Money & Markets Week Ahead for the week of March 21, 2021: I deep dive into GrowGeneration’s earnings expectations. I also breakdown an IPO that I’m tentatively excited about.

It’s a big week for cannabis companies.

There’s a well-known television manufacturer pricing its IPO this week.

Here’s more of what to look for in the week ahead on Wall Street:

On the IPO Front

There are several IPOs expected to price this week, but I want to focus on one whose products you are likely familiar with.

Vizio Holdings Corp. is expected to price its IPO on March 25. The company plans to trade on the New York Stock Exchange under the ticker VZIO.

What it is: The company is most well-known for its smart televisions that are sold around the world.

The company is based in Irvine, California and also produces sound systems for televisions. Its products are sold in major retail stores and e-commerce platforms like Walmart, Costco, Amazon and Best Buy.

In its S-1 filing with the Securities and Exchange Commission, it had net revenue of $1.8 billion in 2018. That grew slightly in 2019 and reached $2 billion in 2020.

Vizio’s total gross profit has also increased over the last two years.

It recorded $110 million in gross profit in 2018, which it more than doubled by 2020 to $296 million.

The company’s net income went from a minus-$156,000 in 2018 to a positive $102 million in 2020.

It shipped 7.1 million smart televisions and had 12.2 million active SmartCast — its app and streaming operating system — accounts in 2020.

The offering: The company is offering 15.1 million shares at a price range of $21 to $23 per share.

It hopes to raise around $333 million with the offering, which will be used to increase capitalization and financial flexibility to include working capital and to pay for operating expenses.

According to Renaissance Capital, at a mid-point of $22 per share, the company would see a market value of $4.5 billion.

Bookrunners on the deal include JPMorgan, Bank of America Securities, Wells Fargo Securities and Guggenheim Securities.

The skinny: I like the growth Vizio Holdings has posted over the last three years.

Its profits and free cash flow are pretty strong, so it’ll use the influx of capital to expand on their operating system.

The company is in a good position in terms of offering smart televisions as that market continues to grow at a reasonable pace.

There is a good amount of competition in the market by companies that are much larger and have more cash, which could paint a target on Vizio for future acquisition.

All-in-all, I’m not a huge fan of investing in IPOs when they launch, but this one could be one worth looking at.

Deeper Dive: GrowGeneration Earnings

This week, several cannabis companies will drop their earnings reports.

I cover the cannabis market in my Marijuana Market Update each week on our YouTube channel. You can check it out here.

Some of the cannabis companies reporting earnings this week include:

- Body and Mind Inc. (OTC: BMMJ).

- TerrAscend Corp. (OTC: TRSSF).

- Akerna Corp. (Nasdaq: KERN).

- Trulieve Cannabis Corp. (OTC: TCNNF).

- Vireo Health International Inc. (OTC: VREOF).

- Charlotte’s Web Holdings Inc. (OTC: CWBHF).

- Cresco Labs Inc. (OTC: CRLBF).

- GrowGeneration Corp. (Nasdaq: GRWG).

Today, I want to focus on the last company on the list: GrowGeneration Corp.

Pro tip: I added GrowGeneration to our Money & Markets Cannabis Watchlist in November 2020. It is up more than 95% since I added it.

The company operates hydroponic and organic gardening stores in the U.S.

It distributes lighting, nutrients, fans, filters and dehumidifiers … all the things that it takes for cannabis to grow.

