Power and fans aren’t the only things that cool our homes and keep food fresh.

A key element for air conditioners and refrigerators is a fluid or gas called “refrigerant.”

It absorbs heat from its surroundings to push cold air through an A/C unit or pump.

The North American refrigeration market was valued at $10.3 billion in 2012.

By the end of this year, Grand View Research estimates an increase of 71.8% to $17.7 billion.

Today’s Power Stock is a refrigerant services company: Hudson Technologies Inc. (Nasdaq: HDSN).

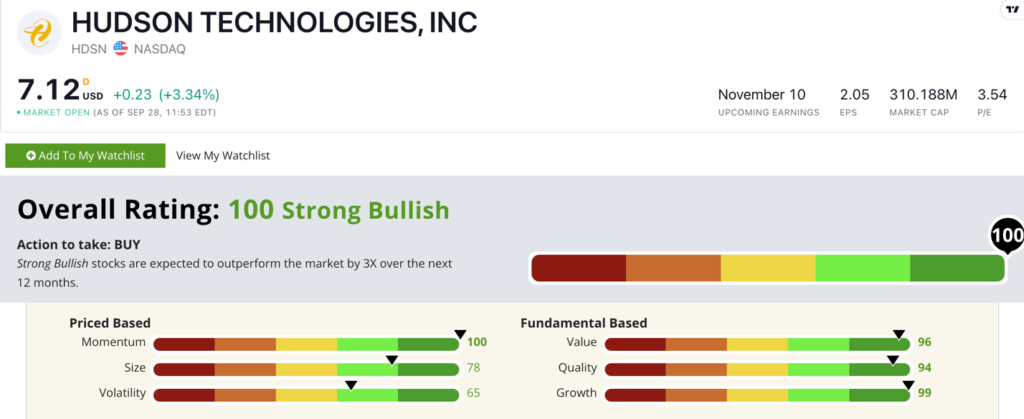

HDSN Stock Power Ratings September 2022.

HDSN is a $310.2 million company that sells refrigerant to large companies all over the continent.

It also reclaims refrigerant — processing used materials into new gas.

Hudson Technologies stock scores a “Strong Bullish” 100 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

HDSN Stock: Outstanding Fundamentals + Maximum Momentum

HDSN had a fantastic second quarter of 2022 and is lining up for another solid year:

- Quarterly revenue was $103.9 million — a 71.7% year-over-year jump.

- Revenue for the first half of 2022 was $188.3 million — 7% more than the previous year.

Hudson is also a terrific value stock.

Its price-to-earnings ratio is 3.54, which is more than three times lower than the industry average.

The company’s price-to-cash flow ratio blows away its diversified industrial distribution industry peers’ average of 7.3.

This tells us HDSN is a bargain compared to its peers.

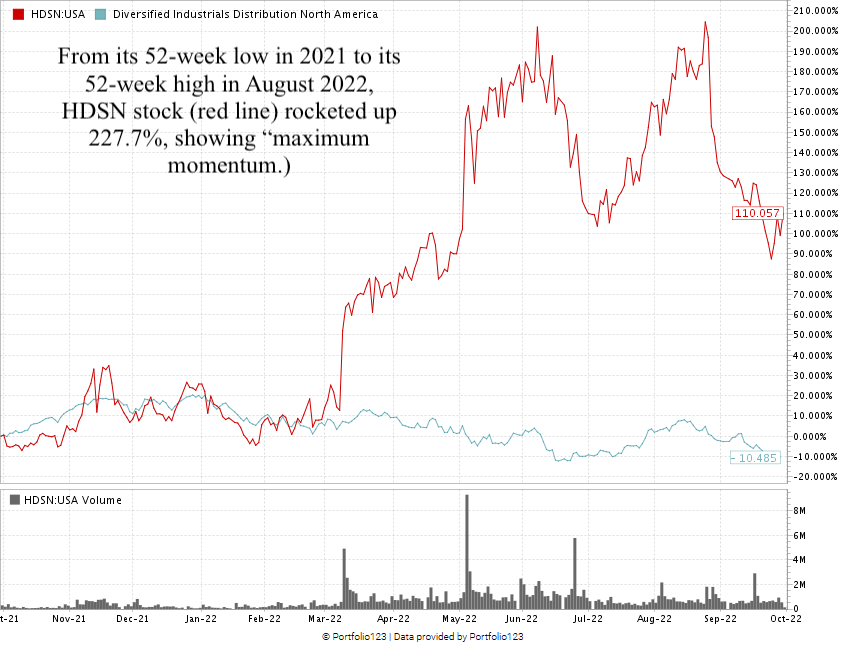

From its 52-week low in October 2021 to its 52-week high in August 2022, HDSN stock jumped 227.7%.

Despite broader market headwinds paring some of those gains back, the stock is still up 110.1% over the last 12 months.

It’s blowing the doors off its industry peers, which averaged a 10.4% loss over the same time.

Hudson Technologies stock scores a perfect 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Created in September 2022.

Bottom line: The global demand for refrigerants will reach a new high this year.

But I don’t think the market is done growing yet.

As you can see, HDSN is a smart addition to your portfolio.

Stay Tuned: Steer Clear of This Retail Investor Disaster

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a stock that made big splashes during the GameStop meme stock craze but is now persona non grata for investors.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.