Inflation is rising. As consumers, we know that higher prices will hurt our finances. But as investors, there isn’t a clear answer about the impact of inflation.

As it so often does, history can provide a guide. The last time inflation jumped in the United States may have been in the 1970s. While that’s not a precise precedent for the current situation, there are many similarities with that time.

Most importantly, the Federal Reserve is pursuing a policy it followed at that time.

The Fed has operated under a dual mandate since the end of the Second World War. At that time, scarred by memories of the Great Depression, Congress mandated that Fed policies “promote maximum employment, production, and purchasing power.” This means the Fed is responsible for minimizing unemployment and inflation.

The Fed’s Pursuit of Employment May Fuel Inflation

In pursuit of lower unemployment in the 1970s, the Fed expanded the money supply. The result of that monetary policy was high inflation.

For now, the Fed is once again committed to lowering unemployment. But the target is ill-defined. The Fed now believes that “maximum employment is a broad-based and inclusive goal and reports that its policy decision will be informed by its assessments of the shortfalls of employment from its maximum level.”

In the past, the Fed target for unemployment was defined as the non-accelerating inflation rate of unemployment (NAIRU). That’s the lowest level of unemployment that can exist in an economy before inflation starts to accelerate.

Given the fact the Fed seems intent on overheating the economy in pursuit of an ever-changing employment goal, it makes sense to look at how that worked in the 1970s and 1980s when inflation reached double digits.

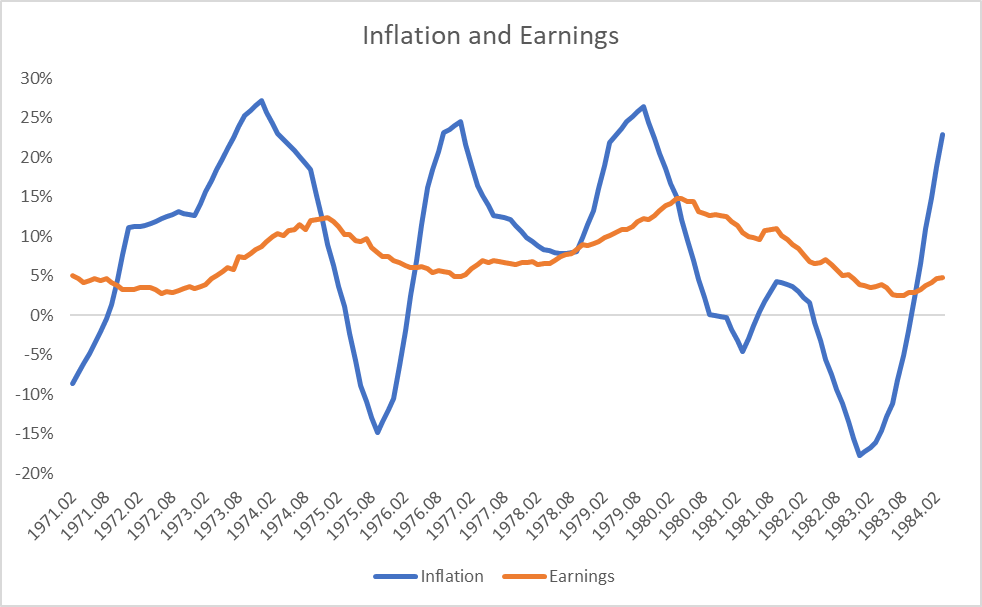

The chart below shows inflation (the blue line) and the change in earnings per share (the orange line). Earnings were almost unaffected by the changes in inflation.

Source: Robert Shiller.

Stocks fell over that time because investors lost faith in the economy. We are likely to see a similar scenario in the next few years.

Inflation won’t hurt earnings that much. But it will reduce investor confidence, and that will hurt stock prices.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.