GRWG Stock Has Been On Fire

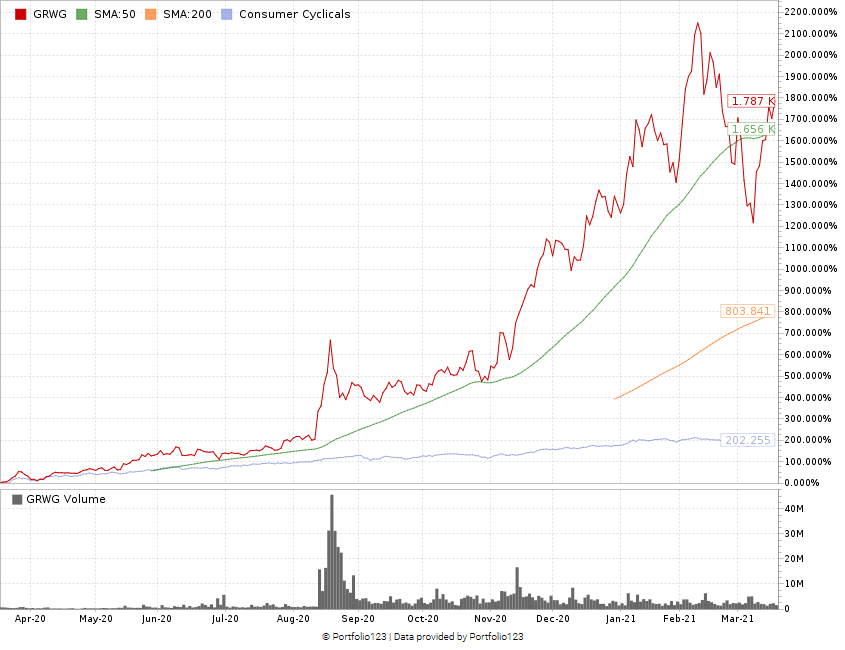

Over the last year, GrowGeneration stock has gained a whopping 1,787% and cannabis stocks, in general, received a big boost following the 2020 elections.

It was one of the reasons why I added it to the watchlist.

After Democrats took control of the White House and Congress, investor sentiment poured into cannabis stocks with the belief that decriminalization and even legalization in the U.S. could be a reality.

GrowGeneration Total Revenue Climbs

As you can see, with the exception of a hiccup in January 2020, GrowGeneration has done a solid job increasing its quarterly topline revenue.

From $7.2 million in July 2018 to $55 million in October 2020, the company has increased that quarterly revenue by 664%.

GrowGeneration Earnings Get Back to Positive

The company has also pulled its quarterly earnings per share into the green.

In July 2018, the company reported minus-$0.04 per share in earnings.

That has grown to $0.06 per share by October 2020 — that’s a $0.10-per-share turnaround in just two years.

Expectations are for the company to report earnings of $0.07 per share on revenue of $59.9 million.

It would mark the fourth straight quarter where GrowGeneration has bested the previous quarter in both earnings and revenue.

I believe GrowGeneration earnings will beat those expectations and continue to increase those numbers in the quarters to come.

Money & Markets Week Ahead: Data Dump

New home sales in the U.S. will be in the spotlight as the U.S. Census Bureau will release its monthly new home sales report on Tuesday.

The report looks at the number of new, single-family homes sold during the previous month.

New home sales in the U.S. were on a bit of a roller coaster ride in 2020.

New Home Sales Trending Up

Home sales were down in the spring due to the coronavirus, but as stimulus measures went into effect, the market exploded to a high of 1 million new homes sold in August 2020.

Sales were somewhat level in the two months that followed.

However, November and December sales were down to below 845,000.

After a January uptick, expectations are for home sales to fall back to around 875,000 for the month of February.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out this week:

Monday

Tencent Music Entertainment Group ADR (NYSE: TME)

SYNNEX Corp. (NYSE: SNX)

Raven Industries Inc. (Nasdaq: RAVN)

Tuesday

Adobe Inc. (Nasdaq: ADBE)

GameStop Corp. (NYSE: GME)

Trulieve Cannabis Corp. (OTC: TCNNF)

Wednesday

General Mills Inc. (NYSE: GIS)

GrowGeneration Corp. (Nasdaq: GRWG)

Winnebago Industries Inc. (NYSE: WGO)

Thursday

Conagra Brands Inc. (NYSE: CAG)

Cresco Labs Inc. (OTC: CRLBF)

Oxford Industries Inc. (NYSE: OXM)

Friday

Blackberry Ltd. (NYSE: BB)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.