Japan has set the global standard for low interest rates for decades. Yields on 10-year government bonds have been below 2% since the turn of the century. In 2016, the yield on the 10-year dropped below zero at a time when economists were still debating whether or not negative rates were even possible.

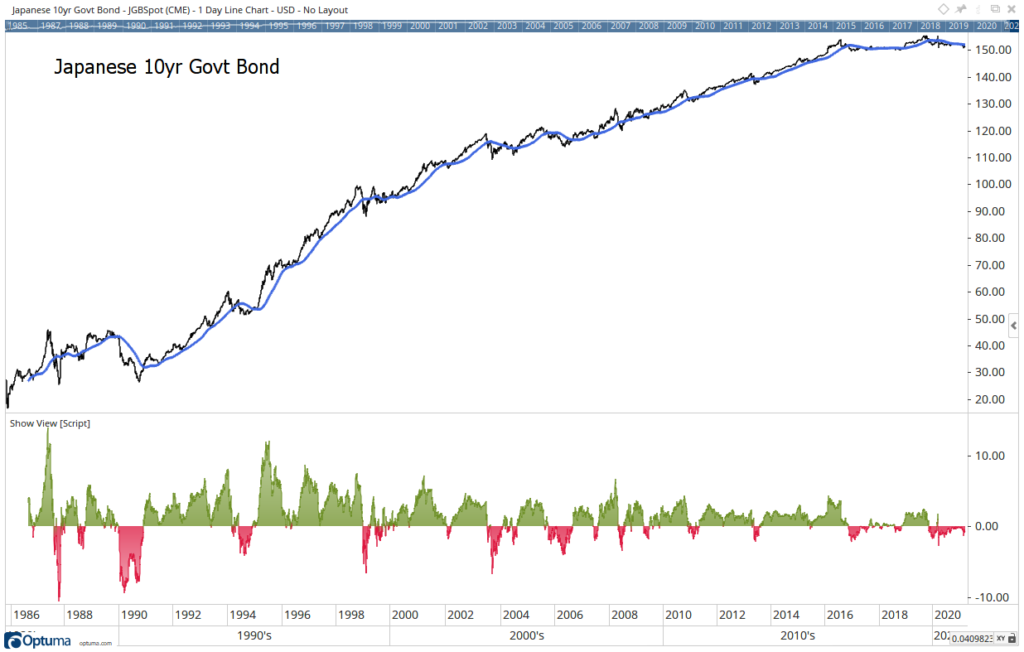

That long-term trend of low rates seems to have reversed in November 2019. That was when the price of government bonds fell below its 200-day moving average (MA).

Before turning to the chart, it’s important to remember how bond prices reflect changes in interest rates.

As rates rise, the price of bonds declines. This relationship exists because once bonds are issued, they trade in the secondary market. This provides liquidity for investors who might not want to hold the bonds to maturity. But it means that old bonds must be priced competitively against newly issued bonds.

If new bonds are issued at higher rates, older bonds must drop in price so that investors can pay less and receive an amount of income equivalent to the new bonds.

This means a bear market in bonds, where prices fall, will occur as interest rates rise. The chart below indicates Japanese bonds could be in the early stages of a bear market.

Japanese Bond Prices

Source: Optuma.

Bearish Japanese Bond Market Is Coming

This chart shows the price of the bond since 1986. The blue line is the 200-day MA. At the bottom of the chart is an indicator showing how far the price is from its 200-day MA.

What’s important now is that the price has been below its MA for about 16 months. There was a brief rally as rates fell when the economy shut down last year. But that was short-lived.

The length of time prices have been below the MA indicates the market is changing. A bear market in bonds appears likely. That means higher rates are ahead, all around the world.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.