It’s been about a month since we started providing you with several new features here on Money & Markets.

We know from your feedback that you’re enjoying everything from Chief Investment Strategist Adam O’Dell and the rest of the crew.

I have to tell you, though: Green Zone Ratings is the feature all of us on the Money & Markets team are most excited about.

And the best part is that it will only get better from here.

Green Zone Ratings is still in its first stage on the Money & Markets website, but we have big plans for it!

If you don’t know what our Green Zone Ratings system is, here’s a quick breakdown:

- Adam spent years developing an algorithm that analyzes stocks using six factors and rates them from zero to 100.

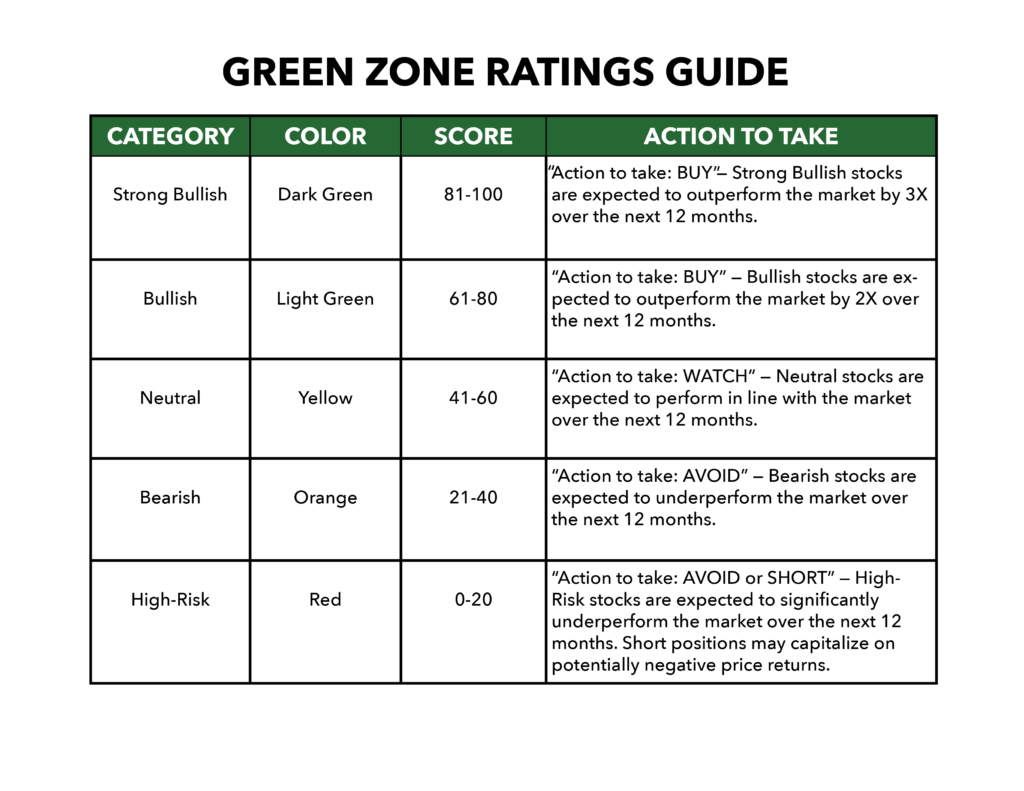

- Anything that lands in the 81-100 range is what we call “strong bullish.” These stocks are expected to outperform the S&P 500 by three times over the next one to three years.

- And now, you can use that system to look up over 8,000 stocks!

It’s that easy!

That brings us to our featured email for this edition of Feedback Friday.

Use Green Zone Ratings for Your Own Portfolio — It’s Easy!

Dale wrote in with a question about how he can use Green Zone Ratings for his own portfolio.

He writes:

Adam,

I like the way you rate stocks in a logical manner on a 0 to 100 scale. I’d like to get your rankings for my current stock holdings. How can I do that?

Thank you, Adam!

—Dale

Thanks for the great question, Dale!

The easiest way to do this right now is to follow this three-step guide to using Green Zone Ratings.

1. First, go to moneyandmarkets.com. Once you are on our homepage, look for the search bar in the top-right corner.

2. Type in the company name or stock ticker symbol for any stock in your portfolio. As long as it’s one of the 8,000 stocks rated in Adam’s system it should pop up. (Feel free to reach out the feedback@moneyandmarkets.com if are having trouble finding a particular stock.)

3. Click on the company name under “Popular Symbols” to bring up that stock’s information page.

Once you have pulled up a stock using Green Zone Ratings, you can see where it lands overall. You can even click the “Expand Detail” tab to see how it ranks on the six different factors Adam tracks:

- Momentum.

- Size.

- Volatility.

- Value.

- Quality.

- Growth.

The overall rating will place the stock in one of five categories, which you can read about in the table below:

And that should be enough to get you started on analyzing your own portfolio, Dale!

Keep this in mind if a company rates poorly in our system: Green Zone Ratings is an algorithm, and it’s always worth considering factors that our system doesn’t rate (for instance, dividend payouts.) Feel free to send us an email if you’d like Adam O’Dell, Research Analyst Matt Clark or Income Expert Charles Sizemore to take a second look at a stock that you’ve looked up in Green Zone Ratings!

While we don’t have a way to track your own portfolio within www.moneyandmarkets.com yet, I do want to share a workaround.

If you sign up for a free account on our site, you can create your own watchlist from the homepage. You can register for a free account here.

When you sign up, it takes 24 to 48 hours to receive your confirmation email. (Know that we are working on making this an even smoother process.)

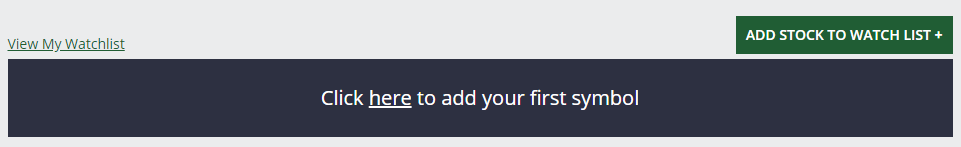

Once you are logged in, the tool to add stocks to your watchlist from our homepage looks like this:

You can search for stocks within your portfolio and add them to your watchlist to track them easily.

Also, if you have an account on our website, you can access to the Money & Markets Hotlist for free.

Every Thursday, Adam reveals 10 stocks that are scoring high marks in Green Zone Ratings that week. It’s a great way to find new potential stocks to add to your portfolio.

I hope this was helpful for Dale and anyone else that wants to know more about Green Zone Ratings, Adam and Money & Markets in general.

Email feedback@moneyandmarkets.com with any questions or comments you have, and we might feature your comments in our next dive into the mailbag. (But don’t worry — we’ll never use your full name.)

Best,

Chad Stone

Assistant Managing Editor

Money & Markets