The word “unprecedented” tends to get thrown around too often.

But when you consider the turn of events of these last six weeks, I think you’ll agree there’s really no other word to describe what we’ve been through.

All told, we’ve seen:

- The fastest-ever 20% decline from all-time highs.

- Two consecutive intraday swings of 4% in the S&P 500 (something that’s never happened before).

- And indiscriminate panic-selling, where in a single day, 10 stocks plunged lower for every one stock that edged higher.

This was the financial markets’ equivalent of a rollercoaster, make no mistake about it.

Investors were reeling from day-to-day, struggling to digest dramatic headlines about tariffs, supply shortages and potentially catastrophic price increases.

But paid-up Green Zone Fortunes subscribers held their course at my recommendation — sticking with each of the stocks in our model portfolio, and in turn being richly rewarded…

Market Shock Turned Green Zone Windfall

President Donald Trump’s “Liberation Day” announcement sent stocks reeling during the first week of April — with businesses, investors and consumers scrambling to adjust to a new reality.

The following week, shortly after I urged Green Zone Fortunes readers to keep “steady hands” and resist the urge to panic sell, Donald Trump issued a temporary pause on his new retaliatory tariffs.

Sure enough, the tariff turmoil gradually cleared as news of the first trade deals came in. The broader stock market came roaring back, but not as fast as our Green Zone Fortunes model portfolio, which is composed of 26 highly-rated positions, based on the Green Zone Power Rating system I write about almost daily in this newsletter.

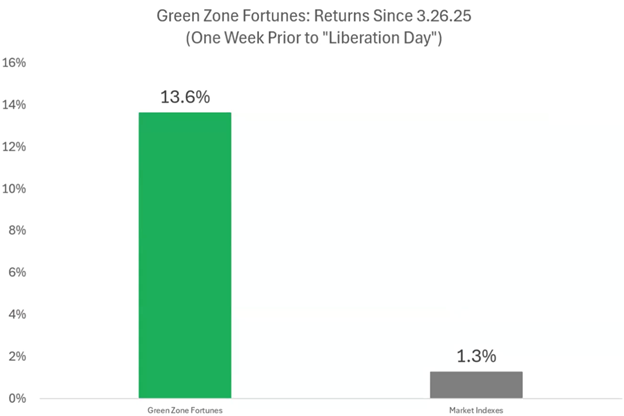

Have a look at how my subscribers’ commitment to this portfolio paid off:

This is precisely what the Green Zone Power Rating system is designed to do — allow us to identify only the market’s most highly-rated “Bullish” or “Strong Bullish” stocks … and in turn target returns that have historically proven to beat the market by 2X to 3X.

Realize, though, lasting success requires more than buying stocks that recover more vigorously once a market downturn ends…

By trusting the system to guide us to the best stocks for both up and down markets, we can fare better than the market through a complete cycle, or even through a short-lived period of “insanity,” when most other investors are losing their cool and smashing the “sell” button. Just consider how our Green Zone Fortunes portfolio has performed through the entire episode so far, beginning one week before Liberation Day:

That’s nearly two full months where the broader stock indexes returned just 1.3%.

Meanwhile, our Green Zone Fortunes stocks logged an impressive 13.6% gain during that same period – roughly 10X the market’s return!

All told, the performance of my Green Zone Power Rating system through this compressed bear market swing should give you confidence in the data-driven approach we share … and prove that the “New Bulls” list we publish here every Thursday is well worth your time to examine…

Trusting The System Makes Investing Easier

As you know well, the investing landscape is constantly changing.

New financial data, new earnings reports, new product releases — there are a million different factors that can lead an investor to reconsider their holdings.

This is especially true during times of uncertainty, panic, or overwhelmingly bearish sentiment. That’s why so many investors end up sabotaging themselves and selling low after buying a little too high.

The best way to avoid these kinds of mistakes is to invest systematically, so you always know exactly where you stand…

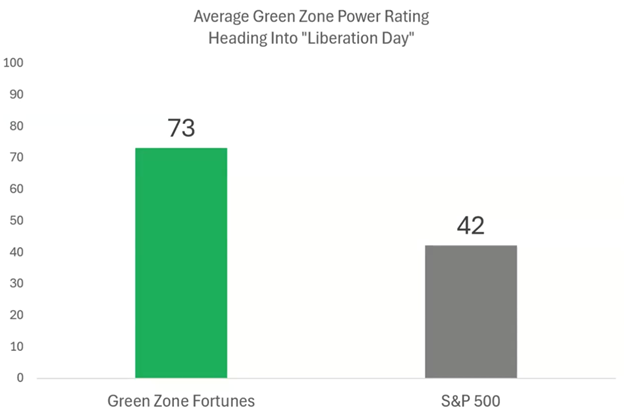

In our case, my Green Zone Fortunes subscribers have systematically invested in a basket of 26 highly rated stocks across various sectors and industry groups. On average, our holdings were rated 73 out of 100 heading into the Liberation Day panic.

That gave us a well-rounded, “Bullish” rated portfolio … which was head and shoulders above the S&P 500, which averaged a Green Zone Power Rating of just 42 at the time (and still today)…

Realize, my system categorizes ratings less than 40 as “Bearish” or “High-Risk,” so the broader index is just barely achieving a “neutral” reading.

For those investors who were heavily into index funds and ETFs, there may have been a good cause for concern.

But for those of us who’d built a concentrated portfolio of highly-rated bullish stocks, there wasn’t any reason to budge.

If you’re not yet a subscriber, then now’s as good a time as any to get started. Click HERE for full subscription details and sign up before my next upcoming recommendation…

To good profits,

Editor, What My System Says Today