Thanks to the coronavirus pandemic, health care dominates the headlines day in and day out.

We’re inundated with stats on how many are infected and, unfortunately, how many have died as a result.

But even before COVID-19, Americans spent around $10,000 per year on health care.

A majority — 34% — of that is spent on private health care while Medicare and Medicaid each account for around 20% of health care spending.

Health care spending will continue to rise for two reasons:

- The aging baby boomer population.

- The coronavirus has made us more health-aware now than ever before.

We used Money & Markets Chief Investment Strategist Adam O’Dell’s proprietary stock rating system to find two companies poised to capitalize on the boom in the health care industry.

More on that in a moment.

But first, I’ll tell you where the health care sector is going.

The Health Care Boom Is Coming

The health care industry is one of the biggest in the country.

In 2019, the estimated revenue of the industry was nearly $2.5 trillion. Health care takes up nearly 20% of the gross domestic product (GDP) in the U.S.

In short, we spend a ton of money on health care.

And we’re poised to spend even more.

Health Care Spending to Jump 47%

That jump in spending will benefit health care stocks … and, more importantly, those who wisely invest in them now.

We’ve found two health care stocks using Adam’s rating system that can provide those benefits.

These 2 Health Care Stocks Lead the Pack

Using Adam’s stock rating system, we found a pair of high-quality health care stocks with the potential of returning double-digit gains in short order.

The first is LHC Group Inc. (Nasdaq: LHCG), a home health company that has more than 550 home health services locations nationwide. It also operates 110 hospice locations and 11 long-term acute care hospitals.

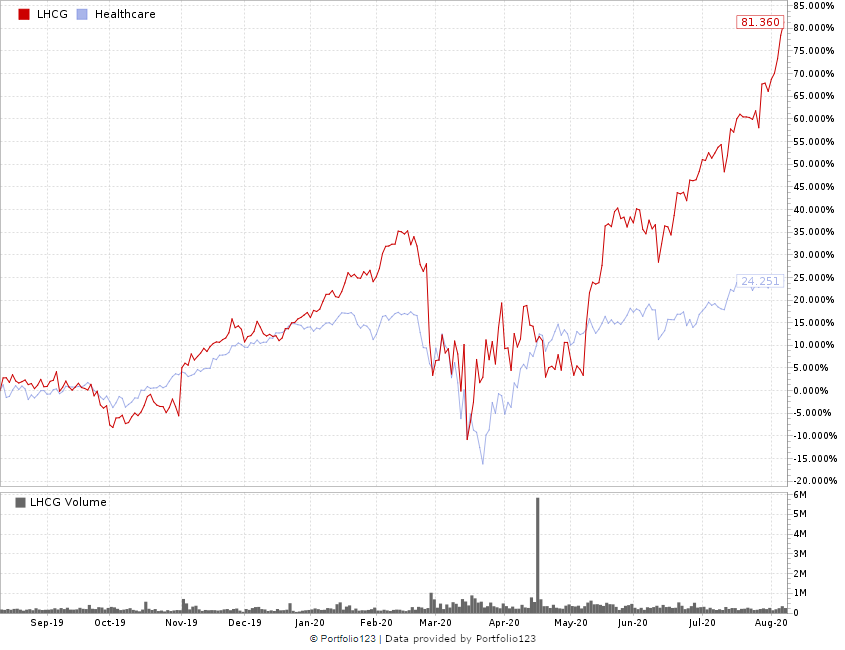

LHC Group Gains Outpace Health Care Industry

LHC Group earns a 90 overall rating on Adam’s system. It rates high in growth, volatility and quality.

Here’s a deeper look at LHC Group:

- Growth — The company earns a 95 on overall growth — only 5% of all other stocks rate higher. Its $119 million in income gives it a 95 in that metric, and its sales over the last 12 months were $2 billion — giving it a 92 What’s more is that the company’s sales have grown 31.5% over the last three years!

- Volatility — LHC Group’s growth is coupled with mild volatility (92). Its stock beta and risk-adjusted returns are better than nearly 80% of all other stocks.

- Quality — The company earns an 85 on quality with strong cash flow (85) and returns on investment, assets and equity that outpace the rest of the health care sector.

The second health care stock we found is Henry Schein Inc. (Nasdaq: HSIC). The company provides products and services to dentists. These products and services include generic pharmaceuticals, dental implants and even dental chairs.

Henry Schein Inc. has expanded its products to include software that helps any medical practice manage its operations.

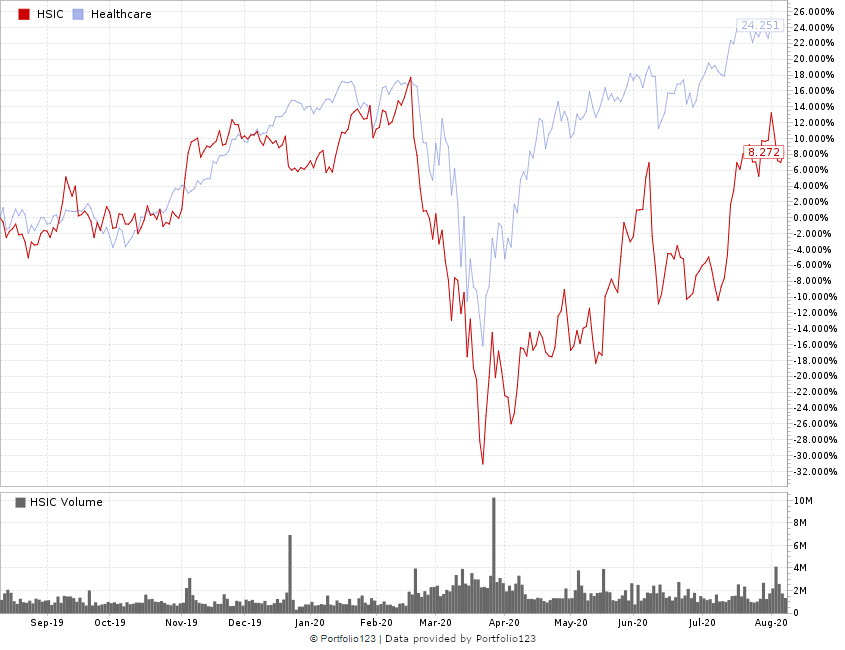

Henry Schein Continues to Move Up

Henry Schein Inc. rates an 83 overall on Adam’s stock rating system, scoring highest in quality, value and volatility.

Here’s what we found out about Henry Schein:

- Quality — The company rates a 95 in this metric with returns on assets, investment and equity that are higher than the industry average. It also has a strong cash flow of $524 million.

- Value — The value of Henry Schein stock rates a 75 — only 25% of all other stocks rate better. Its price to cash flow, price to earnings and price to sales are all significantly lower than the health care industry average, making its shares a strong value.

- Volatility — Henry Schein’s quality and value come with only mild volatility (72 overall) with a beta of around 1 (A beta of 1 means its volatility is equal to that of the market).

What You Should Do Now

Last year, Adam spoke at a conference and highlighted that health care stocks are in a unique position.

These companies will benefit from advancements in technology. Plus, an aging baby boomer population will continue to drive demand.

Both Henry Schein Inc. and LHC Group fit that bill.

They are companies that will not only gain from those two factors, but lead the way in providing products and services.

We believe these two companies will continue to rise and provide investors, like you, double-digit gains in the future.