It’s earnings season again…

Matt dove deep into big bank earnings and the financial sector in yesterday’s Money & Markets Daily. (Click here if you missed it.)

We’ve already seen some stocks rally big after quarterly calls, and there’s no doubt we’ll see more in the coming weeks. This can stir up feelings of FOMO (fear of missing out), and that’s totally natural.

Instead of dwelling on that, I want to show you how we can use Green Zone Power Ratings as it relates to earnings.

And I’ve found a “Bullish” stock that’s set to outperform after its blockbuster earnings call Thursday afternoon.

But first, let’s see how our system and quarterly calls interact…

Green Zone Power Ratings and Earnings

When Adam O’Dell designed Green Zone Power Ratings, he didn’t base the entire model around quarterly earnings reports.

It is a complex system that considers dozens of variables and boils them down to six simple factors and an easy-to-digest overall rating.

This is also a long buy-and-hold indicator. We’re looking at projections for a stock for the next 12 months. While an earnings report may spark a short-term move, Green Zone Power Ratings tells you if that bullish (or bearish) price action should continue from here.

But we can still use the system to our advantage because we can do two things:

- See if a recent price rally is sustainable for a specific stock.

- See how a stock rates before it reports — to either avoid a potential crash or get in before the next earnings beat.

Let’s put it into practice with a company that blew the doors off with its latest numbers.

The Netflix Pivot

For a while there, it looked like Netflix Inc. (Nasdaq: NFLX) was in trouble. The streaming service was struggling to attract new subscribers while spending piles of cash on original content. (Matt highlighted these issues way back in 2021 if you want to check it out.)

So Netflix did what most never thought it would…

It started offering a cheaper subscription tier that includes advertising back in late 2022. Subscribers at this level can still binge all they want, so long as they’re OK with interruptions from big brands like T-Mobile and Nespresso.

And it looks like this move is paying off.

During its third quarter earnings call on Thursday, Netflix reported its ad-tier subscriber base grew by 35% quarter-over-quarter. It now boasts 282.7 million subscribers across all of its tiers.

That boost helped the company beat expectations on both earnings per share ($5.40 vs. $5.13 expected) and revenue ($9.83 billion vs. $9.77 billion) for the quarter.

Investors pushed the stock 10% higher today after the strong earnings report.

And while that growth is impressive, it’s tough to judge a stock off one earnings call.

That’s where Green Zone Power Ratings comes in…

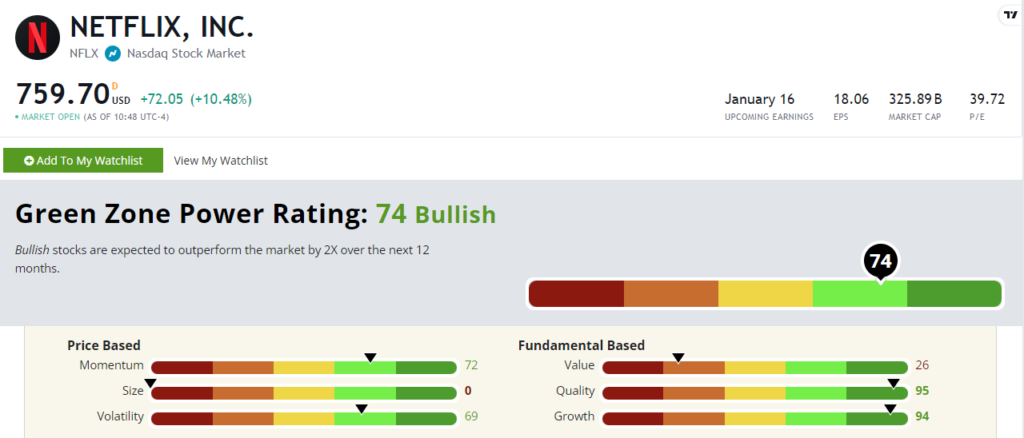

Netflix stock currently rates a “Bullish” 74 out of 100 in our system. Stocks in this category are expected to beat the broader market by 2X over the next 12 months.

Looking closer at its 95 Growth rating…

Netflix’s growth has been robust, with a 76.2% earnings-per-share rise over the last 12 months.

At the same time last year, the company’s earnings growth was paltry at -16.4%.

Netflix’s sales increased by 15% over the previous quarter and 14.7% in the last 12 months.

Similar to its earnings, Netflix’s trailing 12-month sales growth was just 3.5% at the same time last year.

It also boasts a strong Quality rating of 94 out of 100. Its return on assets has grown from 8.7% 12 months ago to 15.3% today. The internet and data services industry average is -14.6%.

Its return on equity has grown from 20.3% a year ago to 34.7% now. This is particularly strong compared to the industry average of -19.9%.

And investors are tuned in to these strong numbers. The stock is up almost 120% over the last year. That’s reflected in its 74 rating on Momentum.

It looks like the Netflix pivot is paying off, and Green Zone Power Ratings confirms that.

Until next time,

Chad Stone

Managing Editor, Money & Markets