Employment reports are among the most important pieces of economic data.

Policymakers, especially elected officials, know that unemployment is important in elections. When unemployment is high, incumbents often lose elections.

Political appointees are often replaced after elections. This makes reducing unemployment important to policymakers who lose their jobs when elections go against them.

This has been true for centuries. In the 1930s, during the Great Depression, policymakers developed programs to put the unemployed to work. This led to an unprecedented expansion of government.

Many of those Depression-era programs were useful. Unemployed individuals were put to work building roads and post offices. Policymakers sought to support communities.

Over time, the government shifted away from directly putting the unemployed to work. New programs created bureaucracies to oversee spending, and these bureaucracies seem to have become the purpose of government.

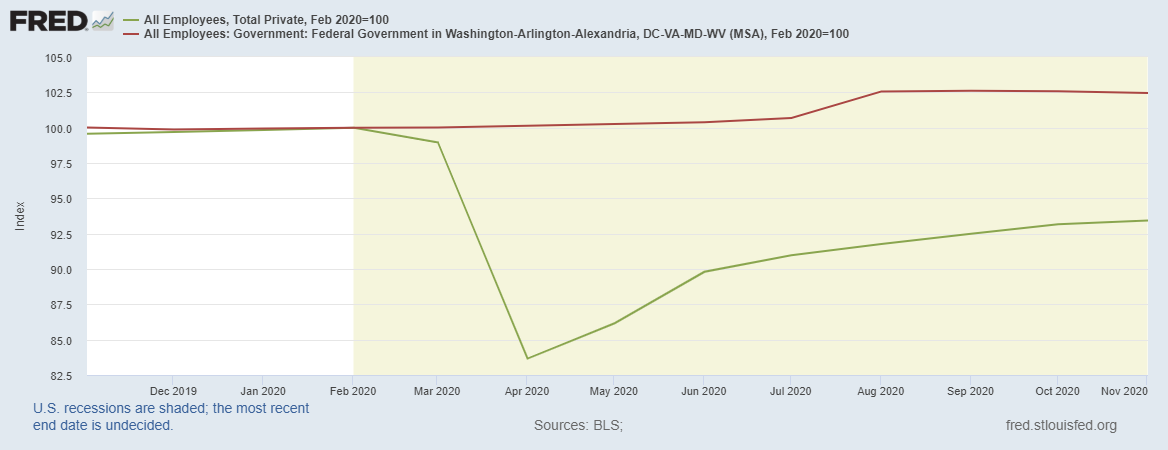

Policymakers, at least in the most recent crisis, created programs designed to help policymakers. This is shown in the chart below.

Government vs. Private Employment

Source: Federal Reserve.

Employment Trend: A Government out for Itself

The red line in the chart shows the number of federal government employees in the Washington, D.C. area. The green line shows private employment in the country. Both values were set to be equal to 100 in February, the beginning of the recession.

At the low in April, private sector employment was down 16.3%. By that time, government employees in the district area grew by 0.1%.

In November, private sector employment was 6.6% below its peak. Government employment was up 2.5%.

As policymakers issued shutdown orders, they hired 9,000 more Federal employees to help them.

Increased employment in the district area is certainly good for that region. But they might not benefit the rest of the country.

Remember, those employees are paid by taxing private sector employees.

Taxes are transferring funds from parts of the country hard hit by shutdowns to the district metro area. Recovery might be hindered by federal employees — who often make rules — restricting what private-sector employees can do.

This chart shows that it’s almost as if government employees are more concerned about their positions than the taxpayers who support them.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.