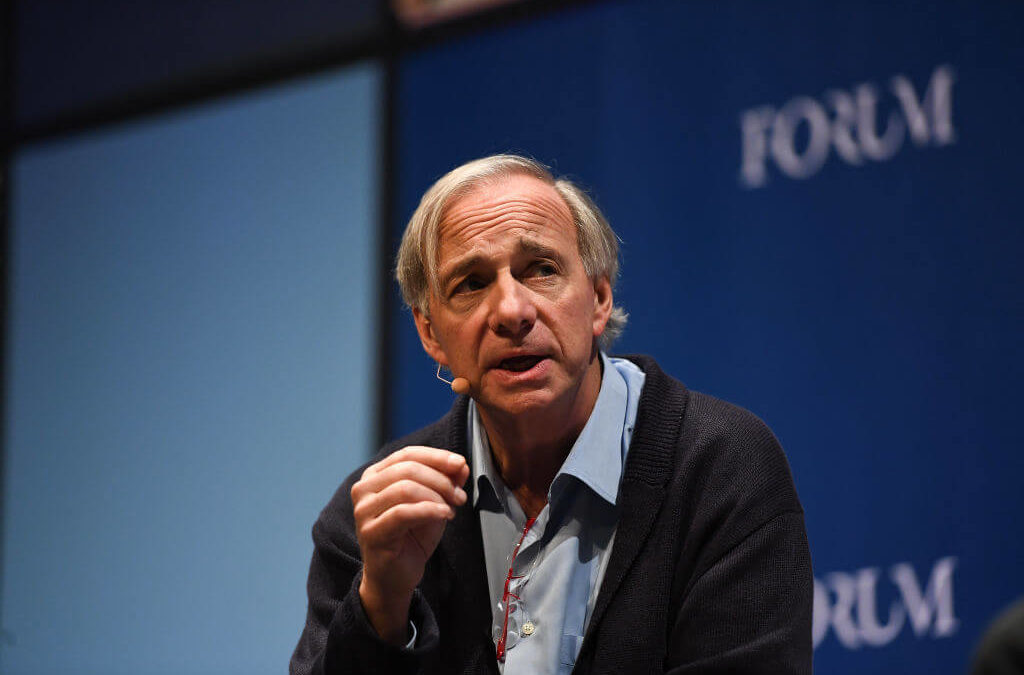

Famed Bridgewater founder and CEO Ray Dalio is an expert when it comes to capital markets and well-versed in the machinations of the U.S. economy and Wall Street.

So when he talks, people listen, and Dalio has been warning more and more recently about growing economic risks and that a recession is on the horizon, and Dalio is now recommending people start shifting funds into gold to safeguard against incoming volatility.

“I think investors today are mostly leveraged long, meaning they own risky assets and have substantially leveraged those assets through company buybacks, private equity, and so on,” Dalio said during a recent discussion with Goldman Sachs Managing Director Allison Nathan. “In order to diversify against this — i.e. reduce exposure to leveraged long portfolios — investors should look to other stores of wealth and areas that have intrinsic diversification.”

Investors generally turn to cash to hedge their bets as things go south on Wall Street, Dalio said, but that’s not a good idea.

“People seem to think that going to cash reduces risk. But that’s only the case from a standard deviation perspective,” Dalio said. “When interest rates are negligible — below the inflation rate/nominal GDP growth — and you pay taxes on that, you’re not getting any return. Cash over the long run is the worst performing asset class, and therefore the riskiest asset class.”

So instead of letting inflation set fire your cash sitting in a low-interest savings account, Dalio said, take the leap and invest in gold.

“I know gold sounds like a kooky investment. But gold is just an alternative currency to fiat paper currencies,” he said. “If your portfolio is likely to perform poorly in the adverse environment I’ve been describing — less effective monetary policy, the need to run larger fiscal deficits and monetize them, and challenging politics — the behavior of gold as alternative cash has some diversifying merit.

“Gold’s record during the past two bear markets was quite impressive. However, in the bear market of 2000 to 2003, gold rose 27.6% while stocks fell 42.5%. That looks like a real hedge after all. During the bear market following the 2008 financial crisis, stocks fell 51% while gold rose 18.6%.”