I’m a bit of a history buff.

As a kid, I spent hours reading my Encyclopedia Britannica set. I loved learning about things like World War II, the Vietnam War and Wall Street (I know, kind of nerdy, right?).

And I believe the words of former British Prime Minister Winston Churchill, who said:

Those that fail to learn from history are doomed to repeat it.

We can also use history when investing.

Adam O’Dell’s six-factor Green Zone Ratings system uses historical data to calculate a stock’s score on momentum, size, volatility, value, quality and growth.

Those six factor scores determine a stock’s overall rating and investment potential.

Using those scores and other indicators, we compile a hotlist of 10 stocks every week. These 10 weekly stocks have the potential to crush the market over the next 2-3 months.

Pro tip: To learn more about our weekly hotlist, click here.

It’s been about one year since I started tracking the performance of these hotlist stocks.

I thought it was a perfect time to revisit the first hotlist and show you how some of those stocks have performed.

The results are impressive.

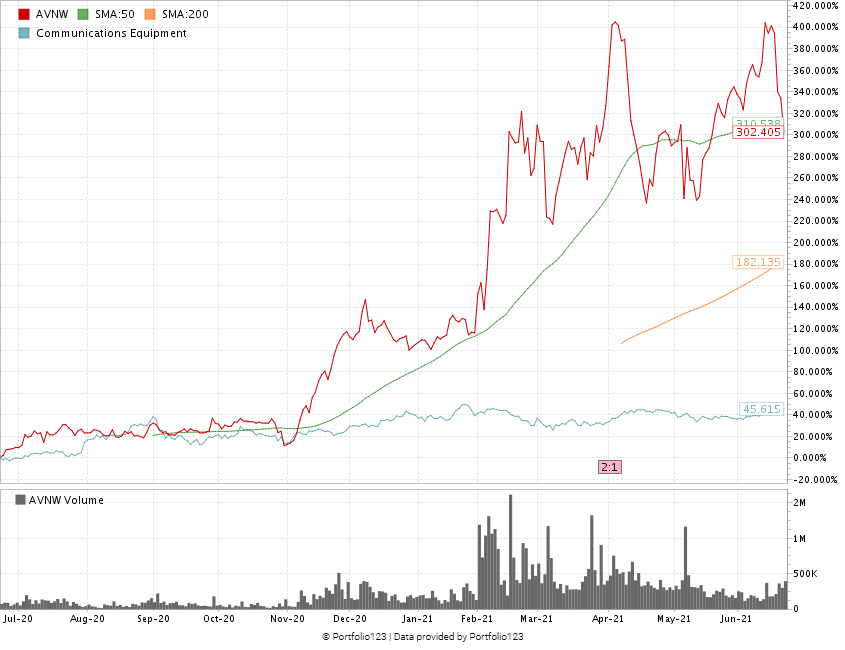

Triple-Digit Hotlist Winner: Aviat Networks Inc.

The highest-rated stock on our hotlist from June 23, 2020, was Aviat Networks Inc. (Nasdaq: AVNW).

Aviat, based in Austin, Texas, designs, manufactures and sells wireless networking products.

It sells broadband wireless network stations, routers and software tools to help improve wireless communication for businesses and individuals.

At the time it made our weekly hotlist, Aviat Networks scored a 99 overall in our Green Zone Ratings system.

It meant we were “Strong Bullish” on the stock and expected it to outperform the market by three times over the next 12-18 months.

Aviat Notches Triple-Digit Gains in 12 Months

It did more than that!

Over the last 12 months, Aviat’s stock has gone from around $8 per share to more than $33 per share — it factors in a 2-to-1 stock split the company performed in April 2021.

That’s a 302% gain compared to the S&P 500’s 36.2% return over the same time!

Today, Aviat Networks rates a 95 overall on our Green Zone Ratings system, meaning we are still “Strong Bullish” on the stock.

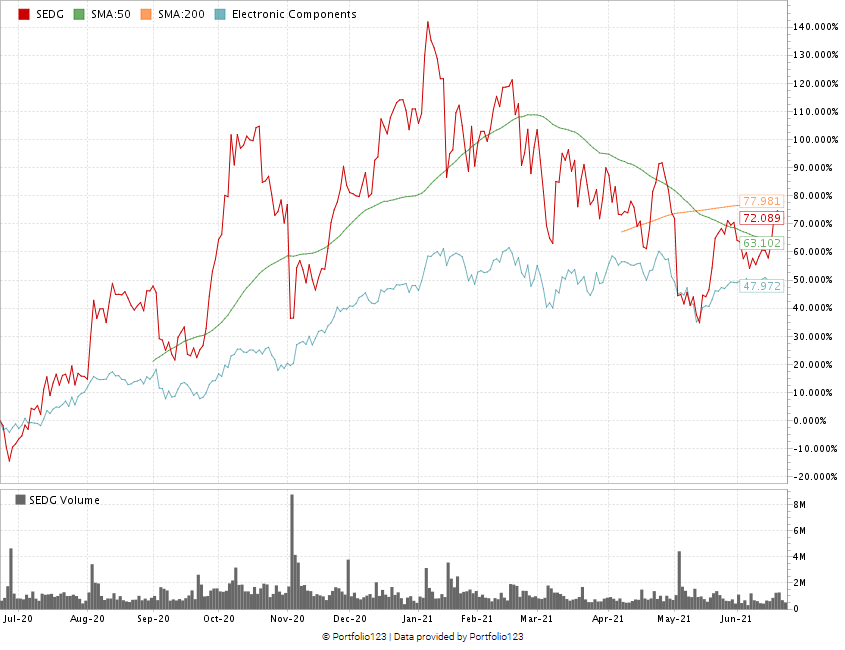

A Solar Boom Success: SolarEdge Technologies Inc.

Another of our top-performing stocks from the June 23, 2020 hotlist was SolarEdge Technologies Inc. (Nasdaq: SEDG).

The company designs, develops and sells inverter systems to help convert solar power to electricity.

Its products are used for residential, commercial and small utility-scale solar installations worldwide.

When SolarEdge made our hotlist a year ago, it scored an 86 overall on our Green Zone Ratings system.

Like Aviat, we were “Strong Bullish” on SolarEdge and expected it to beat the broader market by three times over the next 12-18 months.

Solar Boom Propelled SolarEdge

On June 23, 2020, SolarEdge stock was priced at around $151 per share.

Today, the stock is almost at $280 per share — an 84% gain! The stock reached as high as $365 per share in January.

That’s a 142% upswing from June to January.

Today, SolarEdge rates a 32 overall.

Here’s how other stocks on our June 23, 2020 hotlist have performed to date:

- TopBuild Corp. (NYSE: BLD) — Up 52%.

- PJT Partners Inc. (NYSE: PJT) — Up 38%.

- STMicroelectronics NV (NYSE: STM) — Up 35%.

- Corcept Therapeutics Inc. (Nasdaq: CORT) — Up 32%.

Bottom line: I’m not trying to brag about these gains or show you what you might have missed out on.

I want to show you some of these numbers as proof of how powerful Green Zone Ratings and Adam’s weekly hotlist can be. It can help you find your next investment.

In the coming weeks, I’m going to tell you about even more of our hotlist stocks and how they’ve performed over the last 12 months (We have a lot of triple-digit winners to talk about).

Make sure you check out our weekly hotlist by clicking here.

Until next time …

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. He is a certified Capital Markets and Securities Analyst with the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.