Bubbles require two pieces. First, the market must be experiencing rapid price gains. Second, these gains must be irrational.

Rapid price gains explain why some analysts are concerned about a bubble in the housing market. Home prices, measured by the S&P/Case-Shiller U.S. National Home Price Index are up 11.2% in the past 12 months.

The large gain in prices raises concerns about a bubble. But data on the supply of homes offsets those concerns. Supply tells us the gains are rational.

The supply of homes changes slowly. It takes months to build a new home. Even before construction can start, it can take years to secure approval approvals to build.

Right now, homebuilding is too slow to meet demand. That long lead time for new projects means a shortage will persist for years.

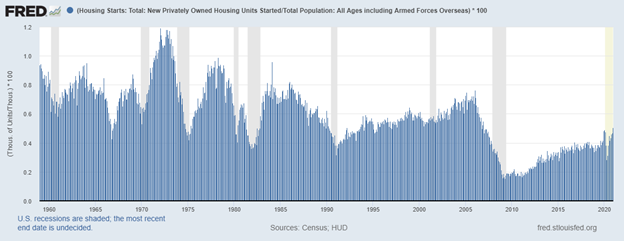

This problem is shown in the chart below. The pace of construction is well below historical levels. It’s also well below the level needed to meet the demand of new households.

Ratio of New Homes to Total Population

Source: Federal Reserve.

Homebuilding Shortage Could Benefit Investors

This is a chart of the ratio of new home construction to population. New homes under construction are the first step in increasing supply. Dividing this value by the population of the U.S. allows us to compare the pace of construction over time.

From the 1950s to about 2000, this ratio was fairly steady. Since then, there has been a steep drop-off. The decline could be due to increased regulation, slower income growth or some other reason. It’s certainly not due to a decrease in demand since the population keeps rising.

The cause of the decline is important for policymakers to understand. They need to stimulate construction to meet the demands of the growing population.

As investors, we simply need to know that there aren’t enough homes being built. This makes SPDR S&P Homebuilders ETF (NYSE: XHB) and shares of individual homebuilders attractive as long-term investments.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.