Intel Corp. (Nasdaq: INTC) and the U.S. Department of Commerce have signed a non-binding preliminary memorandum of terms (PMT) for up to $8.5 billion in direct funding to Intel for commercial semiconductor projects under the CHIPS and Science Act.

The proposed funding would support Intel’s semiconductor manufacturing and research and development projects at its sites in Arizona, New Mexico, Ohio, and Oregon.

Intel Plans Job Creation, Expansion

Under the PMT, Intel would also have the option to draw upon federal loans of up to $11 billion and plans to claim the U.S. Treasury Department’s Investment Tax Credit (ITC), which is expected to be up to 25% of qualified investments of more than $100 billion over five years.

The direct funding award and federal loans are subject to due diligence, negotiation, and the achievement of certain milestones.

Intel’s strategy is centered on establishing process technology leadership, building a resilient and sustainable global semiconductor supply chain, and creating a foundry business.

The company is on track to deliver five semiconductor process nodes in four years and expects to return to process technology leadership by 2025 with Intel 18A.

The proposed funding would support Intel’s investments in Arizona, New Mexico, Ohio, and Oregon.

Intel currently employs nearly 55,000 people in the U.S., indirectly supports over 720,000 American jobs, and contributes more than $102 billion annually to U.S. GDP, according to the company.

The company’s planned U.S. investments are expected to create more than 10,000 new permanent jobs at Intel, nearly 20,000 construction jobs, and indirectly support more than 50,000 jobs with suppliers and supporting industries.

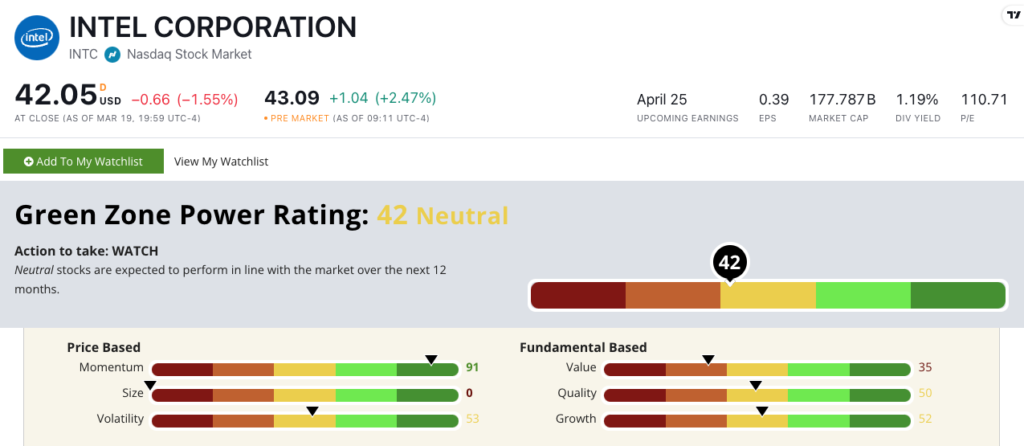

INTC: Green Zone Power Ratings

INTC rates 42 out of 100 on Adam O’Dell’s proprietary Green Zone Power Ratings system.

That means we are “Neutral” on the stock and expect it to perform in line with the broad market over the next 12 months.

INTC rates a 91 on our Momentum factor.

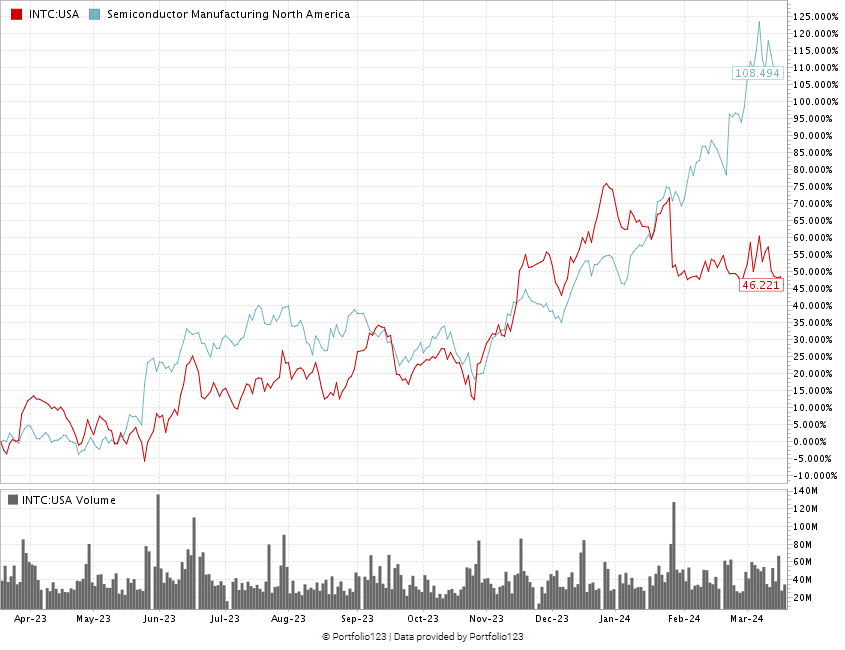

Over the last 12 months, the stock has risen more than 46%, which is in line with the technology sector’s 54% gains over the same time.

INTC’s price movement from March 2023 to March 2024 compared to the semiconductor manufacturing industry average.

INTC has lagged behind its semiconductor manufacturing industry peers — the industry has jumped 108% over the last year.

Intel stock rates a 50 on our Quality factor.

Its gross margin is currently 58%, compared to the industry average of 55%, while its net margin of 3.1% is above the industry average of minus 10.6%.

On Growth, INTC rates a “Neutral” 52.

While its one-year sales and earnings-per-share growth rates are negative, INTC posted a positive 9.7% growth in its quarter-over-quarter sales and 490% quarter-over-quarter growth in earnings.

Bottom line: The award from the Commerce Department will allow Intel to scale its semiconductor manufacturing in the U.S.

INTC remains behind such chip stalwarts as Nvidia Corp. (Nasdaq: NVDA) and Advanced Micro Devices Inc. (Nasdaq: AMD).

However, because Intel designs and manufactures its chips — NVDA and AMD design the chips and send them to outside manufacturers to process — the grant may grow Intel’s market share in the semiconductor space.

Its “Neutral” score on our Green Zone Power Ratings system tells us that it’s best to hold off on adding INTC to your investment portfolio.