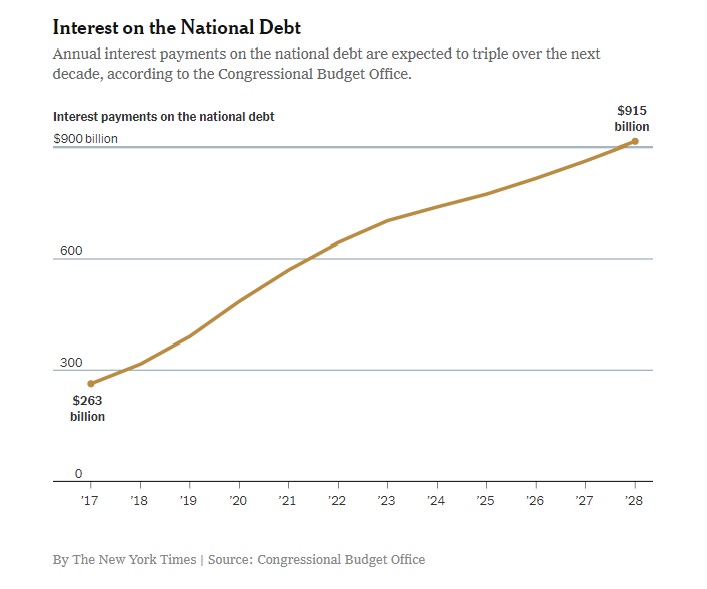

Soon, the federal government could be spending more than $900 billion per year on interest payments to service the national debt.

That is more than it spends on defense, Medicaid or children’s programs, according to a recent report in the New York Times.

The Tax Cuts and Jobs Act effectively put more money in the pockets of the American people, but it will also run up borrowing costs and, combined with rising interest rates, will effectively cost the government more as the debt becomes more expensive.

It also will make infrastructure spending on roads and bridges more difficult.

Per the Times:

Already the fastest-growing major government expense, the cost of interest is on track to hit $390 billion next year, nearly 50 percent more than in 2017, according to the Congressional Budget Office.

Rising interest rates always make borrowing more expensive, and the deficit next year will reach $1 trillion for the first time since 2012 under President Barack Obama.

The CBO expects annual interest payments to triple over the next decade.

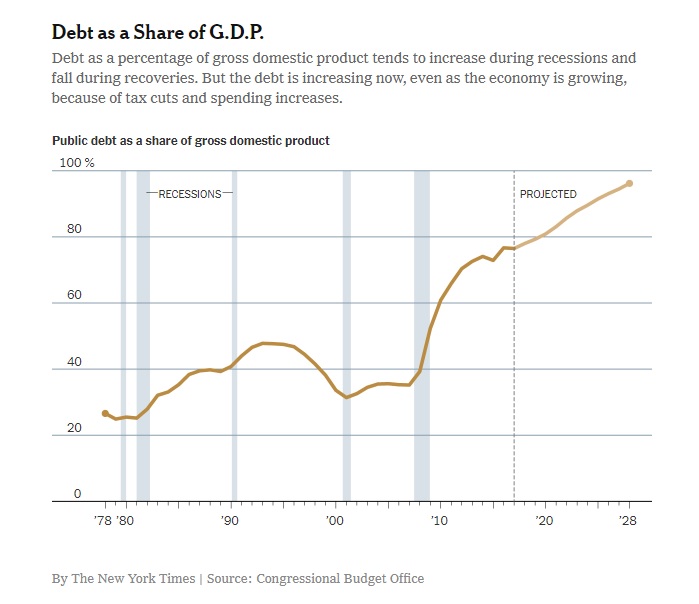

The article notes that in the past — outside of wartime — government borrowing typically expands during recessions and goes down during recoveries. The market is in the midst of the longest bull run in history but borrowing is still way up, something we’ve never seen before.

“There will eventually be another recession, and this increases the chances we will have to slam on the brakes when the car is already going too slowly,” Harvard Economist Jeffrey Frankel notes in the article.

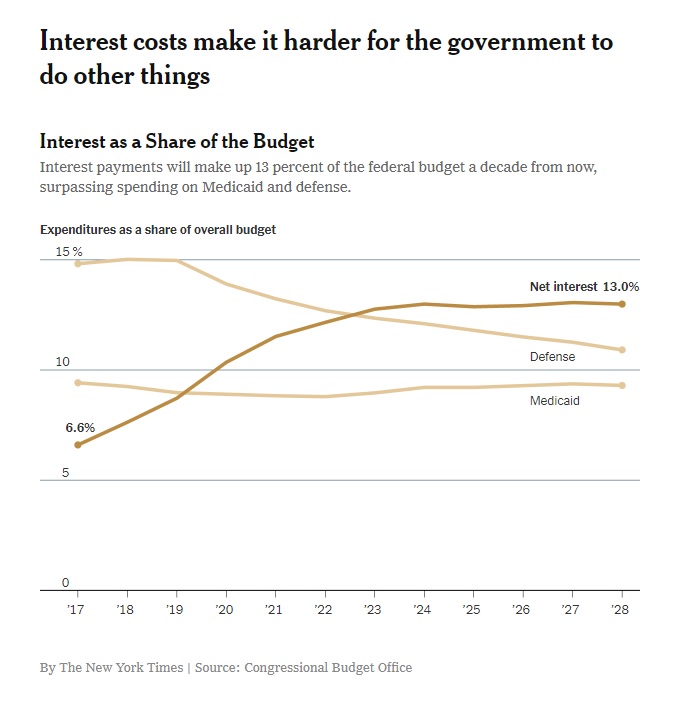

In the next 10 years, an estimated 13 percent of the government’s total spending will go to interest payments. That’s nearly double 2017’s 6.6 percent.

“By 2020, we will spend more on interest than we do on kids, including education, food stamps and aid to families,” said Marc Goldwein, senior policy director at the Committee for a Responsible Federal Budget, a research and advocacy organization.

According to the CBO, interest payments will surpass Medicaid spending by 2020 and the Department of Defense budget by 2023.

President Donald Trump has called for $1 trillion to spend on infrastructure but Congress has done nothing yet to move that process forward, and heavy interest payments could make it an impossibility.

Borrowing hasn’t been much of a problem since the Great Recession because interest rates have been so low.

With the economy booming and the stock market hitting all-time highs under Trump, the Fed keeps raising rates. This year we’ve already seen three hikes and the Fed announced this week it expects another in December, and three more likely to hit in 2019.

“When rates went down to record lows, it allowed the government to take on more debt without paying more interest,” Mr. Goldwein said. “That party is ending.”

Of course, if the economy weakens then interest rates could be lowered again, but members of Congress are looking to make last year’s tax cuts permanent. That would reduce federal revenue by an additional $631 billion over the next 10 years, according to the Tax Policy Center.

The strength of the dollar gives the U.S. plenty of borrowing power because the Fed can simply print more money. But that’s no long-term fix as rising interest costs and a bigger deficit will eventually catch up with us.

“We exported a financial crisis a decade ago, and the world responded by sending us money,” said William G. Gale, a senior fellow at the Brookings Institution.

Charles Schultze, chairman of the Council of Economic Advisers in the Carter administration, once summed up the danger of deficits with a metaphor. “It’s not so much a question of the wolf at the door, but termites in the woodwork.”

[totalpoll id=”5294″]