It’s that time of year.

The time we all come to dread … paying the taxman.

For millions of Americans, not only do you have to file federal taxes, but the state wants their cut as well.

But not all states are the same.

Some charge different tax rates based on adjusted gross income, while some have a flat tax rate, no matter how much you make in a year.

A select few don’t charge any state income taxes at all.

We’re in the middle of filing season, and knowing as much as you can about where your money is going (including the drudgery of taxes) can be a major boon to your financial future.

That leads us to our Chart of the Week…

Chart of the Week: State Tax Rates

The bottom line is that states need taxes to pay for state services.

States with lower or no income taxes get their tax revenue from sales and/or property taxes.

Those states with higher income taxes typically have lower sales and property taxes.

As you can see in the chart below, the Northeast and West Coast are where you’ll find the highest marginal tax rates.

California leads the way with a 13.3% marginal tax rate on individual income. Pennsylvania boasts the lowest rate at 3%, while its neighbor to the north, New York, has an 8.8% marginal rate.

Let’s see how some states get creative with their collecting…

Texas and Alaska have no income taxes but do receive additional revenues via the oil and gas industry.

Tennessee has no state income taxes but does charge a statewide 9.5% sales tax.

State income taxes vary from 0% (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee and Wyoming) to California’s national high of 13.3%.

States like Washington and Minnesota charge a capital gains tax based on a certain amount.

Within those different rates, some states have various levels of taxes based on adjusted gross income, otherwise known as a graduated rate.

Hawaii, despite recent changes to its tax structure, has 12 different tax brackets.

Yet there are some states — Arizona, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Michigan, Mississippi, North Carolina, Pennsylvania and Utah — that have a flat rate … meaning the percentage you pay to the state is the same, no matter how much you earned.

In addition to different tax rates, each state has different deductions and exemptions tax filers can claim based on their filing status.

Kansas, for example, recently hiked its personal exemption for individual filers from $2.250 to $9,160 and the standard deduction from $3,500 to $3.605. The exemption for married couples was also boosted from $4,500 to $18,320!

No Income Taxes Sounds Great, But…

While states with no income taxes recently became very attractive places to live (I can speak from experience living in the tax haven, also known as South Florida), an underlying issue could be problematic.

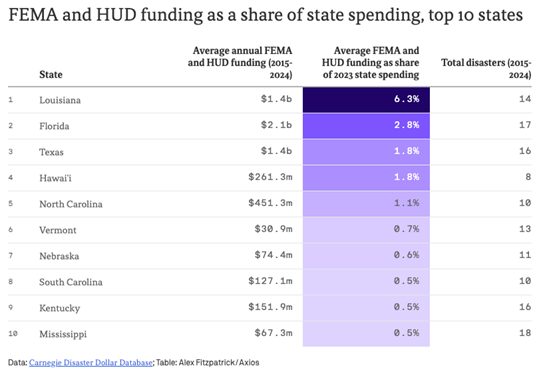

Some of these states — Florida, Louisiana and Texas, specifically — have received billions in federal relief funding because of natural disasters.

Louisiana received an average of $1.4 billion annually from FEMA and the Department of Housing and Urban Development from 2015 to 2024 — more than 6% of that state’s total spending in 2023.

If some of that federal financial aid dries up under the Trump Administration as they work to cut down on federal government spending, those states could be left with a budget deficit. They will likely consider options to bridge the gap, and that usually means increasing taxes somewhere else.

The bottom line is that we are at the height of tax filing season. Even if you’ve already filed, knowing how your state’s taxes apply to you is critical.

If you have questions or issues, make sure to consult with a tax professional.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets