Bridgewater Associates Co-Chief Investment Officer Greg Jensen thinks gold is ready to surge past $2,000 per ounce, which would be a new record, as central banks around the world try to bolster weak inflation rates and political uncertainties remain in the forefront.

Jensen is particularly bullish on the Federal Reserve regarding inflation rates that have been under the central bank’s 2% target for seven years now. Fed Chief Jerome Powell has already signaled that the benchmark interest rate will stay low until the inflation rate comes up.

“It is essential that we at the Fed use our tools to make sure that we do not permit an unhealthy downward drift in inflation expectations and inflation,” Powell said during a November 2019 speech.

Jensen thinks the Fed will let inflation run rampant for a bit and “there will no longer be an attempt by any of the developed world’s major central banks to normalize interest rates.”

“That’s a big deal,” Jensen argued in a recent interview with Financial Times.

Jensen also sees growing political turmoil in the U.S. during an election year, as slowing economic growth creates more wealth inequality. The U.S. is also dealing with uncertainties surrounding relations with China and Iran.

The U.S. and China signed phase one of their new trade deal Wednesday, but some argue the deal is pretty thin. U.S. President Donald Trump has already mentioned that phase two talks would begin immediately after phase one was signed, but he told reporters last week that he “might want to wait to finish it till after the election.”

Tensions have also remained high between the U.S. and Iran as tit-for-tat retaliations have been launched in the Middle East over the past couple weeks.

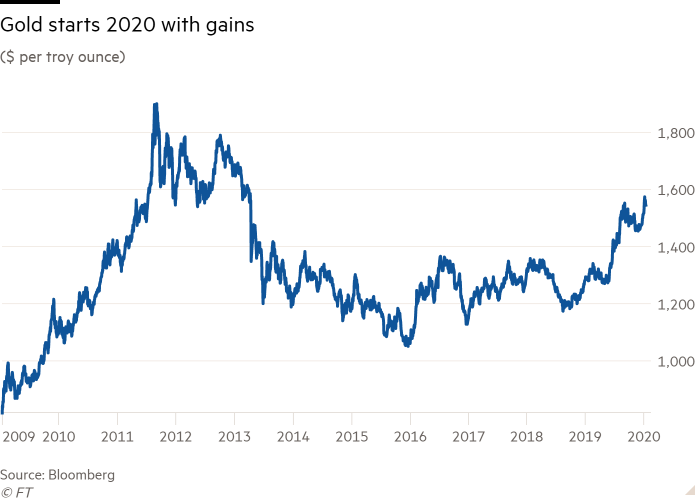

All this is adding up to a rally for gold, Jensen argues. The precious metal has been trading around $1550 per ounce, but Jensen thinks it could gain 30%, and it should be leveraged more heavily in investor’s portfolios.

“There is so much boiling conflict,” Jensen said. “People should be prepared for a much wider range of potentially more volatile circumstances than we are mostly accustomed to.”

Jensen thinks the Fed could cut interest rates again in 2020, and could even take rates to zero in order to fight off a recession or deflation. This flies in the face of the central bank’s recent call to remain steady on rates unless a significant change occurs in the U.S. economy.

All these factors, combined with ballooning budget and trade deficits in the U.S., will help gold remain strong, and Jensen thinks it could eventually weaken the U.S. dollar, which the world uses as its reserve currency.

“That could happen quickly or it could happen a decade from now. But it’s definitely in the range of possibilities,” Jensen said. “And when you look at the geopolitical strife, how many foreign entities really want to hold dollars? And what are they going to hold? Gold stands out.”

Bridgewater founder and CEO Ray Dalio has also echoed a lot of these same sentiments in the past. In a July 2019 LinkenIn post, Dalio said that “gold is just an alternative currency to fiat paper currencies.

“If your portfolio is likely to perform poorly in the adverse environment I’ve been describing — less effective monetary policy, the need to run larger fiscal deficits and monetize them, and challenging politics — the behavior of gold as alternative cash has some diversifying merit.”