My one regret in life right now is not owning a home.

In my early career as a newspaper journalist, I spent a lot of time on the road. I also didn’t make a ton of money, so I was content renting. It’s a lifestyle I’ve never had cause to change.

I know I’m not the norm. Thousands of American families buy or build homes every year.

And housing demand creates a massive opportunity for smart investors like you and me.

If I had the option, I would rather build. I get what I want, how I want it. And I can pick everything from the kitchen sink to the landscaping.

More Americans are looking to build their dream home, especially as housing inventories dwindle.

And it takes a lot of building materials to make that dream a reality.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Green Zone Ratings system, I found a “Strong Bullish” materials stock:

- It produces building materials for new home construction.

- It’s up 24% in the last month.

- Right now, it trades at a new 52-week high.

Here’s why you should buy this materials stock now.

New Home Hunt? Build When You Can’t Buy

Mortgage rates are at historic lows since the Federal Reserve elected to cut its federal fund rates to near-zero at the height of the COVID-19 pandemic.

It’s made financing a home more affordable than ever.

But buyers are faced with a massive lack of current inventory. So they’re turning to building their dream homes, as you can see in this chart:

From 1982 to 2005, the volume of single-family housing project starts jumped 158%!

During the housing market crisis of the mid-2000s, new home construction plummeted to new lows.

But demand is on the rise again.

The National Association of Realtors projects that new home construction will jump 190% from a low in 2011 to 2022.

It’s one reason the materials stock I found a buy now.

Big Value, Quality and Growth: Westlake Corp.

Westlake Corp. (NYSE: WLK) is a huge player in the building production space.

It manufactures and supplies:

- Vinyl siding.

- Windows.

- PVC pipes and fittings.

- Landscape edging.

Here’s why its performance is strong now — and I expect it to get better:

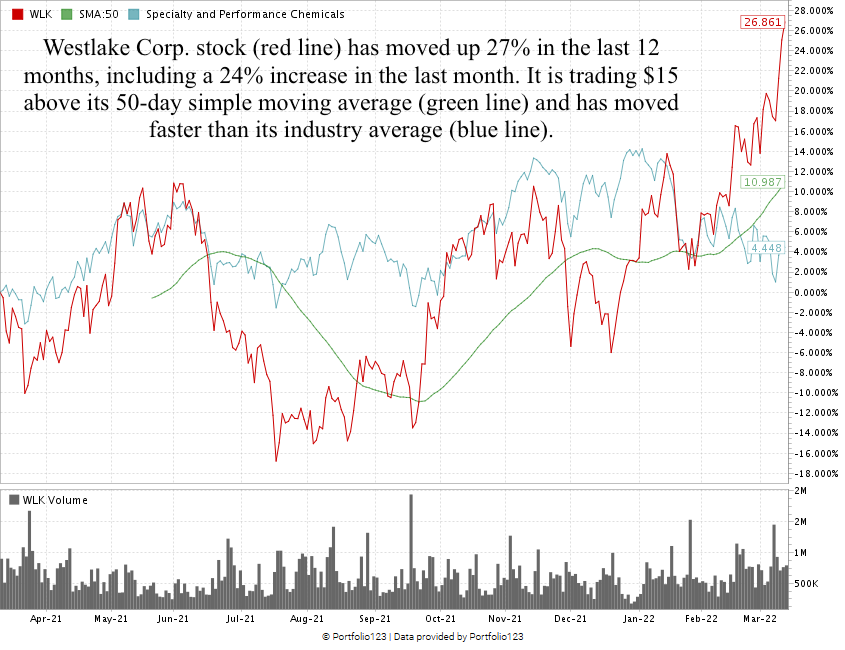

WLK suffered during the COVID-19 pandemic. You can see in the chart above that its total annual revenue dropped 13% from 2018 to 2020.

With homebuilding on the rise, demand for Westlake’s products will increase.

Estimates suggest WLK’s total annual revenue will grow over the next two years. It expects revenue to reach $14.3 billion by 2023 — a 90% increase from 2020 and 66% up from its pre-pandemic levels.

WLK stock has climbed nearly 27% in the last 12 months thanks to increased demand for its homebuilding products.

The stock now trades at a new 52-week high and is $15 over its 50-day simple moving average.

That’s the kind of upward momentum we like to see!

Westlake Corp. Stock Rating

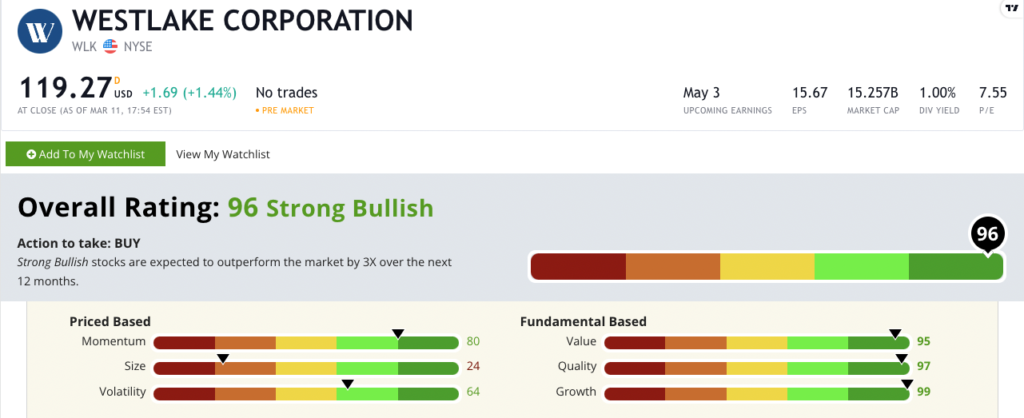

Using Adam’s six-factor Green Zone Ratings system, Westlake Corp. stock scores a 96 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times in the next 12 months.

WLK Green Zone Ratings in March 2022.

WLK rates in the green in five of our six rating factors:

- Growth — WLK has a one-year annual sales growth rate of 57% and a one-year annual earnings-per-share growth rate of 507%. Westlake scores a 99 on growth — meaning it is in the top 1% of all stocks we analyze.

- Quality — Westlake’s returns on assets, equity and investment blow the doors off the industry. It also operates with a net margin of 17% — while its peers’ margins average in the red at negative 5.5%. The company scores a 97 on quality — meaning it’s in the top 3% of all stocks we analyze.

- Value — WLK’s trading ratios are all lower than the industry average, indicating better-than-average-value. Its price-to-earnings is at 7.65, while the specialty and performance chemicals industry’s average is 20. Its price-to-book is 1.93, and the industry average is 2.04. It scores a 95 on value.

- Momentum — WLK stock has jumped nearly 35% since January — showing the “maximum momentum” we love to see in stocks. It rates an 80 on momentum.

- Volatility — After some resistance last summer, WLK has been on a tear on its way to hitting a 52-week high. Westlake stock scores a 64 on volatility.

The stock rates in the red in one category…

Westlake’s $15.25 billion market cap earns it a 24 on size. It’s at the low end of what’s considered “large cap” (more than $10 billion), so it has plenty of room to grow.

Bottom line: New home construction is on the rise.

As the availability of current homes continues to sag, buyers will turn to new construction in droves.

WLK is a “Strong Bullish” materials stock with outstanding growth, excellent quality and great value. That makes this homebuilding materials provider a great addition to your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.