Economists rely on models in various segments like the housing market to develop forecasts, models based on history and the belief that history repeats to some degree.

One broad model is the business cycle. For hundreds of years, the economy has moved from boom to bust and back to boom. Recoveries and downturns shared common characteristics.

That means a recession in 1800 shares some features with a recession in 2020. Among those features was the obvious point that unemployment would rise. This is normal as businesses see revenue decline, and they respond by laying off employees.

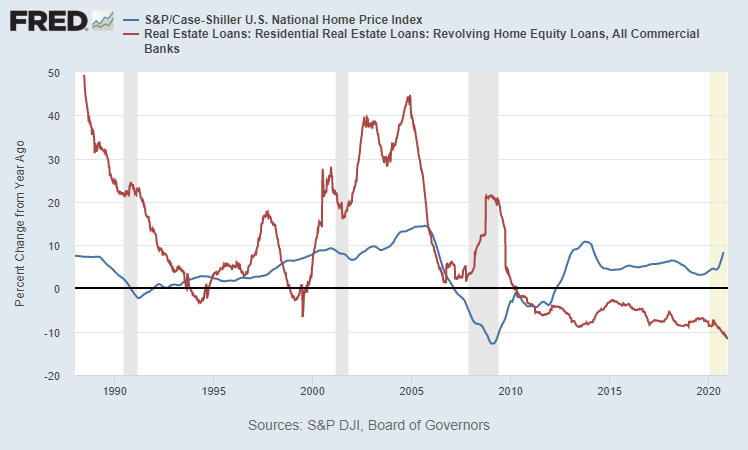

The chart below shows less well-known features of recessions. In the chart, the blue line shows the year-over-year changes in home prices. The red line shows the year-over-year change in home equity lines. Grey bars show previous recessions, and the yellow bar highlights the current recession.

U.S. Home Equity Lines vs. Home Prices

Source: Federal Reserve.

This Housing Market Is Different

In the past three recessions, home prices dipped, and home equity loans increased. These facts aren’t surprising.

In a typical recession, there are fewer prospective homebuyers. That’s because unemployment rises, and those with jobs are more nervous. The lack of buyers creates downward pressure on prices.

At the same time, fear of unemployment leads to homeowners seeking sources of cash, and many will turn to home equity loans. That explains the rise in these loans.

This recession is different. Home equity loans are falling as banks tighten lending standards. At the same time, home prices are rising as those with secure jobs in the K-shaped recovery are buying homes.

For economists, this creates uncertainty.

Recoveries generally include increased homebuying, which boosts economic activity. That is unlikely; potential homebuyers already bought homes.

Recoveries also tend to include high profits for banks benefiting from debt repayment. Those profits fund new loans, and that is unlikely to happen this time.

These are two more data points that demonstrate this time is different. Old models won’t work as well in 2021, and that could make markets more rewarding for investors who take advantage of opportunities as they present themselves.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.