I have a love/hate relationship with Airbnb.

On the one hand, it can be an exciting alternative to boring old chain hotels. I love browsing the site for unique vacation spots whenever I’m planning a trip.

Heck, even my honeymoon on Vancouver Island back in 2017 would have looked a lot different — and cost a pretty penny more — without Airbnb.

This Pacific Ocean view in Ucluelet, British Columbia, was way cheaper than you think…

With amazing views and a fully stocked espresso bar in our kitchen, it was hard to pack up and head back home after that week.

But these days, finding the right spot has started feeling like more work than it’s worth.

Many properties now come with a long list of rules and inflated cleaning fees. Some hosts even expect you to throw your linens in the washing machine or take all your trash out to the street.

Hello? I’m on vacation!

Those are the exact chores I’m running away from at home!

As a result, travelers are now broadening their horizons — and expanding their search to new platforms like Vrbo. Some are even returning to the comfortable familiarity of chain hotels, which have really upped their game lately.

And with Airbnb Inc. (Nasdaq: ABNB) now facing an increasingly competitive marketplace, it’s a good time to check in on the stock’s Green Zone Power Ratings.

From Bad to Worse This Week for ABNB

On Tuesday, Airbnb reported earnings. Revenue came in at $2.75 billion for the second quarter, 11% higher year-over-year. But the company missed on earnings per share estimates: 86 cents vs. 92 cents.

What may be most telling is a warning in the company’s guidance. It reported “shorter booking lead times globally and some signs of slowing demand from U.S. guests.”

Adam O’Dell has mentioned to his paid-up subscribers this week that the consumer discretionary sector is a laggard in the market, and Airbnb’s reporting backs that up. I know I’m definitely being more considerate about each purchase I make now.

All told, the less-than-stellar report triggered an aftermarket sell-off for ABNB. Shares dropped as much as 15%, its worst day since 2022.

But that didn’t stop Airbnb’s CEO from hitting up his Twitter (sorry … “X”) mentions, responding to a comment about its earnings with a since-deleted comment: “I’m confident it’s a good time to buy.”

Are you sure about that? Maybe there are better ways to spend investors’ money than building life-size Polly Pocket rooms.

Here’s what Green Zone Power Ratings says:

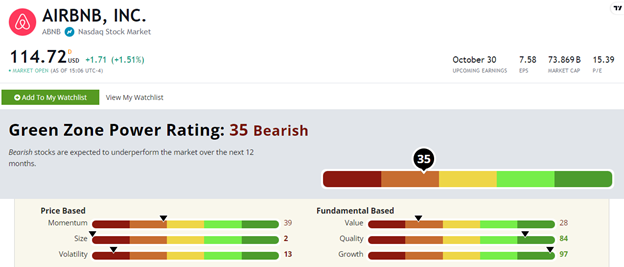

It looks like Adam’s system was ahead of the game, as ABNB rates a “Bearish” 35 out of 100 in his system. These stocks are expected to underperform the broader market over the next 12 months.

I mentioned its solid revenue growth above, and that’s helped boost its Growth rating to 97.

But that’s paired with poor ratings on Value, Size and Volatility. You’re paying a premium for growth, but the stock isn’t paying you back with positive price action.

Its 39 rating on Momentum is proof of that. Zooming out, ABNB is down 24% over the last month, and 14% year to date. The broader S&P 500 is up 12% in 2024, and that’s taking the recent (and brutal) sell-off into account!

Green Zone Power Ratings is pretty clear on ABNB stock.

I’ll find a better place for my hard-earned cash to stay.

Until next time,

Chad Stone

Managing Editor, Money & Markets

P.S. If you’re looking for stocks with actual momentum, Adam has you covered. But we’re closing the doors on his latest Wealth Multiplier opportunity later today. Click here to see how you can join up and follow his guidance into some stock with incredible potential.