I’m a trader. I’m all about building systems and then watching them work in the wild. I love the intellectual rigor and — naturally — the profits that result.

Not every trade works out, of course, just as even Steph Curry misses the occasional 3-pointer!

But trading… like Steph Curry’s 3-point shooting … is a numbers game. If you find a process that works, you have to give it time to work.

The same holds true with longer-term investing themes. Not every investment works out on the time frame you hope. But if the theme is solid, you can keep coming back to it, even if some of the trades within that theme end up being duds.

Look at green energy. This is the future. It’s happening. I would go so far as to call it an inevitability. Every government in the world is pushing for cleaner energy initiatives, and some of the smartest minds in business are staking their futures on it.

It just makes sense.

High-minded idealism isn’t the reason the world is going green. It’s basic economics.

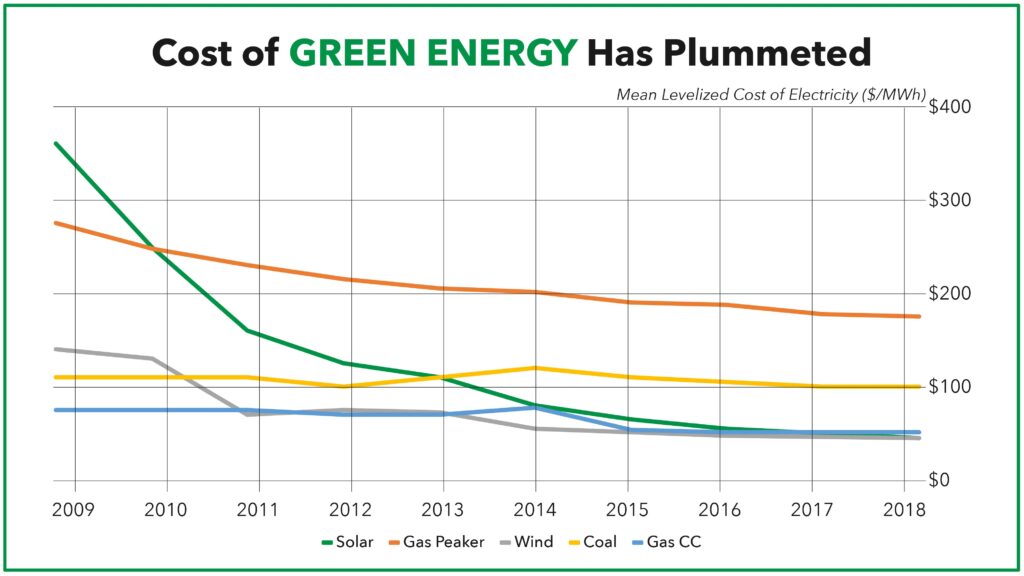

In 2018, the cost of generating new wind and solar energy dropped below the cost of generating power from existing coal plants for the first time.

That was three years ago, and prices haven’t stopped dropping. Solar and wind energy now slug it out with natural gas in a race to be the cheapest energy source.

Forget politics. Forget the midterm elections. Forget all of that noise. At the end of the day, money talks. And green energy delivers the goods cheaper, so its share of the grid will only continue to grow.

As of last year, renewable energy — including wind, solar hydroelectric and even biomass – already accounted for 23% of all utility power generated in the United States. Between 2040 and 2045, renewables will make up a majority of all energy produced.

2022 Will Be a Strong Year for Green Energy

Last year saw some of the bigger names in green energy stumble, particularly in the electric vehicle space.

Tesla Inc. (Nasdaq: TSLA) has trended lower since early November, and many of the high-flying Chinese competitors have fared much worse. NIO Inc. (Nasdaq: NIO) lost more than half of its value since topping out earlier this year.

Likewise, solar stocks haven’t had a great run. The Invesco Solar ETF (NYSE: TAN) is down nearly 40% from its 52-week highs.

But here’s the deal. Many of the stocks in this space have worked out just fine, including several I recommended in Green Zone Fortunes.

I recommended a maker of energy-efficient power systems in June, and it’s up a good 24% already. And my stock for this month’s issue is a revolutionary battery maker that is up around 5%, with plenty of room to run higher.

My Green Zone Fortunes readers even banked a 53% gain on the second half of a position back in August after holding since my initial recommendation in July 2020. (We closed the first half of this position for a 124% gain after only five months!)

Again, not every trade works out. But in a powerful mega trend like this, we can wait for our moments and trade around them. Like Steph Curry, we can keep lobbing 3-pointers because we are confident that enough of them will drop.

And green energy is too big of a mega trend to ignore. If you want to see how we are following it in Green Zone Fortunes, along with other top mega trends like biotech and the genomics revolution, click here to watch my “Imperium” presentation.

Join us now, and get ready for a life-changing 2022!

To good profits,

Adam O’Dell

Chief Investment Strategist