In a power plant, turbines like the one pictured above move at different rates to produce electricity.

Each turbine is independent. But they must be controlled at the same time to generate the right amount of power.

Before automation, one person would have to adjust each turbine.

Now, a distributed control system can make those decisions and adjustments at the same time.

The chart above shows the value of the distributed control systems market worldwide. From 2018 to 2026, it will increase 53.4%.

I have high conviction the demand for these automated systems will grow beyond current projections.

Today’s Power Stock creates distributed control systems throughout Asia: HollySys Automation Technologies LTD (Nasdaq: HOLI).

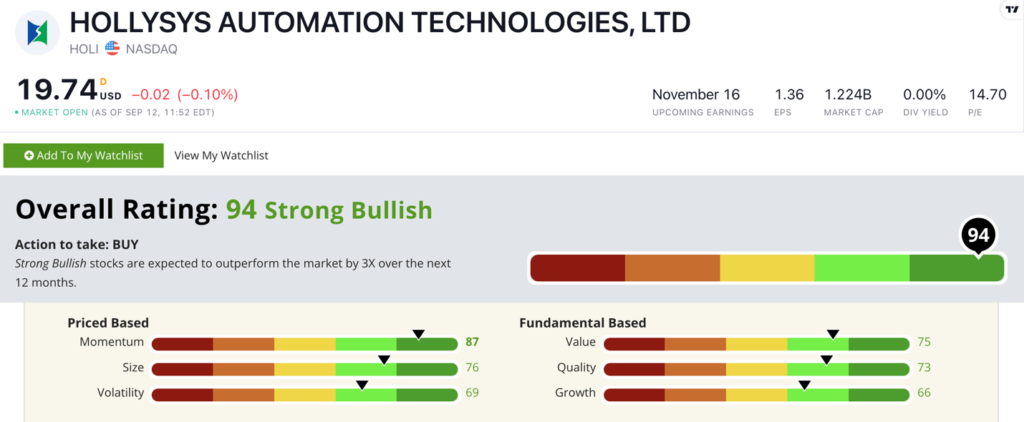

HOLI Stock Power Ratings in September 2022.

The company develops complex automation systems for the rail industry.

HollySys stock scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

HOLI Stock: High Momentum and Strong Value

HollySys just reported a strong quarter.

Highlights include:

- Quarterly revenue of $182.1 million — a 15% year-over-year increase!

- Growth of 67% in product sales for the quarter.

HOLI earns a “Bullish” 73 on growth.

It scores a 75 on value thanks its price-to-earnings ratio of 14.5. Compare that to the industry average of 25.5, and you can see HOLI stock is a bargain compared to its peers.

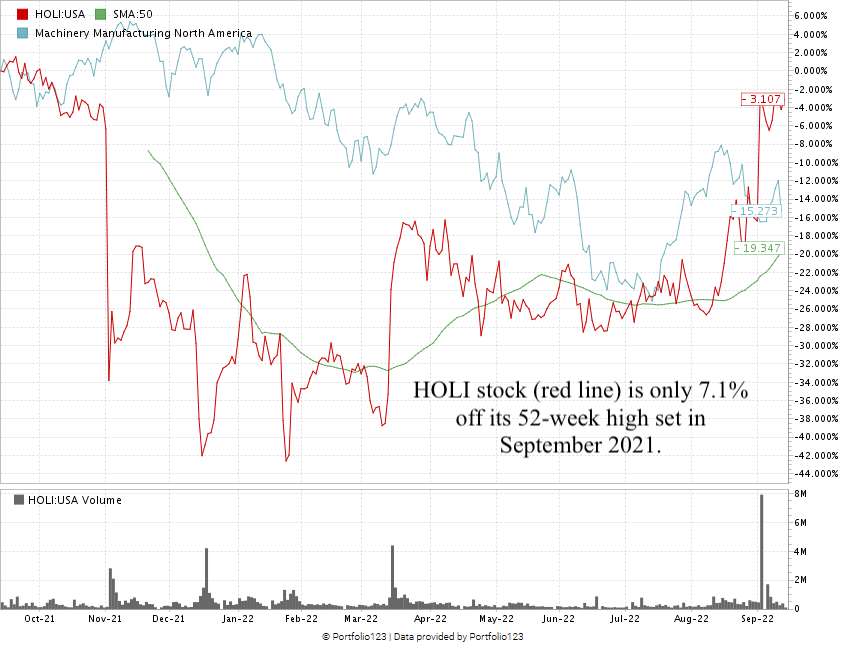

HOLI is only 7.1% away from its 52-week high set in 2021. It’s crushing the machinery manufacturing industry (blue line in the chart below) — down 15.2%.

Since the beginning of August, the stock has climbed 32.1% — earning it an 87 on our momentum metric.

HOLI scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The automation market continues to expand as companies seek out more efficient ways to handle operations.

HOLI’s momentum and value are compelling reasons to add it to your portfolio.

Bonus: The company’s 1.6% dividend is an annual payout of $0.32 per share that you own.

Stay Tuned: Avoid This Exercise Stock at All Costs

I’m switching it up in tomorrow’s Stock Power Daily. Instead of a top-rated company, I’ll analyze a stock to avoid right now.

Stay tuned for the next issue, where I’ll share all the details on a former COVID-19 pandemic top performer that’s down over 70% year to date — and it isn’t a buy.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.