Measured as a country, the cost of cybercrime last year would be the world’s third-largest economy behind the U.S. and China, at $6 trillion.

Zooming in, IBM reports that the average cost of one data breach or cyberattack is $4.2 million.

Cybercrime and cybersecurity are big business, as companies rush to protect valuable data from hackers:

In 2016, the value of companies that teach the best IT practices to combat cyberthreats was $47.6 billion.

The sector expects revenue to increase 74% by 2027.

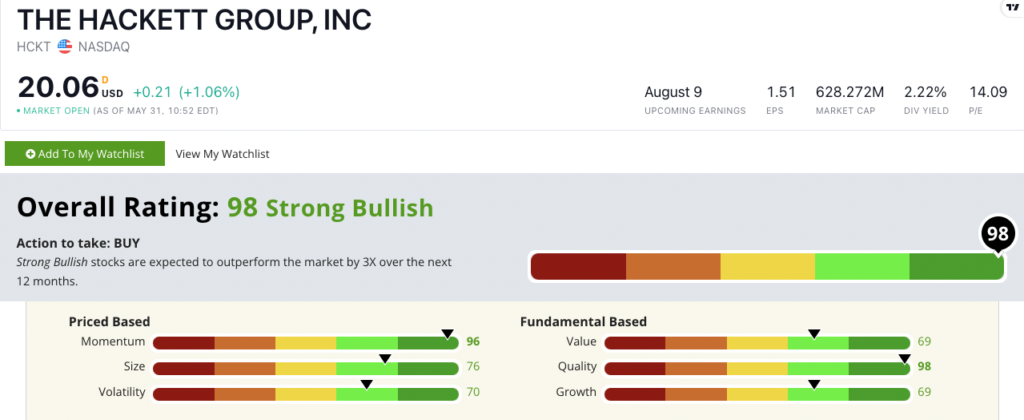

Today’s Power Stock shows companies how to combat cyberattacks: The Hackett Group Inc. (Nasdaq: HCKT).

HCKT Stock Power Ratings in June 2022.

The Hackett Group Inc. is a strategic advisory and consulting firm that works with global companies to implement best practices in tech.

It partners with tech giants including Amazon, Microsoft and Oracle to protect against cyberthreats.

Hackett stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

HCKT Stock: Green Means Go

As I looked back at the last year of financials for HCKT, here’s what stood out to me:

- Last year, the company increased its net income from $5.4 million to $41.5 million — that’s a massive 668.5% year-over-year increase!

- The company’s revenue from consulting grew 17%, while its software licensing revenue jumped 53.7% in 2021.

HCKT scores a 98 on our quality metric due to its excellent returns and strong margins.

The stock’s return on equity of 31.1% demonstrates the company’s outstanding quality. It’s even more obvious when you contrast it with the tech consulting sector’s average: negative 6.3%!

Its net margin is 15.7%, while the sector average is negative 22.7%.

HCKT scores in the green on all six of our Stock Power Rating metrics, which tells us this is a top-notch stock.

The chart above shows from June 2021 to May 2022, HCKT stock jumped 42% to hit its 52-week high.

The sell-off in the tech sector pushed it down 22.2% from that high. But after a 4.2% rebound, the stock is showing strong momentum.

The Hackett Group Inc. stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Cybersecurity is a growing sector, as hackers find new ways to steal personal and corporate information.

The Hackett Group helps position companies to best combat cyberthreats now and in the future.

Bonus: The company’s forward dividend yield of 2.2% means the company will pay you $0.44 per share, per year just to own the stock.

Stay Tuned: No. 1 Chip Manufacturer

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a solid semiconductor manufacturer.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.