Many homeowners remember the housing bubble that collapsed home prices a little more than a decade ago.

As home prices shot up, traders entered the market. These “flippers” were similar to Robinhood traders in stocks. They had little capital or knowledge — and almost no fear. That combination proved catastrophic after prices peaked in 2006.

The crash that followed spread from real estate to the mortgage market to the stock market. The Federal Reserve and other central banks needed trillions of dollars to stop the decline.

Is the same pattern unfolding now as home sales and prices are rising again?

“U.S. home sales rose to a 14-year high last month,” according to The Wall Street Journal, “a rare bright spot for the economy as ultra-low borrowing costs and the sudden shift in living preferences during the pandemic power the market.”

The demand for homes pushed prices up. The median existing-home price rose 15.5% from last year to $313,000, a record high, according to the National Association of Realtors.

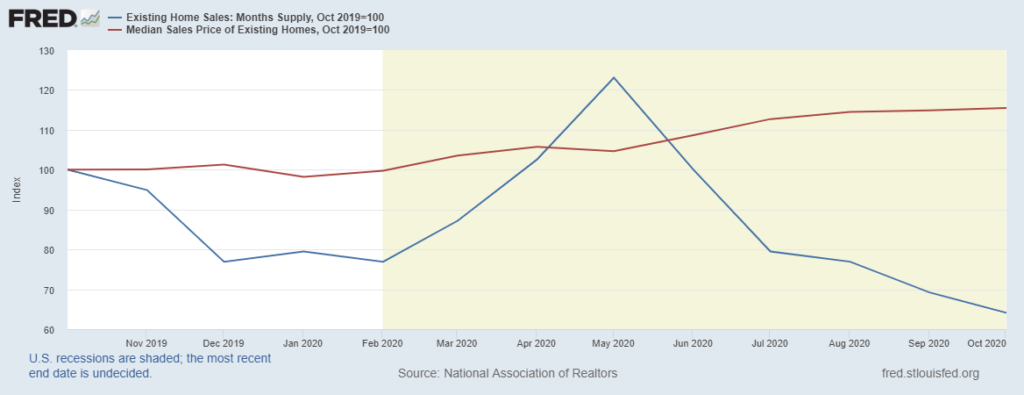

The chart below shows price gains (the red line) coincide with falling supply (the blue line). In the past year the supply of unsold homes fell 35.9%.

Home Prices Rise as Supply Crashes

Source: Federal Reserve.

Why Home Prices Shouldn’t Crash Again

It’s easy to explain demand. Some buyers are fleeing cities amid the pandemic. Millennials, who range from their mid-20s to late 30s, are entering prime homebuying age.

The largest group of millennials were born in 1990 and are turning 30 this year. They should drive demand in home purchases for the next few years.

At the same time, fewer homeowners are selling. The number of homes listed for sale is enough to last 2.5 months, a record-low, at the current sales pace.

That explains why 72% of the homes sold in October were on the market for less than a month.

Potential buyers might expect home prices to crash like the early 2000s. But supply and demand indicate that shouldn’t happen. The forecast for home prices is bullish.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.